Car Insurance Groups And Prices Uk

Everything You Need to Know About Car Insurance Groups and Prices in the UK

There is a lot of confusion surrounding car insurance groups and prices in the UK. It can be a challenge to find the right coverage at the right price. But understanding the basics of car insurance groups and prices can make it easier to compare policies and get the best deal. Here is everything you need to know about car insurance groups and prices in the UK.

What are car insurance groups?

Car insurance groups are a system used by the Association of British Insurers (ABI) to categorise cars. Each car is assigned a number from one to 50, which determines the level of risk associated with the car. The higher the number, the higher the risk, and the more expensive the car insurance is likely to be.

The factors taken into account when assigning a car to an insurance group include the car's value, performance, safety features and security features. The cost of replacement parts and the cost of repair are also taken into consideration.

What are the benefits of car insurance groups?

The main benefit of car insurance groups is that they make it easier to compare policies. By knowing the insurance group of a car, you can get an idea of the level of cover you can expect from a policy. This makes it easier to compare policies and get the best deal.

Another benefit of car insurance groups is that they can help you keep your premiums down. Cars in lower groups are generally cheaper to insure, so if you are looking for a new car and want to keep your premiums down, it can be worth looking at cars in lower insurance groups.

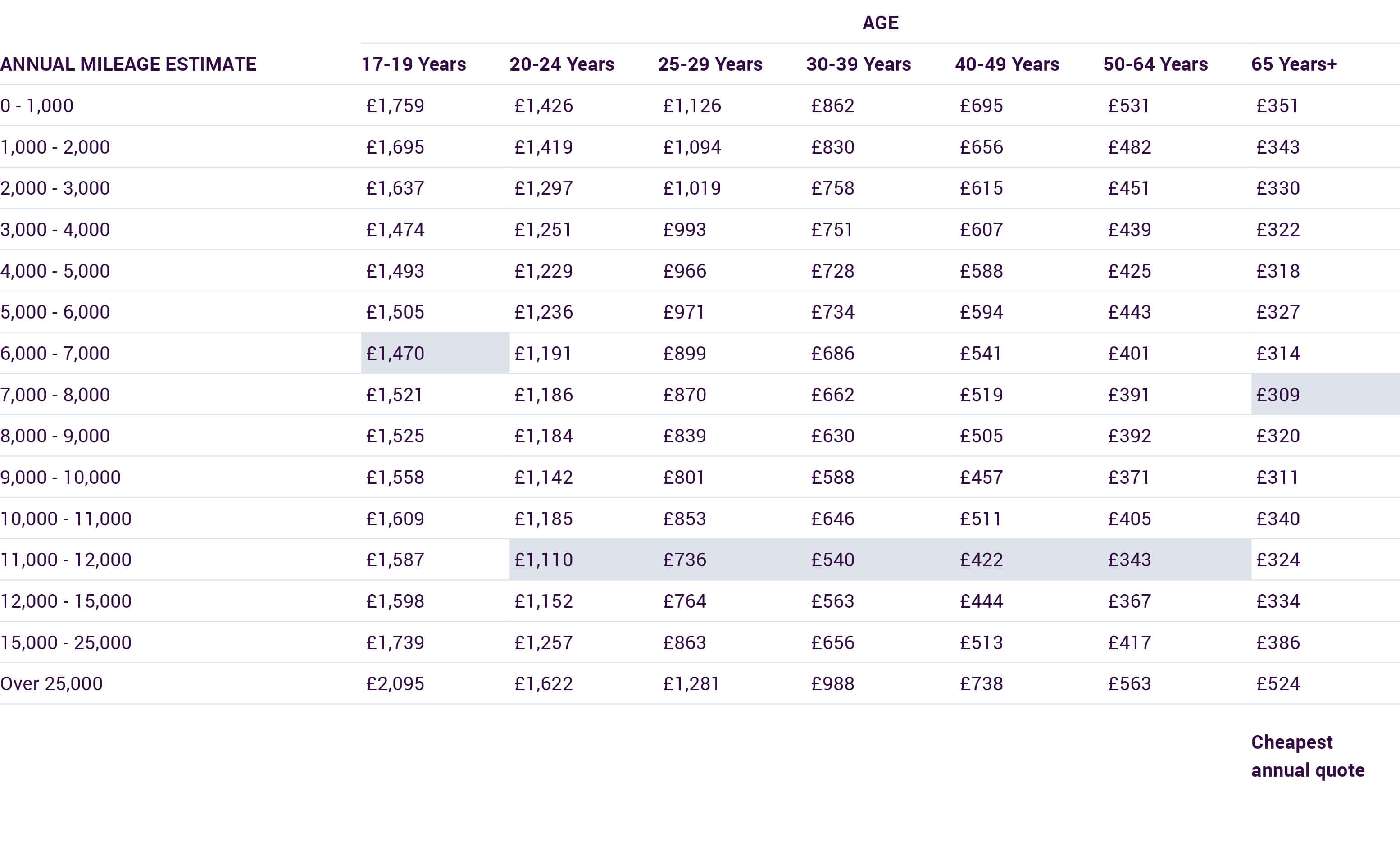

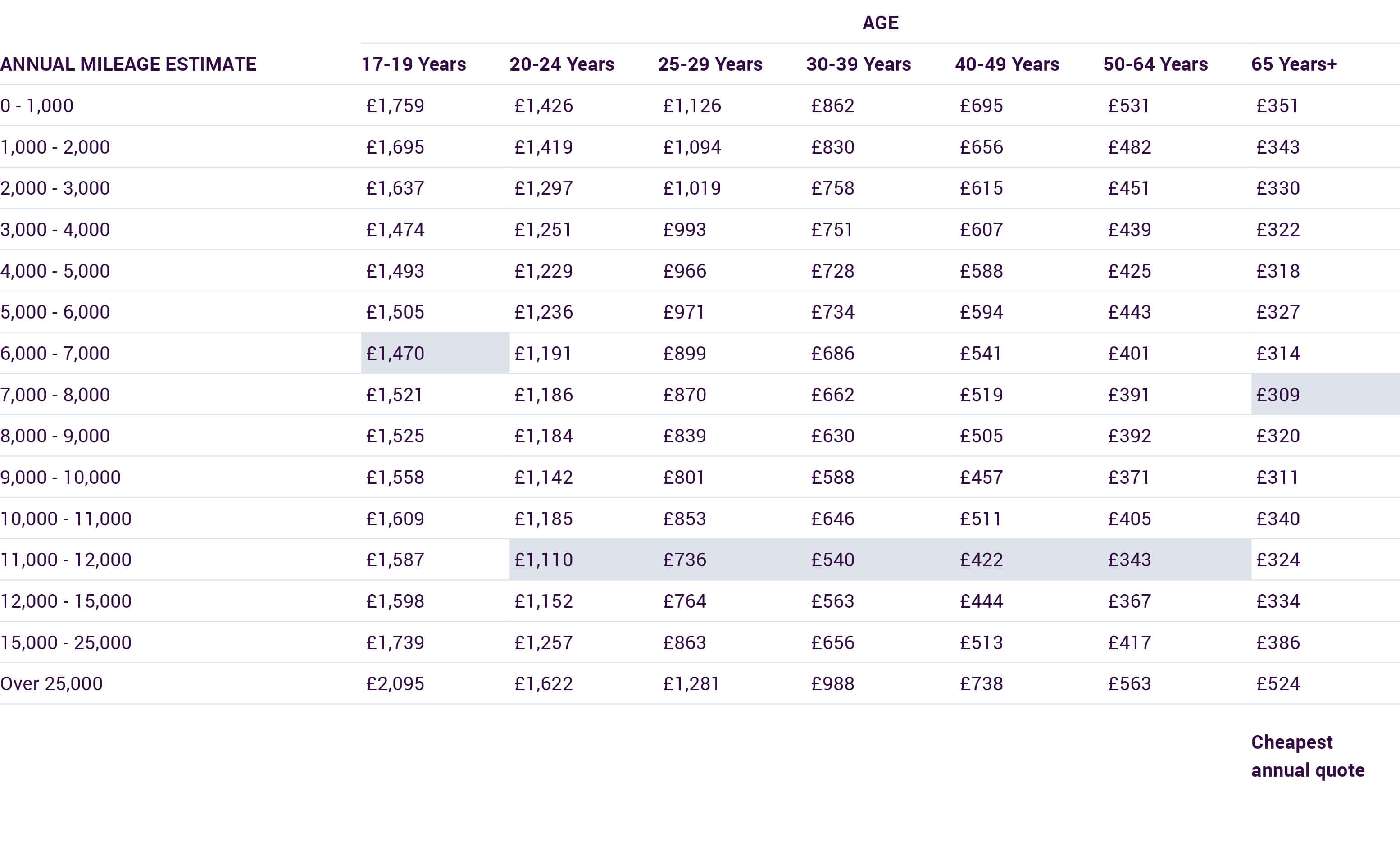

What are the differences in car insurance prices?

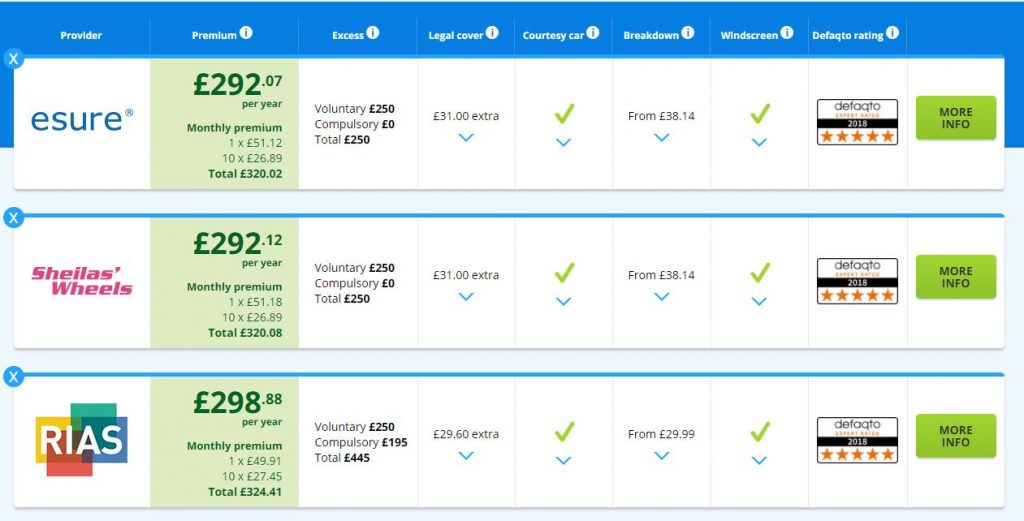

The price of car insurance will vary depending on many factors, including the type of car, your age, your driving history and your postcode. It is important to shop around and compare policies to get the best deal. It is also important to remember that the cheapest policy may not always be the best policy, so it is worth taking the time to read the policy terms and conditions before making a decision.

It is also worth noting that some insurers offer discounts for drivers with a good driving record, so it is worth asking about any discounts you may be eligible for.

How can I find the right car insurance group for me?

If you are looking for the right car insurance group for you, the first step is to research the different insurance groups. You can use online comparison sites or contact insurers directly to get an idea of the different levels of cover available. It is also worth asking friends and family for recommendations, as they may be able to point you in the right direction.

Once you have an idea of the different insurance groups, you can start comparing policies. Make sure you read the policy terms and conditions and check for any excesses or additional charges. You should also check for any discounts or benefits you may be eligible for. When you find the right policy for you, make sure you read all the terms and conditions carefully before signing up.

Conclusion

Car insurance groups and prices in the UK can be confusing. But understanding the basics of car insurance groups and prices can make it easier to compare policies and get the best deal. By researching the different insurance groups and taking the time to compare policies, you can find the right coverage at the right price.

Car Insurance Bands Uk Table - Perodua Kelisa Hits Every Target For

Car Insurance Groups Explained - Insurance Groups Car Prices Table

UK's Best Car Insurance Providers | mustard.co.uk

8 Simple Steps Reduced My Car Insurance By 57% (In Only 20 Minutes

Car Insurance Groups List Uk : UK Car Insurance Groups Explained