How Much Does Turo Insurance Cost

How Much Does Turo Insurance Cost?

What is Turo Insurance?

Turo is an online car rental marketplace that allows car owners to rent their vehicles to people who need them. It’s similar to traditional rental car companies, but it’s often more convenient for customers and less expensive for car owners. The key difference is that Turo offers insurance coverage for both parties. This means that both the car owner and the renter are covered in case of any damage or accidents. So, how much does Turo insurance cost?

Turo Insurance Cost

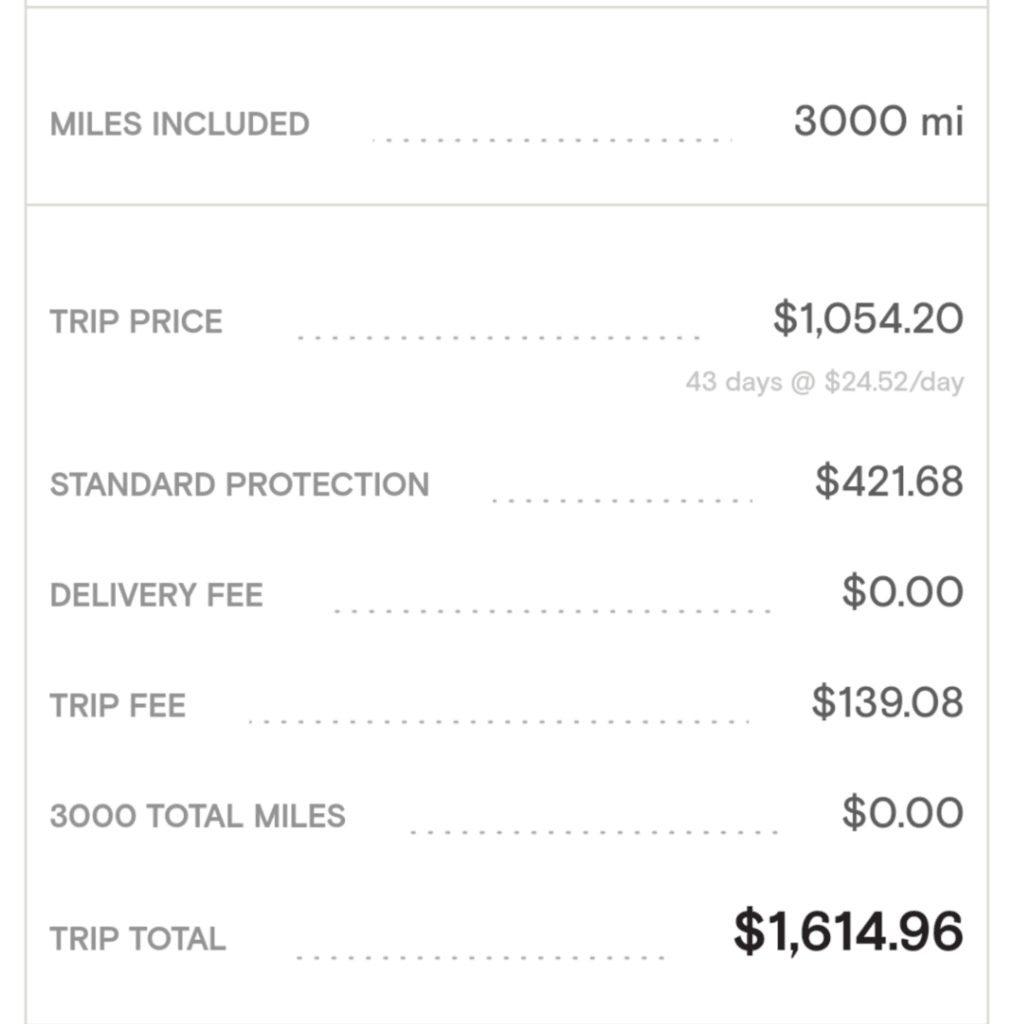

The cost of Turo insurance depends on a few factors. First, the type of coverage you select. Turo offers several levels of coverage, including liability, collision, and comprehensive. The more coverage you select, the higher your insurance cost will be. Second, the type of car you’re renting. Luxury cars and sports cars typically require more coverage, so they will cost more to insure. Finally, the length of the rental period. Longer rentals typically cost more to insure, as do rentals of multiple vehicles.

What is Included in Turo Insurance?

Turo insurance covers both the car owner and the renter for a variety of damages. Liability coverage covers any damages to other people or property caused by the renter. Collision coverage covers any damages to the car caused by the renter. Comprehensive coverage covers any damages to the car caused by something other than the renter, such as theft, fire, or weather damage. In addition, Turo insurance also covers towing and rental car reimbursement in case the car is damaged and cannot be driven.

Where Can You Get Turo Insurance?

Turo insurance is available through a variety of providers. You can purchase insurance directly from Turo, or you can purchase a policy from a third-party provider. Turo also offers a variety of packages that include additional coverage, such as roadside assistance and personal property coverage. Third-party providers typically offer more coverage options, as well as lower prices.

How Do You Get Turo Insurance?

Getting Turo insurance is easy. All you need to do is to log in to your Turo account and select the type of coverage you need. You’ll be asked to provide some information about the car you’re renting and the duration of the rental. Once you’ve done this, you’ll be able to review and purchase the coverage you need. You can also purchase insurance through a third-party provider, which will require you to compare different policies and select the one that best meets your needs.

Conclusion

Turo insurance is an important consideration for anyone who is renting a car. It provides coverage for both the car owner and the renter in case of any damage or accidents. The cost of Turo insurance depends on the type of coverage you select, the type of car you’re renting, and the length of the rental period. Turo insurance is available through a variety of providers, and it’s easy to purchase the coverage you need.

Turo Review: How Renting Out Our Cars on Turo Turned Into a Free Tesla

Need Cash? Have a Car Sitting Idle? Rent it Out with Turo.

Turo, the 'Airbnb for cars,' could upend the car-rental industry

My $20,000 PCS to Hawaii Guide: Flights, Hotels, Rental Cars

HOW TURO INSURANCE WORKS/ HOW I PROTECT MY RENTAL ASSETS - YouTube