Gap In Health Insurance Coverage Between Jobs

Thursday, February 6, 2025

Edit

Gap in Health Insurance Coverage Between Jobs

The Impact of Job Loss on Health Insurance Coverage

In the United States, job loss often comes with a loss of health insurance coverage. For many, this can be a devastating blow, as health care costs are often expensive. This is especially true for those with pre-existing conditions or chronic illnesses. The Affordable Care Act (ACA), commonly known as Obamacare, provides some protection from this, as it extended health insurance coverage to those with pre-existing conditions, and enabled individuals to purchase health insurance on the private market. However, the ACA does not provide protection against the gap in health insurance coverage that can occur when a person loses their job.

When a person loses their job, they may be eligible for certain health benefits if they have been with their employer for at least 12 months. This is known as COBRA (Consolidated Omnibus Budget Reconciliation Act). This can provide some short-term coverage while they look for another job. However, this coverage is often expensive, as the employer usually pays part of the premium. Furthermore, once the coverage expires, the person is left without health insurance, unless they can find a new job with health insurance benefits.

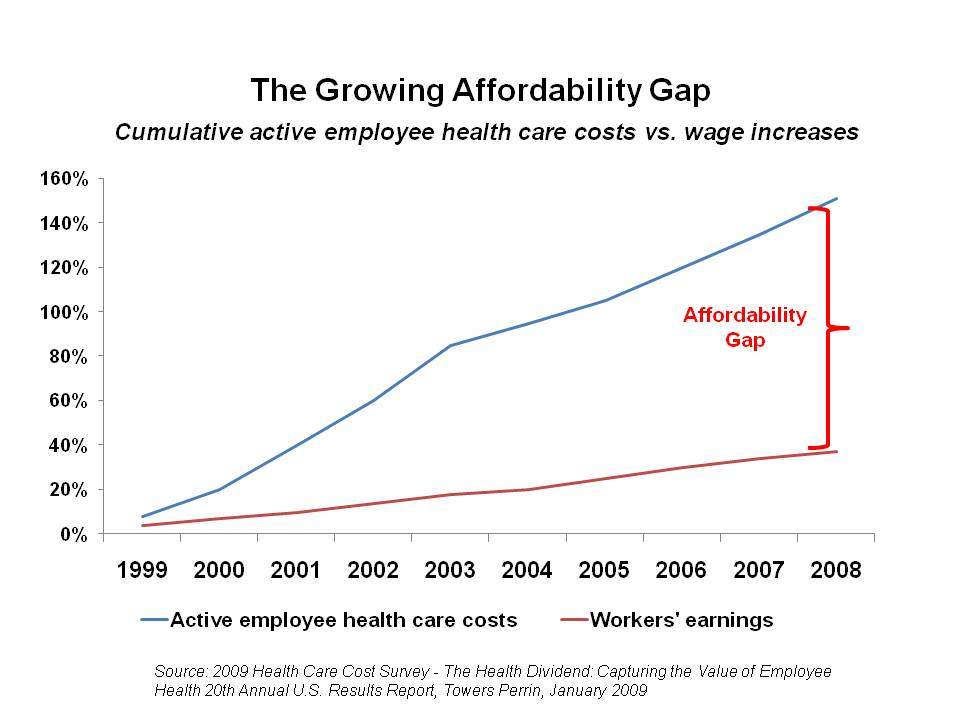

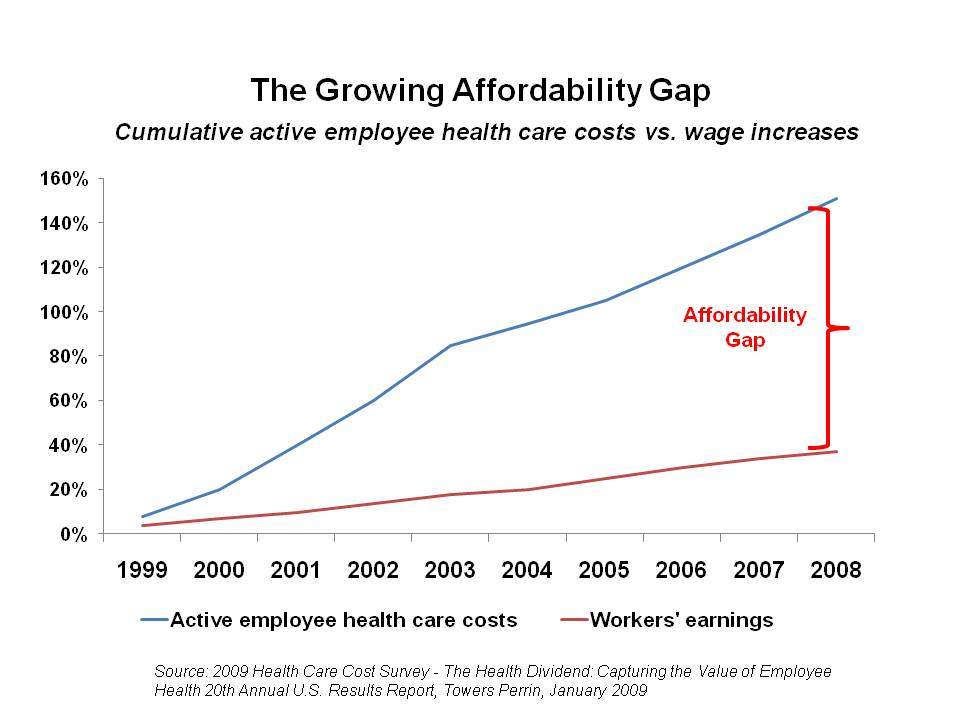

The Impact of High-Deductible Plans on Health Insurance Coverage

The rise of high-deductible health plans (HDHPs) has further contributed to the gap in health insurance coverage between jobs. HDHPs are health plans with a high deductible, meaning that the insured must pay a large amount out-of-pocket before the insurance company will cover the costs. These plans often come with lower premiums, making them attractive to those with tight budgets. However, the high deductibles can be a barrier to accessing care, as the insured must pay out-of-pocket for services until they meet their deductible. This can be especially difficult for those who are between jobs, as they may not have access to the resources to pay for care out-of-pocket.

The Impact of Short-Term Health Insurance on Health Insurance Coverage

Short-term health insurance plans have become increasingly popular in recent years as a way to bridge the gap in health insurance coverage between jobs. These plans, which typically last for up to three months, are often less expensive than traditional health insurance plans, and can provide some coverage during the transition period between jobs. However, these plans are not regulated by the ACA, and may not cover pre-existing conditions or certain services, such as mental health services or prescription drugs. Additionally, they do not provide the same level of coverage as a traditional health insurance plan, and may not cover certain services, such as hospitalization or emergency care.

