Car Insurance Coverage For Rental Cars

What is Car Insurance Coverage for Rental Cars?

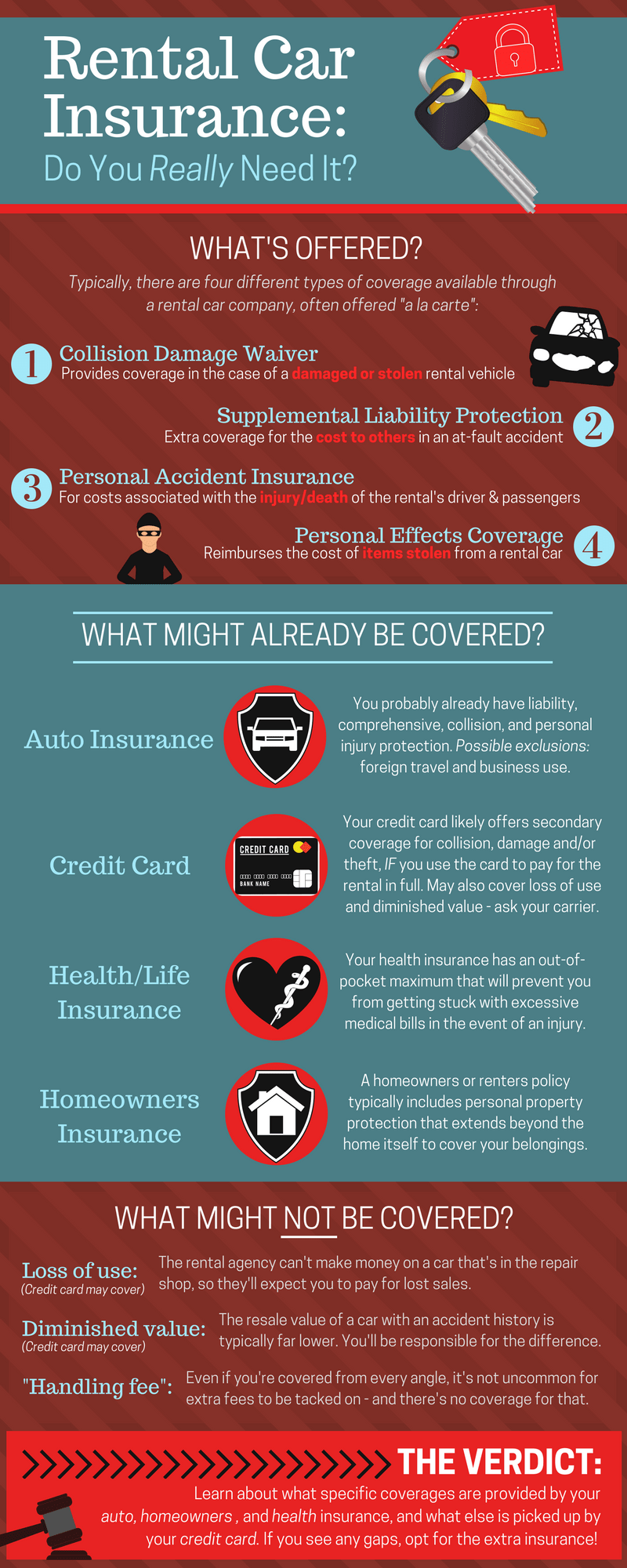

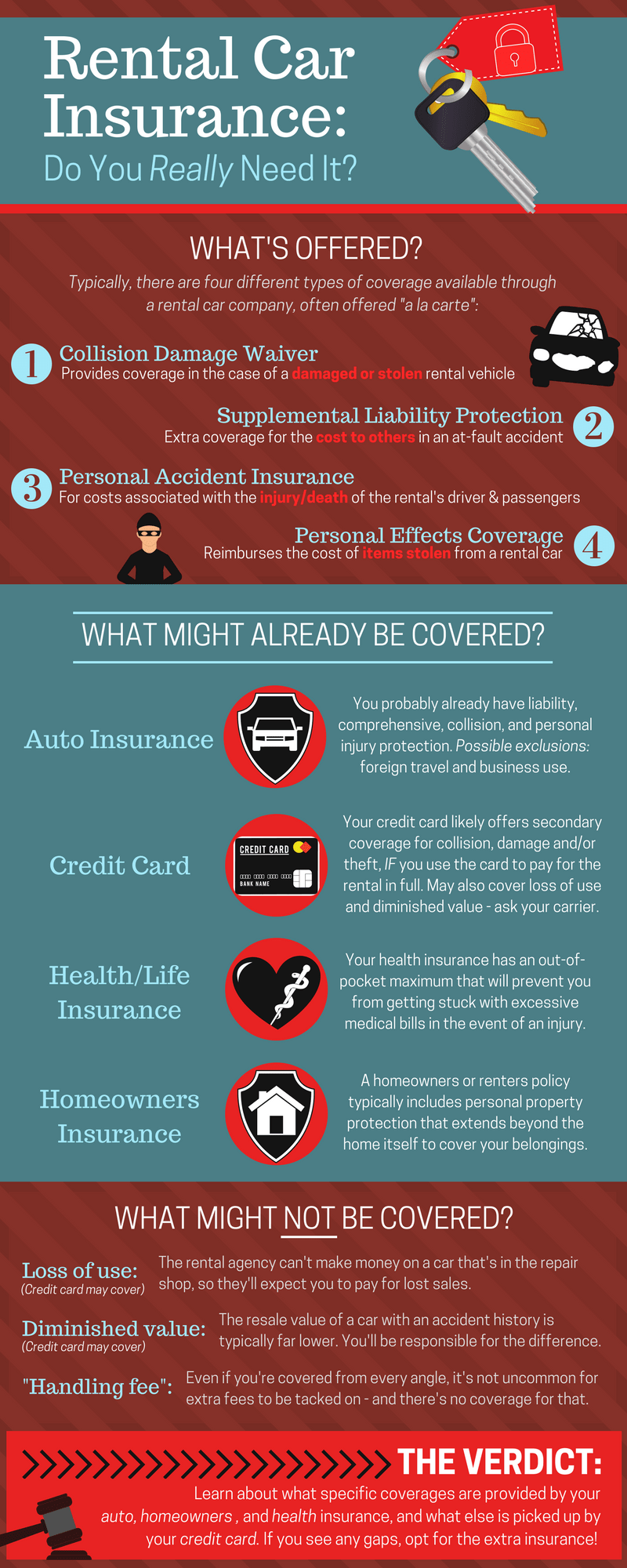

Rental car insurance is an additional coverage that you can purchase when renting a car. The coverage can help protect you if you are involved in an accident while you are driving the rental car. It can also help protect you from expensive repair bills if the rental car is damaged while you are using it. The coverage is optional and not required by law, but it can be a wise investment to protect yourself financially in the event of an accident.

What Does Rental Car Insurance Cover?

Rental car insurance typically covers the cost of repairs for any damage caused to the rental car as a result of an accident or other incident. It also covers the cost of a replacement car if the rental car is damaged beyond repair. Additionally, rental car insurance can cover the cost of medical bills and other expenses that may result from an accident. It may also cover the cost of legal fees, if you are sued as a result of an accident.

Do I Need Rental Car Insurance?

Whether or not you need rental car insurance is a personal decision. If you already have car insurance, it may provide enough coverage to protect you while driving a rental car. If you are unsure, it’s best to contact your insurance provider and ask if your policy covers rental cars. If it does not, you may want to consider purchasing rental car insurance to protect yourself financially in the event of an accident.

How Much Does Rental Car Insurance Cost?

