28 Day Car Insurance For Learner Drivers

28 Day Car Insurance For Learner Drivers

What Is 28 Day Car Insurance For Learner Drivers?

28 day car insurance for learner drivers is a type of short-term car insurance policy for learner drivers. It is intended to give learner drivers a temporary form of insurance for a specified period of time, usually up to 28 days. This type of insurance can be useful for those who are learning to drive and need to take out insurance in order to practice or take their driving test.

It is also a great option for those who have recently passed their test but have yet to purchase their own long-term car insurance policy. 28 day car insurance is usually much cheaper compared to long-term insurance, so it can be a great way to save money in the short-term.

Who Can Benefit from 28 Day Car Insurance?

28 day car insurance can be beneficial for any learner driver who needs to take out insurance to practice or take their driving test. It can also be beneficial for those who have recently passed their test but have yet to purchase their own long-term car insurance policy.

It is also a great way for those who are not regular drivers to save money on their car insurance. For example, if you only need to use a car occasionally, or if you are only using a car for a short period of time, then 28 day car insurance can be a great way to save money.

How to Get 28 Day Car Insurance

Getting 28 day car insurance is relatively easy. Most insurance companies offer this type of policy, so it is just a matter of finding the right provider. Shop around and compare prices from different providers to make sure you get the best deal.

It is important to bear in mind that 28 day car insurance policies are usually more expensive than long-term policies. This is because the insurer is taking on more risk by providing a short-term policy.

What Is Covered by 28 Day Car Insurance?

Most 28 day car insurance policies will cover the same things as a long-term policy. This means that you will be covered for any damage to your car, any damage to other people’s property, and any medical expenses that may arise as a result of an accident.

However, it is important to check the policy details carefully to make sure that the policy covers everything that you need it to. Some policies may not cover certain types of damage or may not cover certain types of medical expenses.

Conclusion

28 day car insurance is a great option for those who are learning to drive, those who have recently passed their test, and those who only need to use a car occasionally. It is usually much cheaper compared to long-term car insurance, so it can be a great way to save money in the short-term.

However, it is important to shop around and compare prices from different providers to make sure you get the best deal. It is also important to check the policy details carefully to make sure that the policy covers everything that you need it to.

Cheaper Learner Driver Insurance for Pupils - Bill Plant Driving School

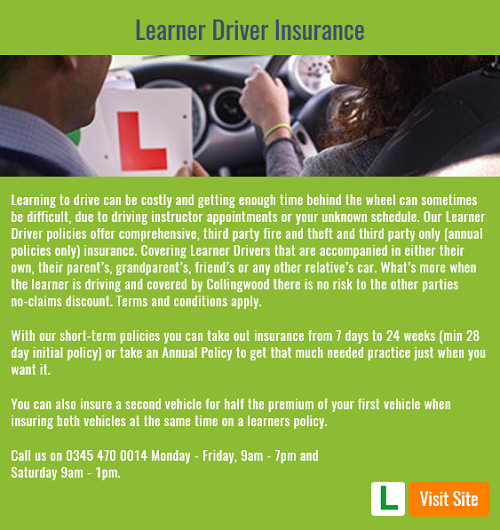

Collingwood Learner Insurance Customers Contact Number: 0345 470 0014

Car Insurance For Learner Drivers - 2017 Car Insurance Driver Tips

Learner driver in car with L plates - GB Quotes Smart Car Insurance

Cheap Car Insurance For Learner Drivers | Cover in a Click