Aaa Home Insurance Roof Age Tiers

Wednesday, March 5, 2025

Edit

Everything You Need to Know About Aaa Home Insurance Roof Age Tiers

When it comes to home insurance, roof age tiers can be an important factor in determining the cost of your policy. Aaa Home Insurance offers four tiers that can affect the cost of your coverage, and it’s important to understand how age tiers work so that you can choose the right level of coverage for your home.

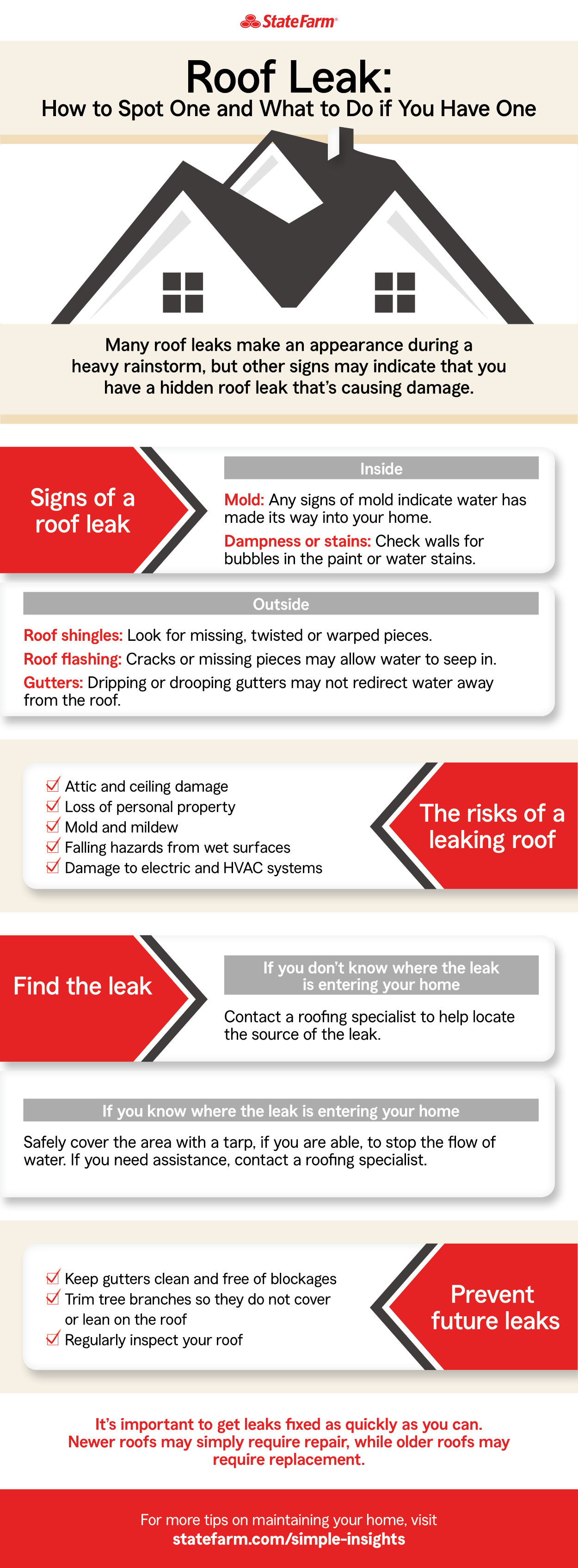

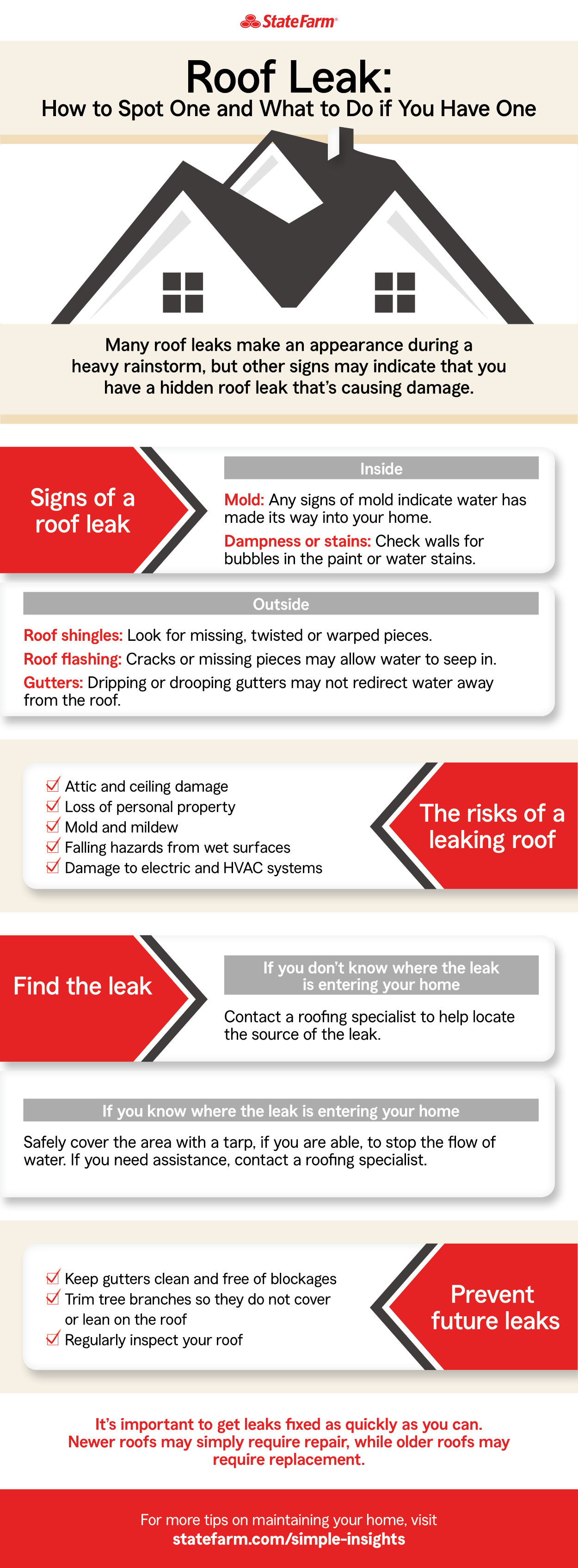

What Are Roof Age Tiers?

Roof age tiers are categories that Aaa Home Insurance uses to determine the cost of a policy. Each tier is based on how old the roof is, with the most common tiers being 0-5 years, 5-10 years, 10-20 years, and over 20 years. The cost of a policy generally increases with the age of the roof, as roofs that are older than 20 years may require more maintenance and repairs.

Why Does Aaa Home Insurance Use Roof Age Tiers?

Aaa Home Insurance wants to make sure that their customers are adequately covered in the event of a covered loss. Older roofs are more susceptible to damage, and they may require more repairs or replacements than a newer roof. By using roof age tiers, Aaa Home Insurance can better assess the risk of a claim and factor that into the cost of the policy.

What Are the Benefits of Aaa Home Insurance Roof Age Tiers?

The main benefit of Aaa Home Insurance’s roof age tiers is that they make it easier for customers to choose the right level of coverage. By taking into account the age of the roof, customers can get more accurate quotes and know exactly how much their policy will cost. This allows them to make informed decisions about their coverage and ensures that they are adequately covered.

