How Does Marmalade Car Insurance Work

What is Marmalade Car Insurance?

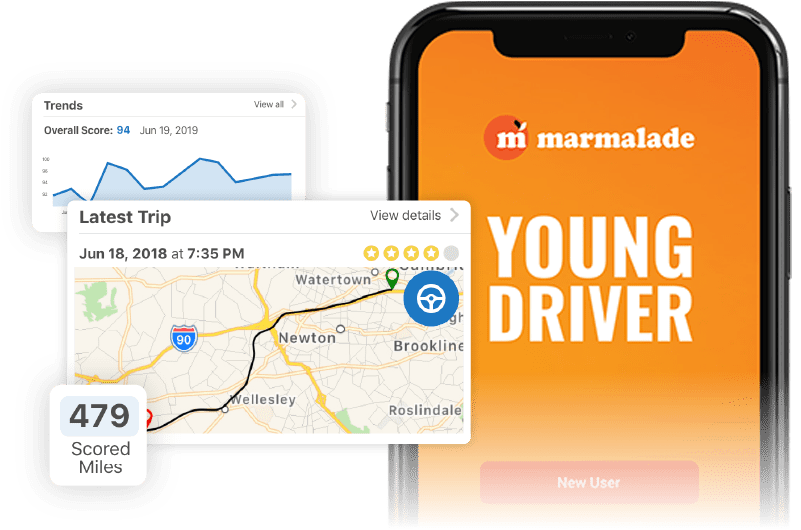

Marmalade Car Insurance is a type of car insurance policy specially designed for young drivers. It is intended to provide an affordable and reliable way for young drivers to protect themselves and their vehicles from any potential financial losses resulting from their car’s use. The policy is offered by Marmalade, a UK-based car insurance provider and can be purchased online or through a broker.

What is covered?

Marmalade Car Insurance offers a range of coverages to protect you and your car. This includes basic liability coverage, which pays for any damages or injuries caused by you to another person or property while you are operating your car. It also offers collision coverage, which pays for any repairs or replacement of your vehicle if you are involved in an accident. In addition, Marmalade Car Insurance also offers property damage coverage, which pays for any repairs or replacement costs for any property damaged by your vehicle. Finally, Marmalade Car Insurance also offers uninsured and underinsured motorist coverage, which pays for any medical expenses if you are injured in an accident caused by an uninsured or underinsured driver.

Who is eligible for Marmalade Car Insurance?

Marmalade Car Insurance is only available to drivers aged 17-25. Drivers must have held a valid UK driving license for at least 12 months. They must also have a clean driving record, with no convictions or claims in the last three years. Drivers must also have a valid UK road tax and be a resident of the United Kingdom. Finally, drivers must have a good credit rating.

What are the benefits of Marmalade Car Insurance?

Marmalade Car Insurance offers a range of benefits to young drivers. The policy includes a range of discounts and benefits, such as no-claims bonuses, multi-car discounts, and a 24-hour claims helpline. It also offers a range of additional optional extras, such as personal accident cover, breakdown cover, and legal protection. The policy also offers a choice of excesses, allowing you to tailor the policy to your individual needs and budget.

How do I apply for Marmalade Car Insurance?

Applying for Marmalade Car Insurance is easy. You can apply online or through a broker. You will need to provide personal information such as your name, address, date of birth, driving license number, and payment details. You will also need to provide information about your car, including its make, model, year, and value. Once you have provided all the required information, you will receive a quote for your policy.

How much does Marmalade Car Insurance cost?

The cost of Marmalade Car Insurance will vary depending on a number of factors, such as your age, driving history, type of car, and the level of cover you choose. It is important to shop around and compare quotes from different providers to ensure you get the best deal for your needs. Marmalade Car Insurance also offers a range of discounts and benefits, so it is worth exploring these to see if you can save money on your policy.

Marmalade launches Pay As You Go car insurance

Looking for car insurance on a car you see? There’s an app for that

Marmalade Introduces Pay as You Go Auto Insurance Solution - Cambridge

Buying a new car - FirstCar

Ageas underwrites Marmalade Pay As You Go car insurance