3rd Party Insurance Price For Car In Sri Lanka

Sunday, March 9, 2025

Edit

The Price of Car Insurance in Sri Lanka and What You Need to Know

Introduction

Car insurance is an essential expense for every car owner in Sri Lanka. Third-party liability insurance is a must for all cars in the country and is mandatory for vehicle registration. It is important to ensure that you are adequately insured and that the policy you choose is best suited to your needs. The cost of car insurance in Sri Lanka can vary depending on the type of cover you choose, the make and model of the car, and the insurer you choose. In this article, we will look at the cost of car insurance in Sri Lanka, the different types of cover available, and how to get the best value for your money.

The Cost of Car Insurance in Sri Lanka

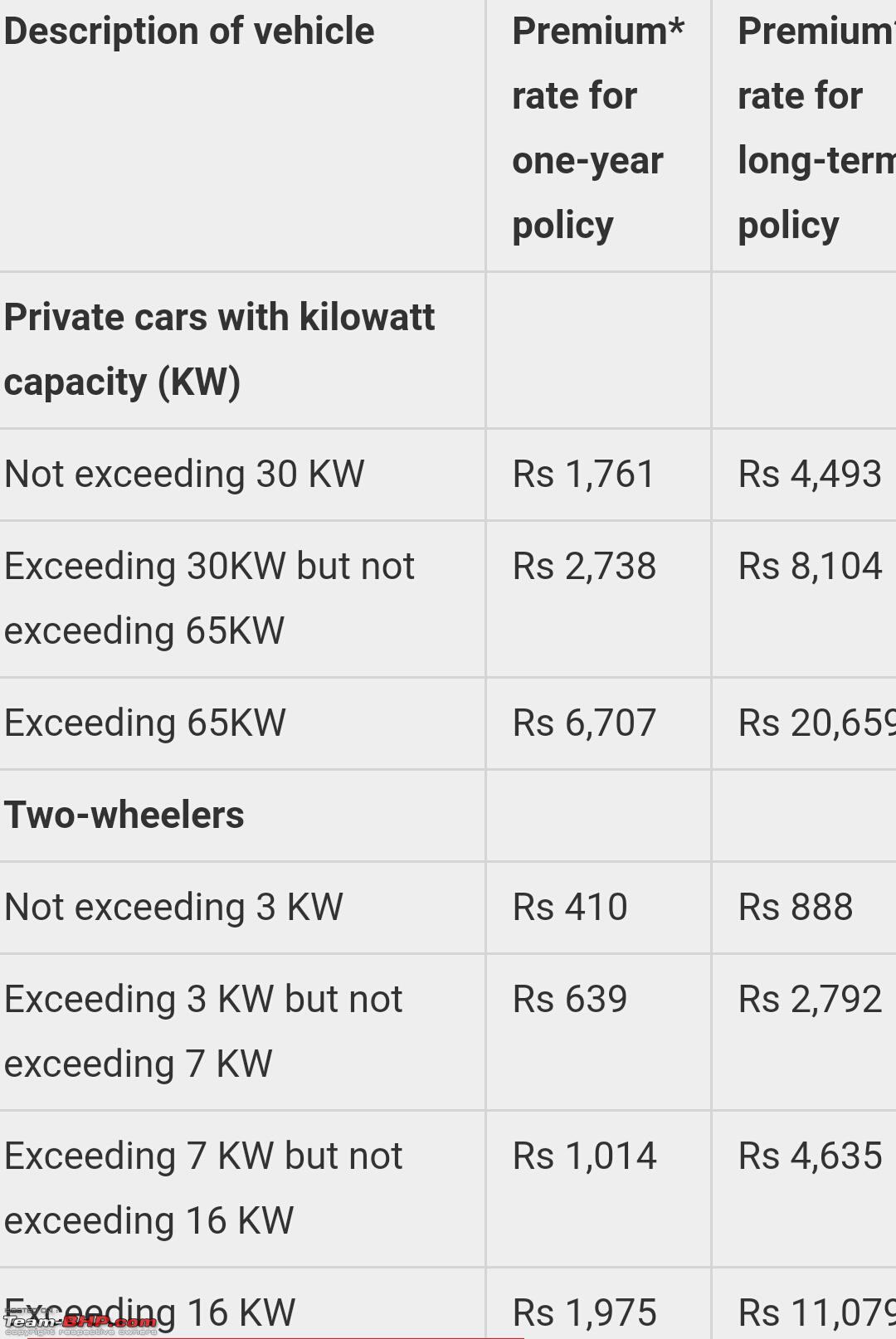

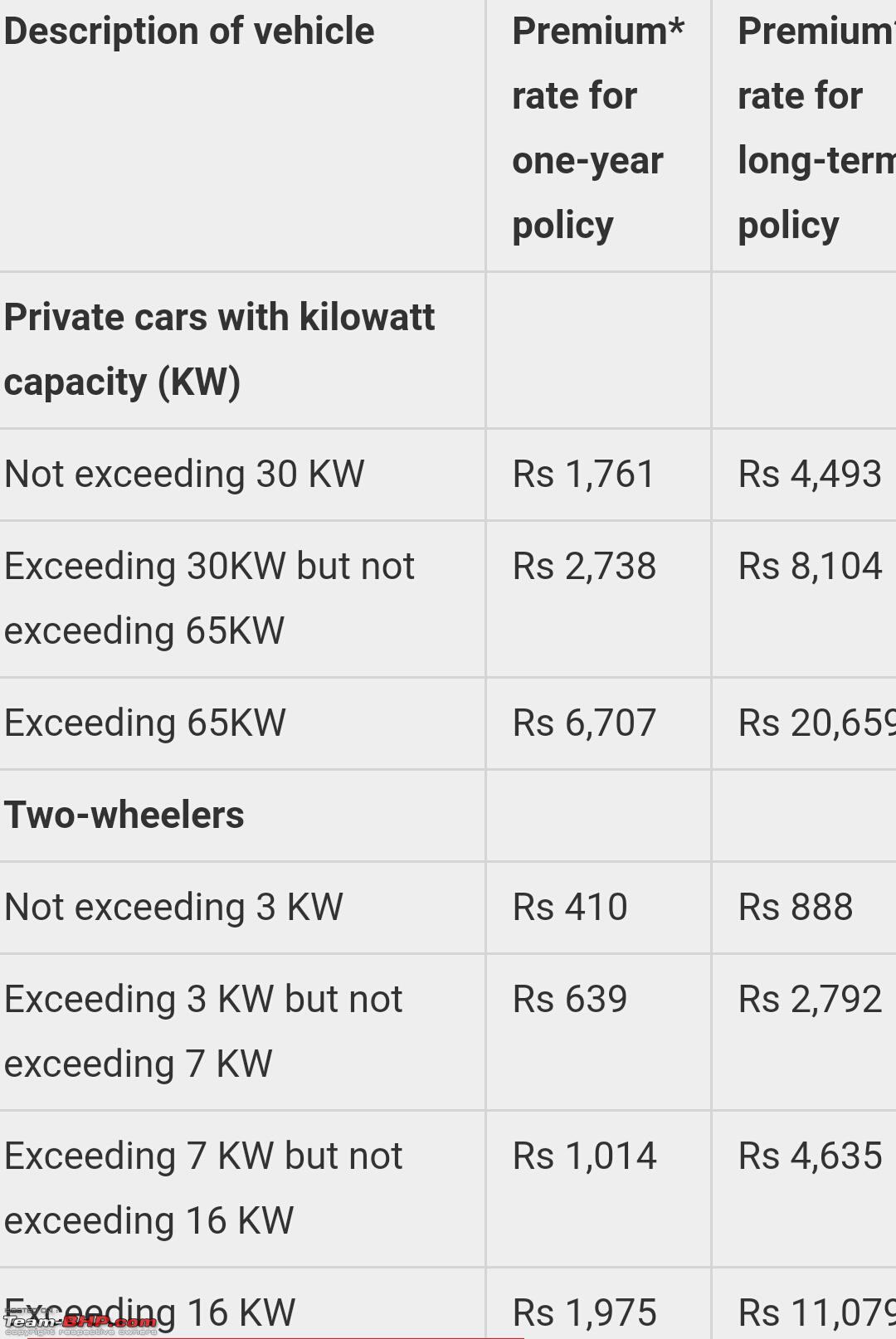

The cost of car insurance in Sri Lanka varies depending on the type of cover you choose and the make and model of the car. Third-party liability insurance is mandatory for all cars in the country and is a requirement for vehicle registration. The minimum level of third-party liability insurance is Rs. 75,000, but the cost of the policy will depend on the make and model of the car, the age of the vehicle, and the insurer you choose. Comprehensive car insurance policies are also available, but these are usually more expensive than third-party liability policies. The cost of comprehensive car insurance can range from Rs. 500,000 to Rs. 1,000,000 depending on the make and model of the car and the insurer you choose.

Types of Car Insurance Available in Sri Lanka

