Budget Direct Vs Virgin Money Car Insurance

Comparing Budget Direct Vs Virgin Money Car Insurance

Introduction

Choosing the right car insurance can be a hassle, especially when you’re trying to compare and decide between two different providers. Budget Direct and Virgin Money are two of the leading car insurance providers in Australia, but which one is the right choice for you? This article provides a comprehensive comparison of Budget Direct and Virgin Money car insurance products, so you can make an informed decision about which company is better for your individual needs.

Pricing

One of the most important factors to consider when looking for car insurance is the cost of the premiums. Budget Direct offers competitively-priced premiums with the ability to save more money by choosing from their range of optional extras. However, their prices can vary significantly depending on the type of coverage you choose, your age, and other factors. Virgin Money also offers competitively-priced premiums, but they are typically more expensive than Budget Direct’s. The exact price you pay with either company will depend on your individual circumstances.

Coverage

Budget Direct offers a wide range of coverage options, including comprehensive, third-party property damage, third-party fire and theft, and third-party only policies. They also offer optional extras such as rental car cover and roadside assistance. Virgin Money’s coverage is slightly more limited, with comprehensive, third-party fire and theft, and third-party only cover. They also offer optional extras, such as windscreen protection and roadside assistance.

Customer Service

Budget Direct has a good reputation for providing excellent customer service, with helpful and knowledgeable staff who are quick to respond to queries and are willing to go the extra mile to ensure customer satisfaction. Virgin Money also provides good customer service, but it’s not quite as highly rated as Budget Direct’s. Both companies offer 24/7 customer support, so you can get help whenever you need it.

Claims Process

Both Budget Direct and Virgin Money have straightforward and easy-to-follow claims processes. With Budget Direct, you can make a claim online, over the phone, or through their app. Virgin Money also offers an online claims process, as well as a more traditional paper-based process. Both companies also offer helpful advice on how to go about making a claim and what to do in the event of an accident.

Conclusion

Whether you choose Budget Direct or Virgin Money for your car insurance needs, you can be sure that you’re getting a quality product at a competitive price. Both companies offer comprehensive coverage, with the ability to add optional extras, and have good customer service and claims processing. Ultimately, the choice is up to you, so make sure you do your research and compare the different policies and premiums offered by each company to find the right car insurance for you.

Budget Direct Car Insurance Renewal

Budget Direct Car Insurance | ProductReview.com.au

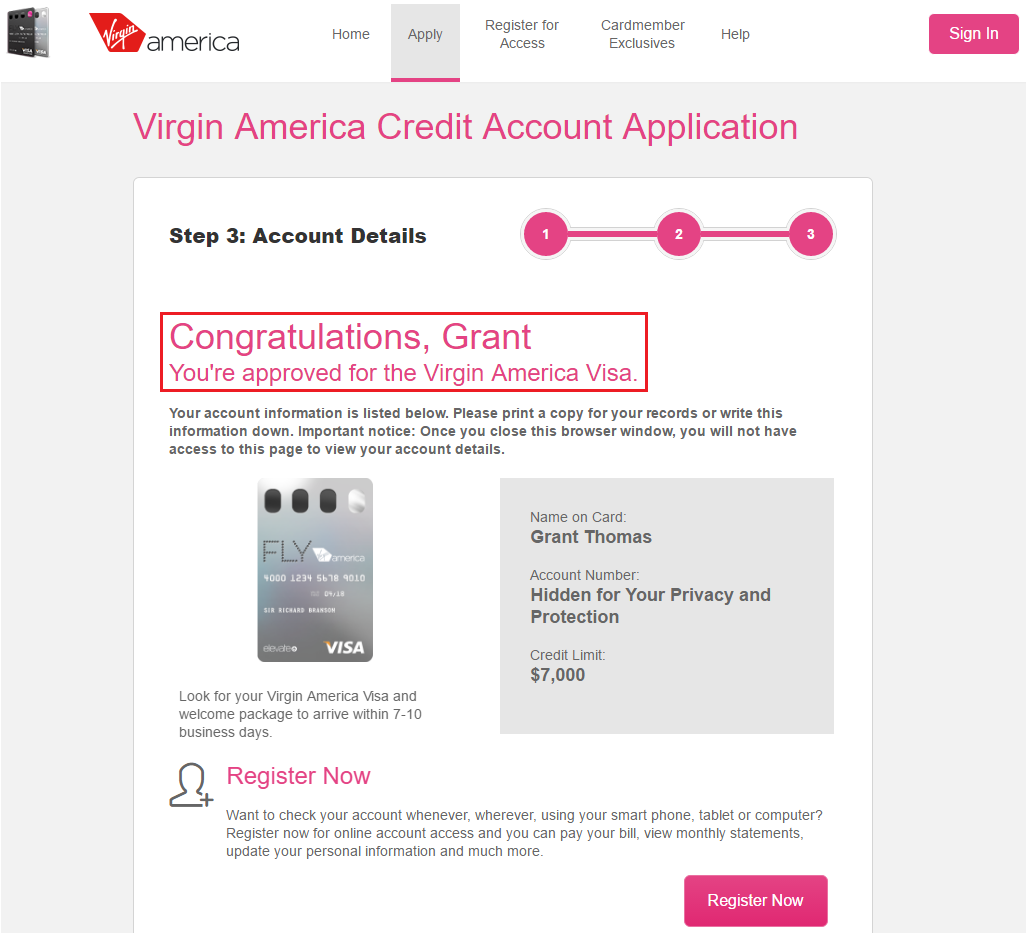

Digital registration for Mobile App and Internet Banking | Virgin Money UK

You can save a lot of money on auto insurance, but you have to know how

My June 2016 App-O-Rama Results: 155,000 Miles/Points and 0 AT&T Phone