Cost Of Long term Care Insurance At Age 60

Cost Of Long Term Care Insurance At Age 60

What Is Long-Term Care Insurance?

Long-term care insurance is a type of insurance policy that covers the costs of long-term care for a person. Long-term care insurance can be used to cover the costs of nursing home care, home health care, assisted living, personal care, and other related services. The amount of coverage and the types of services that are covered vary from policy to policy. Generally, long-term care insurance is designed to cover the costs of care for those who can no longer take care of themselves due to age, disability, or chronic illness.

What Is The Cost Of Long-Term Care Insurance At Age 60?

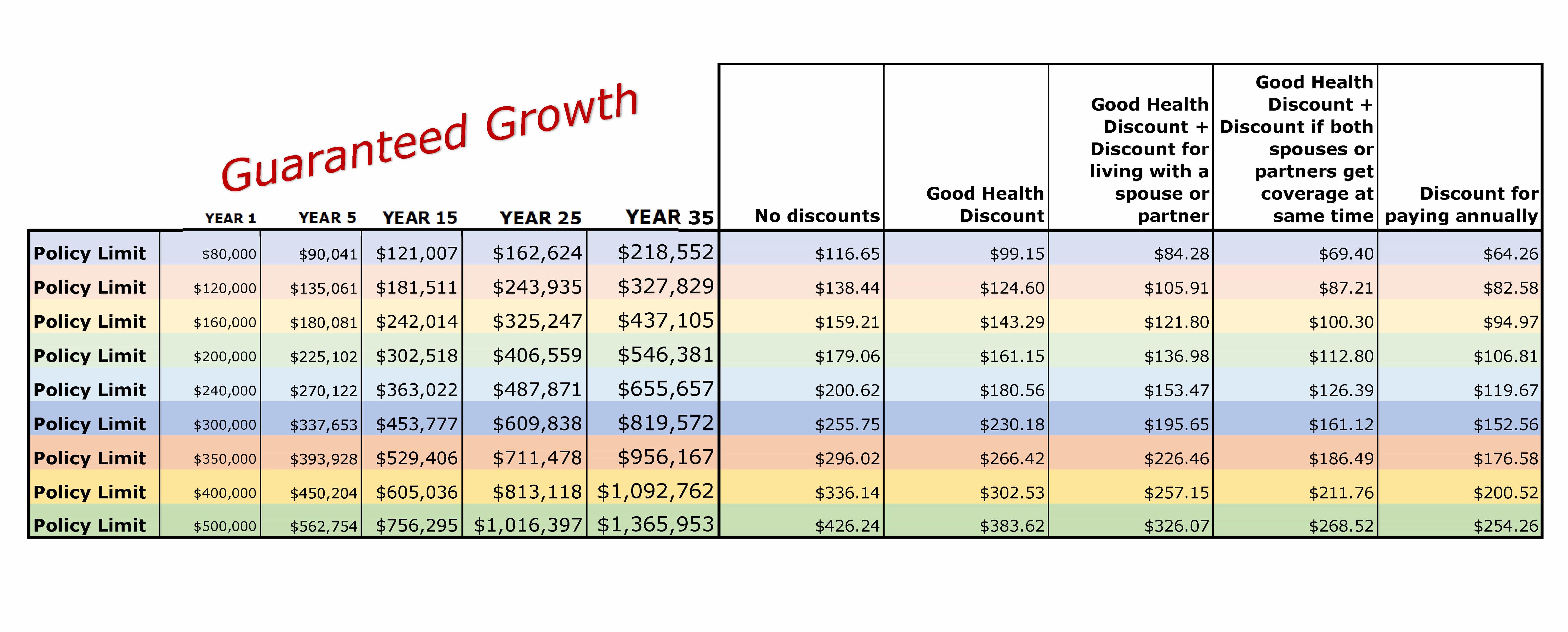

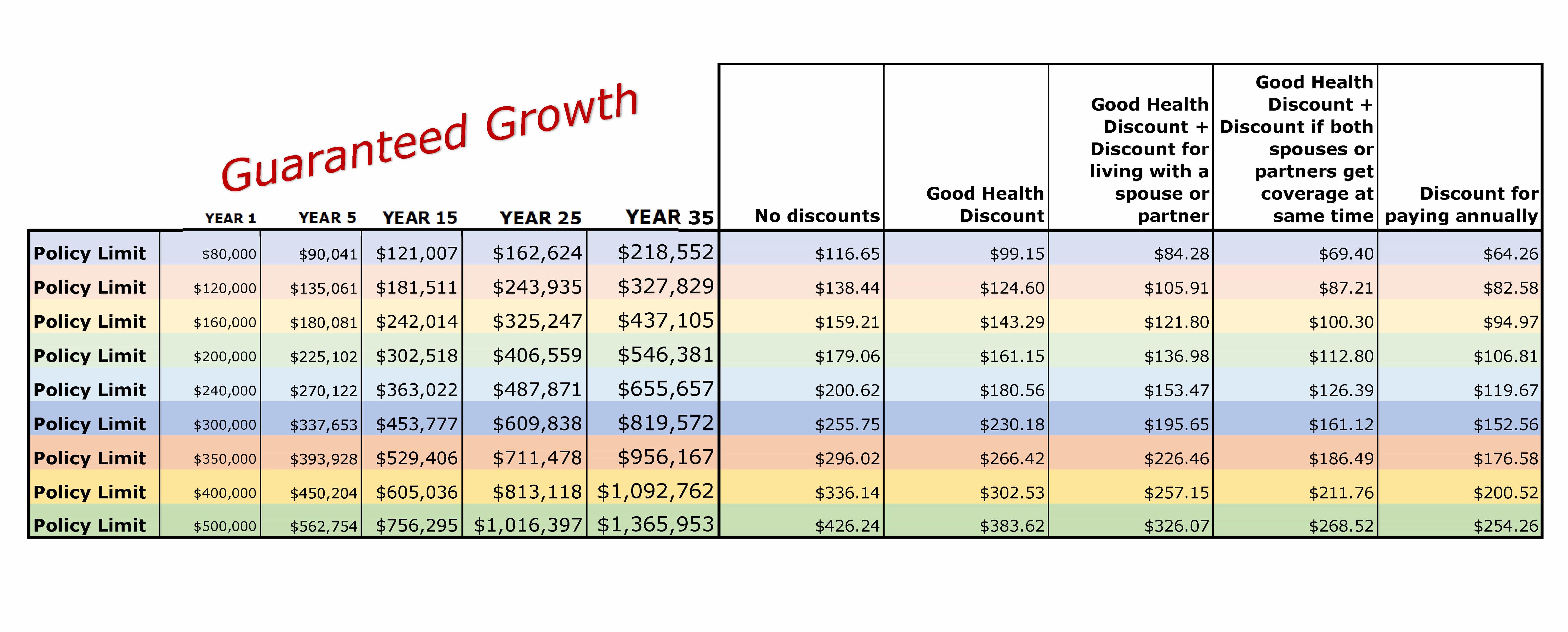

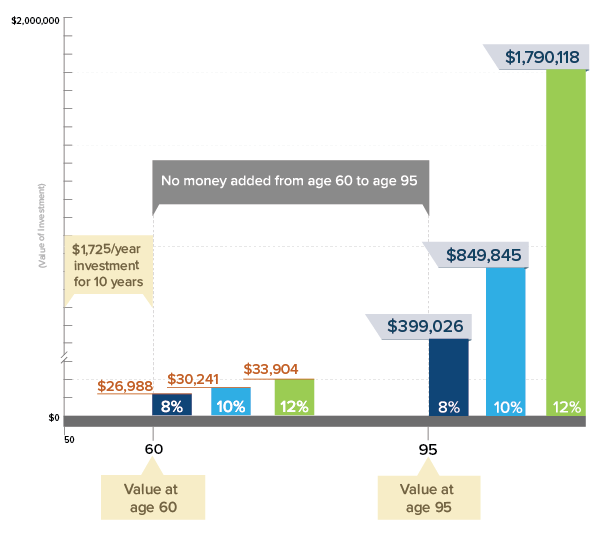

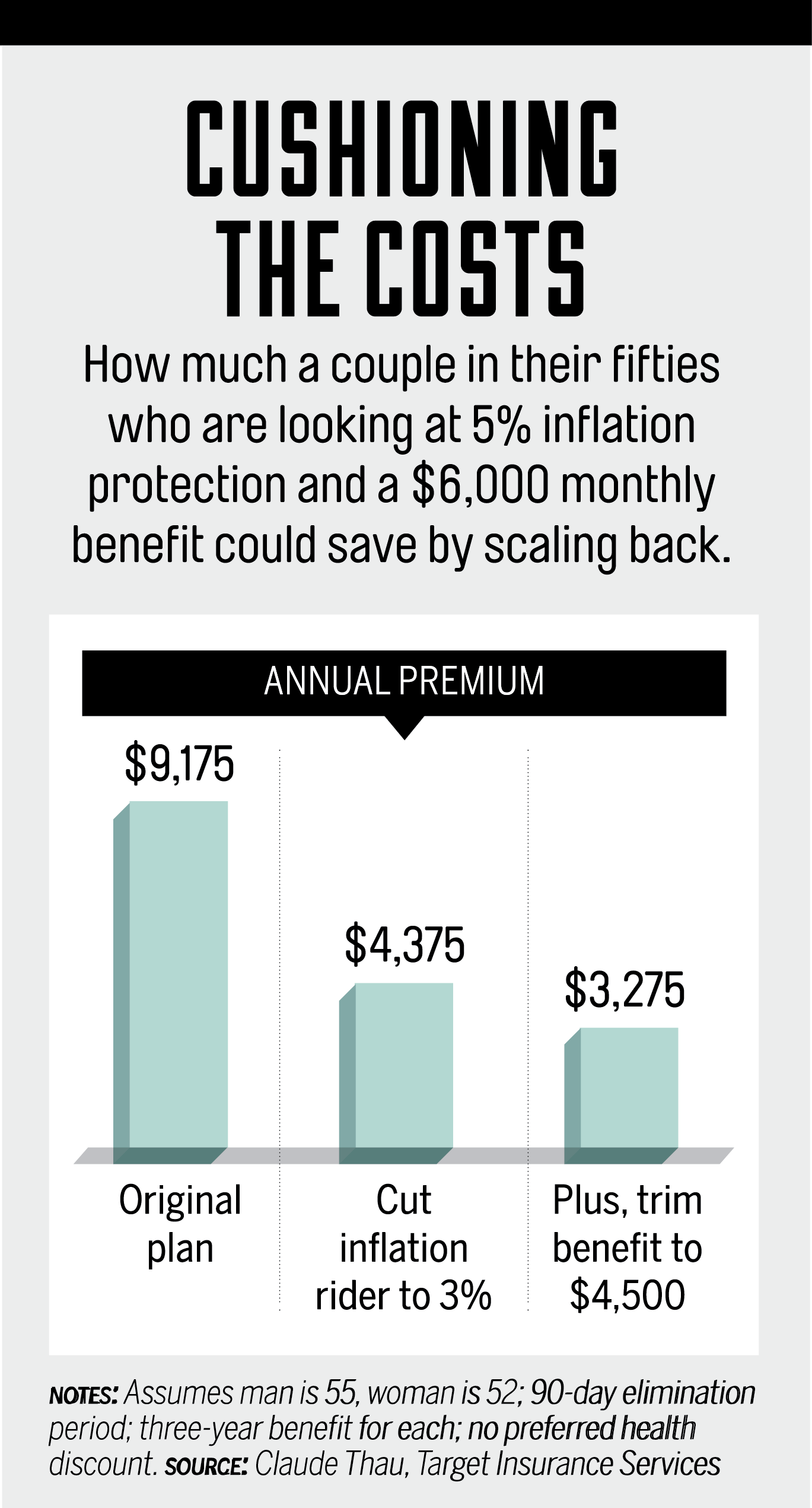

The cost of long-term care insurance at age 60 can vary significantly depending on the type of policy, the amount of coverage, and the provider. Generally, the older a person is when they purchase a long-term care policy, the higher the cost will be. This is because the older a