The cost of rental car insurance varies depending on the type of coverage you purchase. Generally, basic rental car coverage can cost as little as $10 per day. However, if you choose to purchase additional coverage, such as collision damage waiver, the cost can be significantly higher. It’s best to speak with your rental car provider to determine the cost of insurance for the rental car you are considering.

Where Can I Buy Rental Car Insurance?

Most rental car companies offer rental car insurance at the time of rental. However, you can also purchase rental car insurance from a third-party provider. If you choose to purchase insurance from a third party, make sure you read the policy carefully to ensure you are getting the coverage you need. Additionally, some credit cards offer rental car insurance as a benefit, so it’s worth checking with your credit card provider to see if you are eligible for this type of coverage.

Conclusion

Rental car insurance can provide additional coverage and financial protection while you are driving a rental car. Whether or not you need rental car insurance is a personal decision, but if you are uncertain it’s best to contact your insurance provider or credit card company to see if your existing policy will cover a rental car. If not, purchasing rental car insurance can be a wise investment to protect yourself financially in the event of an accident.

Car Rental Insurance: Do I Really Need It? - Crush the Road

Do rental cars get coverage under personal car insurance?

Best Credit Cards for Car Rentals - The Points Guy

Does my Auto Insurance cover a Rental Car? | Inside Insurance

Understanding Insurance on Your Rental Car