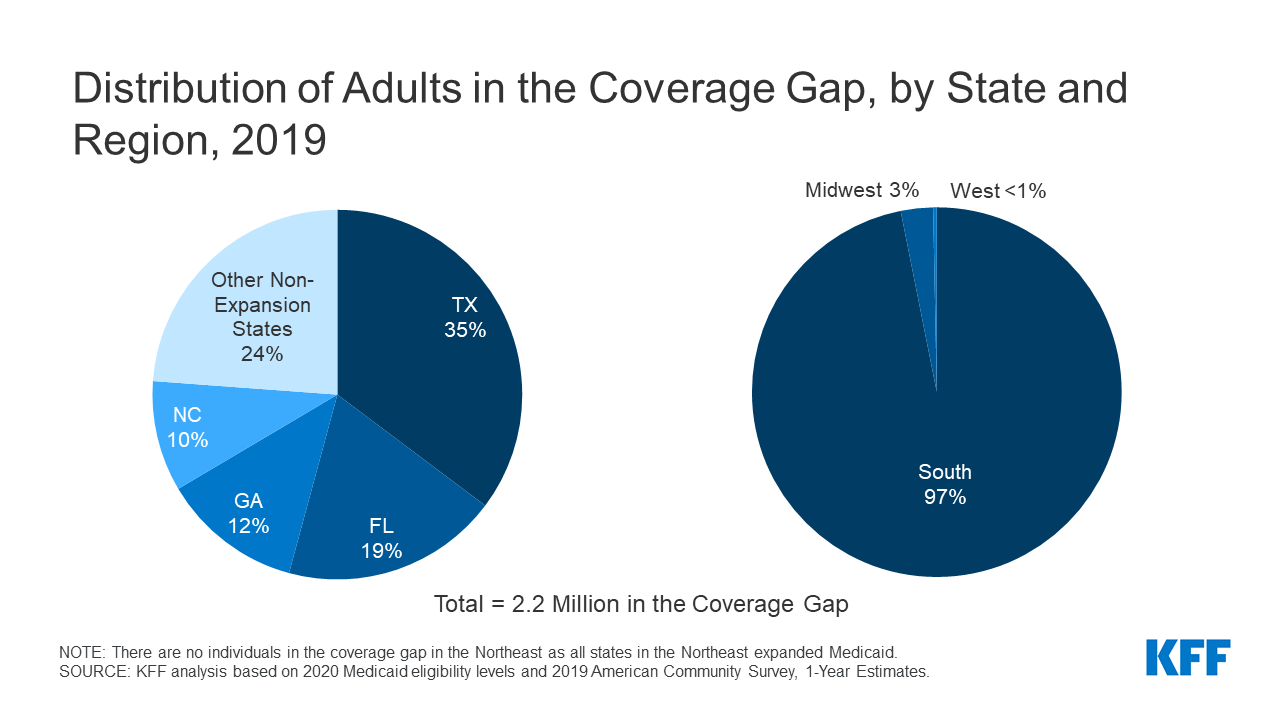

The Impact of Medicaid Expansion on Health Insurance Coverage

The expansion of Medicaid has also had a significant impact on health insurance coverage for those between jobs. Under the ACA, states have the option to expand Medicaid to cover those with incomes up to 138% of the federal poverty level. This has enabled those who have recently lost their jobs and have limited resources to access health coverage. Additionally, states that have expanded Medicaid have seen an increase in the number of people covered, as those who are between jobs are now able to access coverage through the program.

The Impact of the ACA on Health Insurance Coverage

The ACA has had a significant impact on health insurance coverage for those between jobs. The law has enabled those with pre-existing conditions to access health insurance on the private market, and has also provided subsidies to help cover the cost of coverage. Additionally, the law has enabled states to expand Medicaid to cover