How Do I Know Which Roof Age Tier Is Right for Me?

To determine which roof age tier is right for you, you should first figure out how old your roof is. You can do this by contacting a roofer or checking the paperwork from when your roof was installed. Once you know the age of your roof, you can compare it to the tiers offered by Aaa Home Insurance and choose the one that best fits your needs.

What If My Roof Is Too Old for Aaa Home Insurance?

If your roof is too old for Aaa Home Insurance’s roof age tiers, you may need to look into another type of coverage. Aaa Home Insurance may still be willing to insure your home, but they may require that you have additional coverage for your roof. This could include additional repairs or replacements, or even a roof replacement.

Conclusion

Aaa Home Insurance’s roof age tiers are a great way to get the coverage you need at a price that fits your budget. Knowing your roof’s age and comparing it to the tiers offered by Aaa Home Insurance can help you get the right amount of coverage for your home. With the right level of coverage, you can rest easy knowing that your home is protected in the event of a covered loss.

Homeowners Insurance Roof Leak : Roof Leaks | fanniblogolmost

Aaa Texas Homeowners Insurance Quote | mmtcell

Average Cost Of Home Insurance In Orlando Florida | Review Home Co

Aaa Home Insurance Washington State

health-insurance-101-tiers - Pennsylvania Health Access Network