How Much To Add A Named Driver To Car Insurance

Adding A Named Driver To Your Car Insurance

What is a Named Driver?

A named driver is a person that is added to your car insurance policy and is allowed to drive the car. This can be someone such as your spouse, a family member or a friend. When you add a named driver to your policy, the insurer is aware that the driver is an additional risk to them and so they will usually charge an additional premium. This is because the driver is likely to be more experienced on the roads than the policyholder and so is more likely to be involved in an accident.

How Much Does it Cost to Add a Named Driver?

The cost of adding a named driver to your car insurance policy can vary depending on the insurer and the type of policy you have taken out. Generally, the more experienced the named driver is, the more you will have to pay in premiums. It is also important to note that some insurers may charge an additional fee if you add a named driver to your policy. This is usually a one-off fee and will be added to the total cost of the policy.

What Factors Affect the Cost?

There are several factors that can affect the cost of adding a named driver to your car insurance policy. These include the age and experience of the driver, the type of car they will be driving, and the type of policy you have taken out. The age of the driver is particularly important as younger drivers are seen as more likely to be involved in an accident. The type of car is also important as some cars are more expensive to insure than others. Finally, the type of policy you take out can also affect the cost, as some policies may provide more cover than others.

What are the Advantages of Adding a Named Driver?

There are several advantages to adding a named driver to your car insurance policy. Firstly, it allows someone else to drive your car, which is especially useful if you need to borrow someone else’s car. Secondly, the additional driver may be more experienced on the roads than you are, which may reduce the risk of having an accident. Finally, having an additional driver on the policy can help to lower the overall cost of the policy.

Do I Need to Tell my Insurer If a Named Driver Is Driving My Car?

Yes, it is important to inform your insurer if a named driver is going to drive your car. This is because the insurer needs to know if the driver is an additional risk to them and so they can adjust the premiums accordingly. It is also important to make sure that the named driver is aware of the terms and conditions of the policy, as they may be held liable for any damages caused while driving the car.

Conclusion

Adding a named driver to your car insurance policy can be a great way to reduce the cost of premiums and provide you with additional driving cover. However, it is important to remember that the cost of adding a named driver can vary depending on the insurer and the type of policy you have taken out. It is also important to make sure that you inform your insurer if a named driver is going to be using your car. This will help to ensure that the policy is up to date and that you are not held liable for any damages caused by the driver.

Named driver car insurance in Singapore

How Much Does It Cost to Add a Driver to Car Insurance Policy - Cost to

Average Car Insurance Cost For First Time Drivers Uk - Quotes

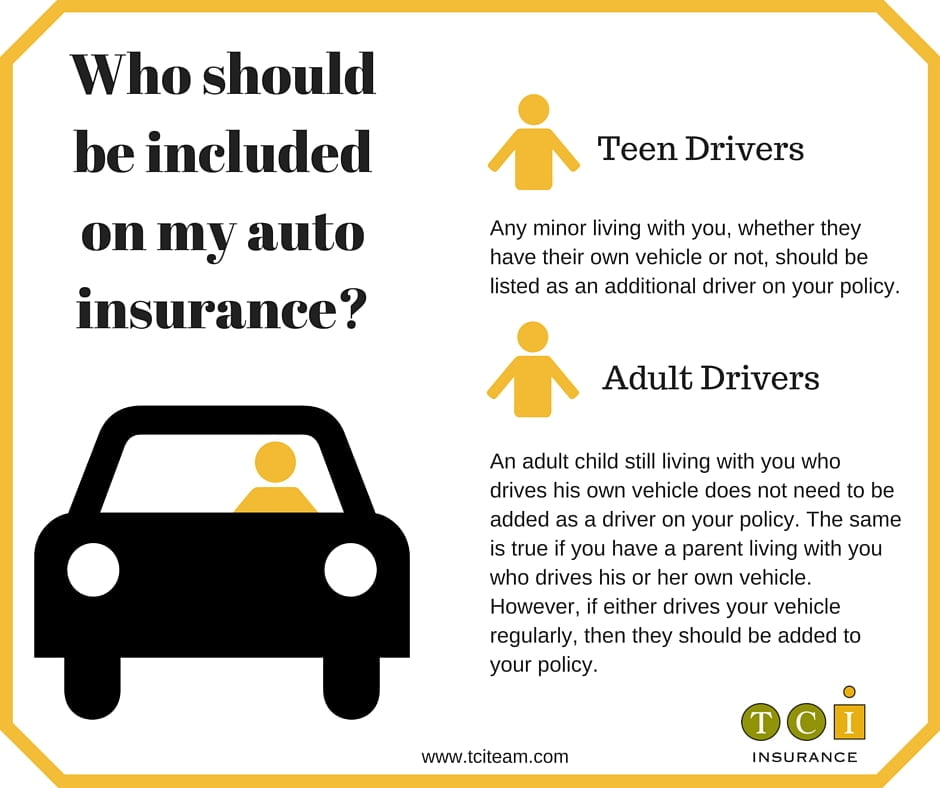

Adding Drivers - TCI Insurance

Compare Texas Car Insurance Rates & Save Today | Compare.com