How Much Does It Cost To Insure A Tesla

Monday, February 17, 2025

Edit

How Much Does It Cost To Insure A Tesla?

Tesla Insurance Is Not Cheap, But It Can Be Affordable

The cost of insuring a Tesla vehicle can vary drastically depending on many factors such as the make and model of the car, the driver’s age and driving record, the insurance company, and the coverage limits chosen. However, it is generally understood that Tesla insurance is more expensive than insuring a traditional gas-powered car, primarily due to the added cost of repair and replacement parts.

Tesla vehicles are equipped with several advanced technologies, such as Autopilot, that can make them more expensive to insure. Additionally, Tesla vehicles have a higher-than-average repair cost due to the complexity of their design, as well as the scarcity of Tesla-specific parts. All of these factors add to the cost of insuring a Tesla.

Factors That Impact The Cost Of Tesla Insurance

In addition to the make and model of the vehicle, the cost of insuring a Tesla can also vary depending on several other factors, such as the driver’s age, driving record, and the coverage limits chosen.

Younger drivers typically pay more for auto insurance, regardless of the make and model of the vehicle. This is because insurance companies consider younger drivers to be riskier, as they are more likely to be involved in an accident. Additionally, drivers with poor driving records will also pay more for their insurance, as they are seen as more of a risk to the insurance provider.

The coverage limits chosen by the driver can also have an effect on the cost of insurance. Higher coverage limits will generally result in a higher premium, as the insurance provider is taking on more risk. On the other hand, lower coverage limits can result in a lower premium, but may not provide enough protection in the event of an accident.

Where To Shop For Tesla Insurance

Shopping around for the best deal on Tesla insurance is a great way to save money. There are several insurance companies that specialize in insuring Tesla vehicles, as well as companies that offer more general auto insurance policies. Comparing quotes from different providers can help drivers find the best deal for their needs.

In addition to comparing quotes, drivers should also consider the reputation of the insurance companies they are considering. Reading online reviews and asking friends and family for recommendations can help drivers make an informed decision.

Tips For Lowering The Cost Of Tesla Insurance

There are several steps drivers can take to reduce the cost of insuring a Tesla. First, drivers should consider raising their deductible to lower their monthly premium. A higher deductible means the driver will have to pay more if they are involved in an accident, but the monthly premium cost will be lower.

Second, drivers should consider reducing their coverage limits if they can afford to do so. Lowering the coverage limits will result in a lower monthly premium, but it is important to ensure that the coverage limits are still adequate in the event of an accident.

Finally, drivers should take advantage of any discounts offered by the insurance company. Many companies offer discounts to good drivers, multi-car households, and drivers who have taken a defensive driving course. Taking advantage of these discounts can help reduce the cost of insuring a Tesla.

Conclusion

In conclusion, insuring a Tesla can be expensive, but it doesn’t have to be. Shopping around for the best deal, raising the deductible, reducing coverage limits, and taking advantage of any discounts offered can all help reduce the cost of insuring a Tesla.

