An Post Car Insurance Faq

An Post Car Insurance FAQs

What Does An Post Car Insurance Cover?

An Post offers a variety of car insurance policies to meet the needs of different drivers. Comprehensive car insurance covers damages to your own car as well as damages to any other cars or property that you may become liable for. It also provides personal accident benefits and medical expenses. Third-party car insurance covers damages to another car or property that you are liable for, but not your own car.

An Post also offers a range of additional cover options, such as windscreen cover, personal effects cover, breakdown assistance and legal costs. You can add these extras to your car insurance policy for an additional cost.

How Much Does An Post Car Insurance Cost?

The cost of An Post car insurance will vary depending on the type of cover you choose and the amount of cover you need. Comprehensive cover is usually the most expensive option, but it also provides the most extensive cover. Third-party cover is usually the cheapest option but provides limited cover. It is important to weigh up your needs and budget when choosing a policy.

The cost of An Post car insurance is also affected by factors such as your age, driving history, the type of car you drive and where you live. You may also be eligible for certain discounts, such as no-claims discounts or safe driver discounts.

What is An Post's Claims Process?

If you need to make a claim on your An Post car insurance policy, the first step is to contact An Post's customer claims department. You will need to provide details of the incident, such as the date and time, as well as details of any other vehicles or parties involved. An Post will then assess the claim and advise you on the next steps.

An Post may require additional information or evidence to help them assess the claim. This can include photos, witness statements or repair estimates. Once An Post has all the necessary information, they will assess the claim and inform you of the outcome.

Does An Post Offer Any Additional Benefits?

An Post car insurance policies come with a range of additional benefits, such as windscreen cover, personal effects cover, breakdown assistance and legal costs. You can also take advantage of discounts and offers, such as no-claims discounts or safe driver discounts.

An Post also offers a range of payment options to make paying for your car insurance easier. You can choose to pay in full or spread the cost with monthly payments. An Post also offers its customers access to a 24-hour customer service line, so you can get help and advice whenever you need it.

An Post - car insurance - car finance - home insurance - funeral plan

An Post - car insurance - car finance - home insurance - funeral plan

An Post - car insurance - car finance - home insurance - funeral plan

Ts Car Insurance – Haibae Insurance Class

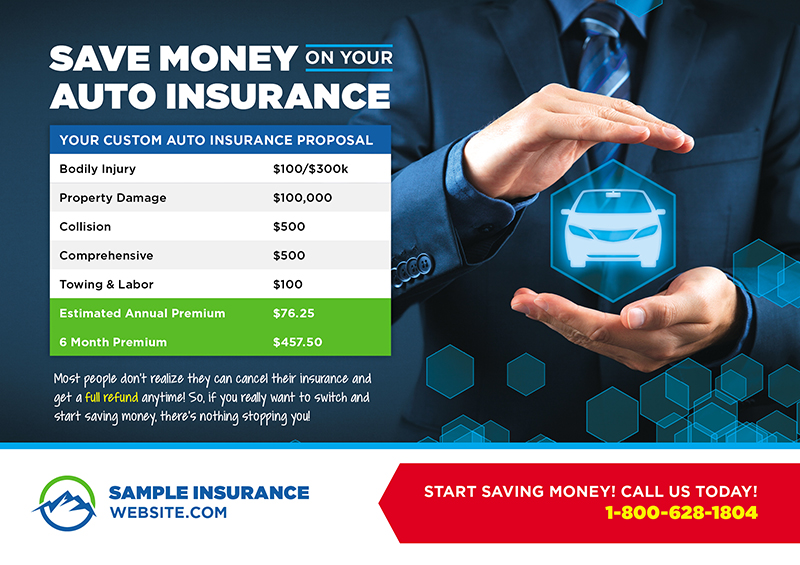

Insurance Postcards/Insurance Direct Mail for Insurance Broker Advertising