person is, the more likely they are to need long-term care in the future. Generally, those who are age 60 or older will pay more for a long-term care policy than those who are younger.

Factors That Affect The Cost Of Long-Term Care Insurance At Age 60

There are several factors that can affect the cost of long-term care insurance at age 60. These factors include the type of policy, the amount of coverage, the provider, and the person's health status. Generally, those who are in good health and have no pre-existing conditions will pay less for a long-term care policy than those who have health conditions or are in poor health. Additionally, those who purchase a policy with a higher amount of coverage will typically pay more for their policy than those who purchase a policy with a lower amount of coverage.

Tips For Finding Affordable Long-Term Care Insurance At Age 60

When shopping for long-term care insurance at age 60, it is important to compare different policies and providers in order to find the most affordable option. It is also important to consider the types of services that are covered by the policy and the amount of coverage that is offered. Additionally, it is important to consider whether or not the policy covers pre-existing conditions and if there are any discounts available for purchasing the policy at an older age.

Conclusion

The cost of long-term care insurance at age 60 can vary significantly depending on the type of policy, the amount of coverage, and the provider. Those who are in good health and have no pre-existing conditions will typically pay less for a policy than those who have health conditions or are in poor health. Additionally, those who purchase a policy with a higher amount of coverage will typically pay more for their policy than those who purchase a policy with a lower amount of coverage. When shopping for long-term care insurance at age 60, it is important to compare different policies and providers in order to find the most affordable option.

Male Age 60 PQP 3 percent compound for life – Long-Term Care Insurance

Long Term Care Insurance Cost By Age : Edmond Consulting Group Llc

Long-Term Care Needs | Long term care insurance, Long term care

Long Term Care Insurance Cost For 40 Year Old

Nursing Home Insurance Policy Cost - Insurance Reference