those with limited incomes. These provisions have enabled those who have recently lost their jobs to access health insurance coverage, and have helped to reduce the gap in health insurance coverage between jobs.

Conclusion

The gap in health insurance coverage between jobs is an ongoing problem in the United States. The ACA has helped to reduce this gap by providing protections for those with pre-existing conditions, and by enabling states to expand Medicaid. Additionally, short-term health plans and high-deductible plans have enabled those between jobs to access some coverage. However, there is still work to be done to ensure that all individuals have access to health insurance coverage, regardless of their employment status.

HealthPopuli.com

So, who exactly is in the coverage gap? - Care4Carolina

Network Health | Pharmacy Information

The Coverage Gap: Uninsured Poor Adults in States that Do Not Expand

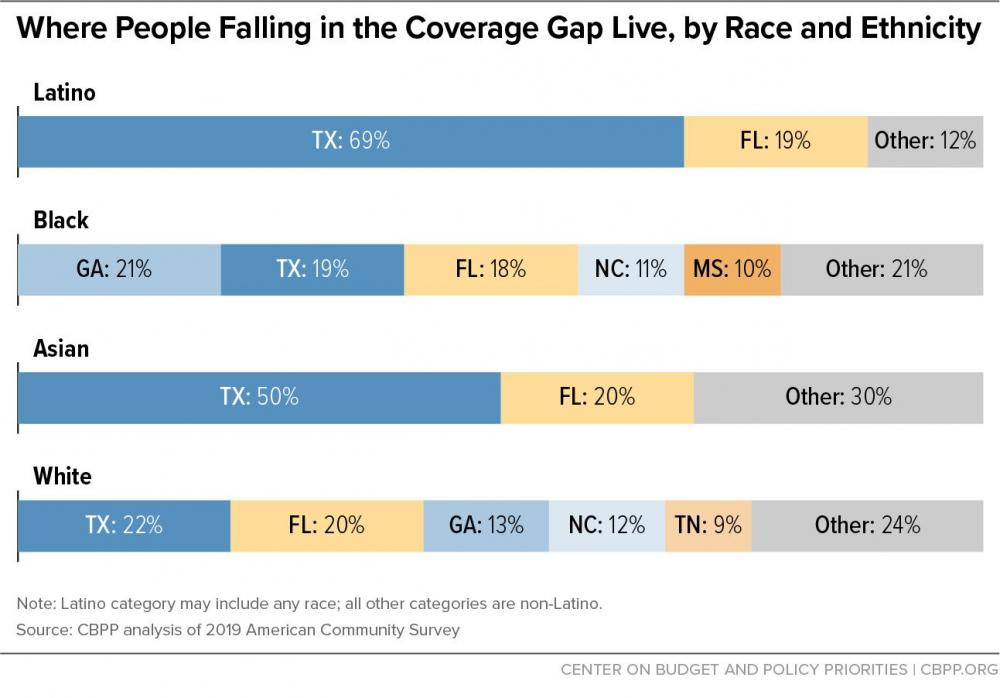

Closing Medicaid Coverage Gap Would Help Diverse Group and Narrow