There are two main types of car insurance available in Sri Lanka: third-party liability insurance and comprehensive insurance. Third-party liability insurance is mandatory for all cars in the country and is a requirement for vehicle registration. It provides cover for any damage caused to another person’s property or injury to another person as a result of an accident involving your car. Comprehensive car insurance policies provide cover for damage to your own car as well as third-party liability cover. The cost of comprehensive car insurance policies depends on the make and model of the car, the age of the vehicle, and the insurer you choose.

How to Get the Best Value for Your Money

When it comes to getting the best value for your money when it comes to car insurance in Sri Lanka, it is important to shop around and compare policies to find the one that is best suited to your needs. It is also important to make sure that you are adequately covered and that the policy you choose meets all the legal requirements for vehicle registration in the country. Additionally, you should look for any discounts or incentives that may be available from your insurer and make sure that you read the fine print of any policy before you purchase it.

Conclusion

Car insurance is an essential expense for all car owners in Sri Lanka. Third-party liability insurance is mandatory for all cars in the country and is a requirement for vehicle registration. The cost of car insurance in Sri Lanka can vary depending on the type of cover you choose, the make and model of the car, and the insurer you choose. Additionally, it is important to make sure that you are adequately insured and that the policy you choose is best suited to your needs. Shopping around and comparing policies is the best way to ensure that you get the best value for your money.

3rd-party insurance prices hiked for the nth time (June 2019) - Team-BHP

Third Party Property Car Insurance | iSelect

Best 3Rd Party Insurance For Car

2017 Car Insurance Policy | The Advantages And Disadvantages Of 3rd

2017 Third Party Insurance Cover - 2017 Auto Insurance Facts - YouTube