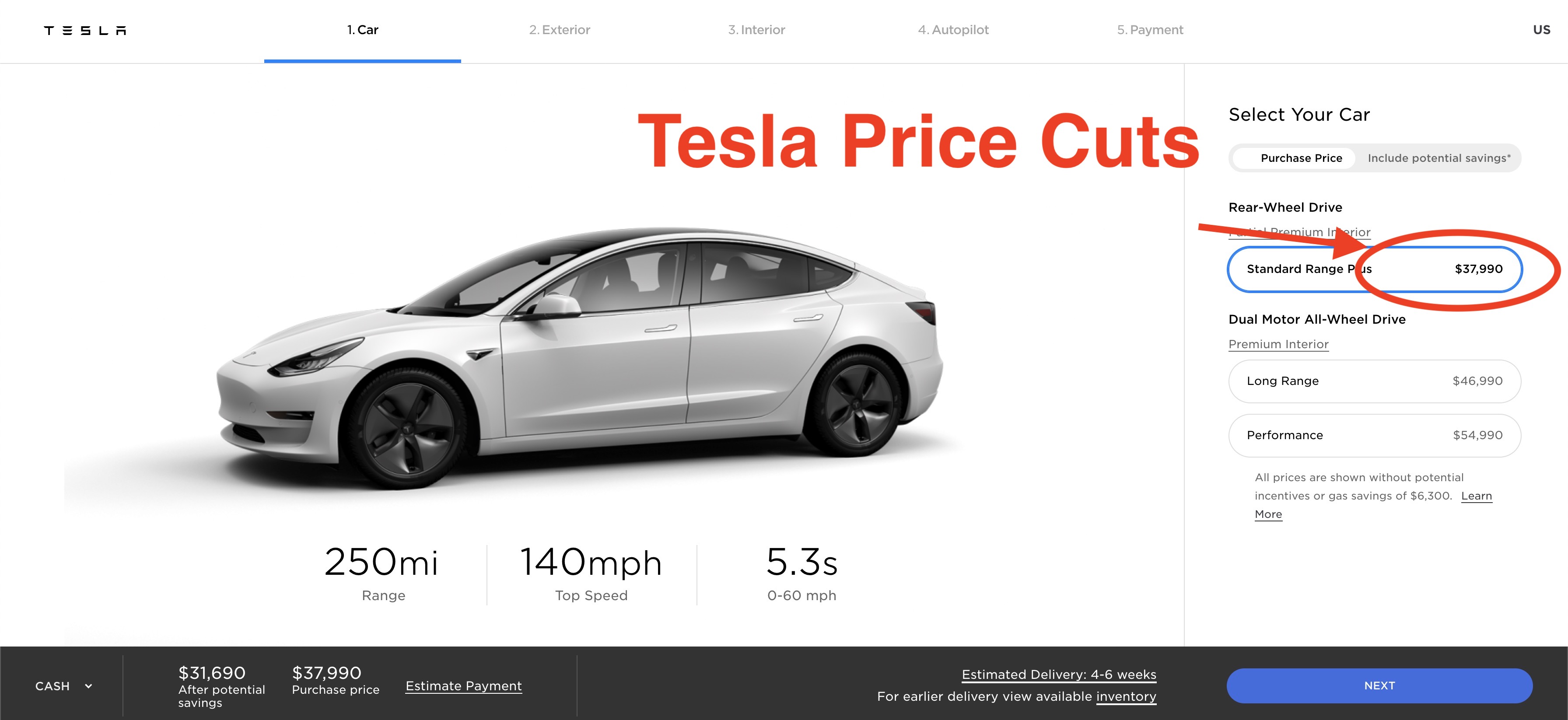

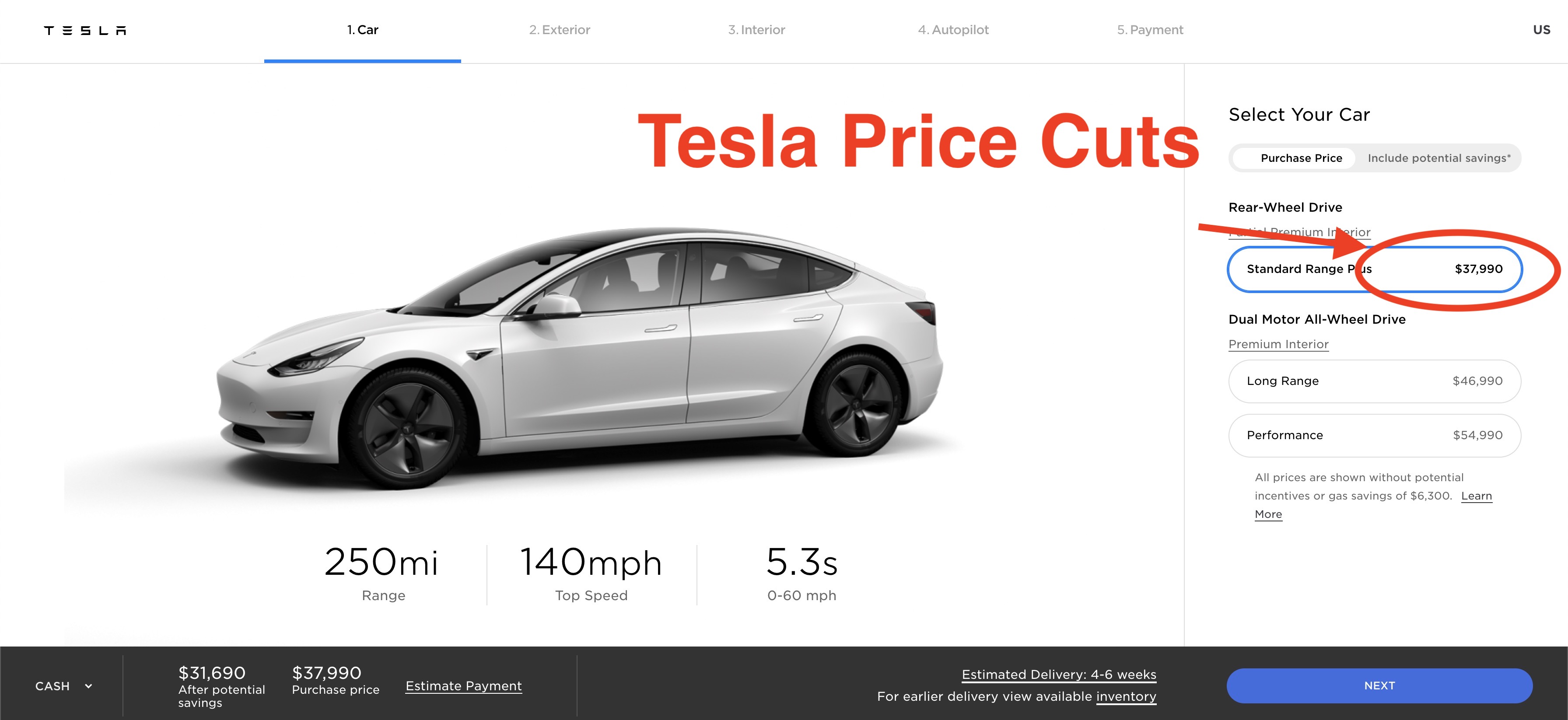

Tesla cuts prices across lineup, Model 3 now starts at $37,990 - Electrek

Tesla Wants to Insure Its Drivers, and Will Double Down on Tracking

Tesla Insurance Cost Breakdown - The Ultimate Guide - EINSURANCE

chmorgan: Tesla Model S - Cost of driving, electric vs. gasoline

What Does It Cost To Insure Your Tesla Model 3? Take Our Poll