Car Insurance For Provisional Licence

All You Need to Know About Car Insurance for Provisional Licence

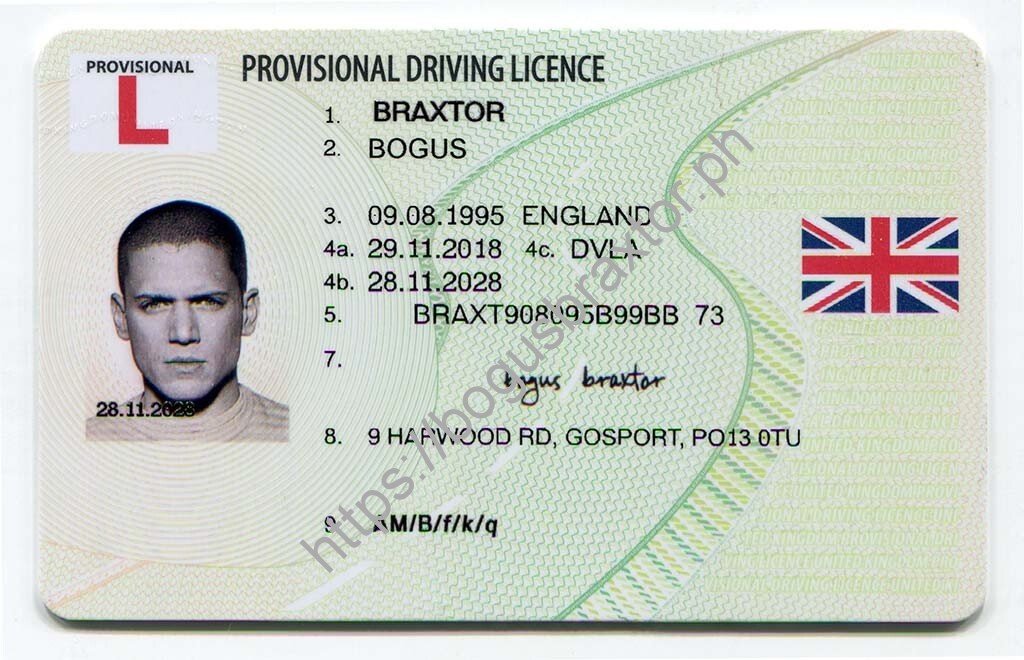

What is a Provisional Licence?

A provisional licence is a type of licence issued by your local driving licence authority. It enables you to learn to drive a car in the UK, as long as you are accompanied by a qualified driver who is over 21 and has had a full licence for at least three years.

In order to obtain a provisional licence, you must be at least 17 years of age and have passed your Theory Test. Additionally, you must provide proof of identity and address, and pass an eyesight test. Once you have your provisional licence, you must display "L" (for learner) plates on the car you are driving.

Do I Need Car Insurance if I Have a Provisional Licence?

Yes, you must have car insurance if you have a provisional licence. The insurance must cover you, the vehicle, and any other named drivers. It also needs to meet the minimum legal requirements for your country. Additionally, you must be insured to drive any car you are learning in, and the person accompanying you must have a valid full licence.

You have the option to buy a provisional licence insurance policy that is specifically designed for learner drivers. These policies usually have a lower premium than a standard car insurance policy and will provide you with the necessary cover.

What are the Benefits of Having a Provisional Licence Insurance Policy?

Having a provisional licence insurance policy means that you can get on the road and start learning to drive without having to worry about the cost of a standard car insurance policy. It also gives you peace of mind that you are covered in the event of an accident.

A provisional licence insurance policy can also provide additional benefits such as access to a 24-hour helpline and legal assistance in the event of an accident. Additionally, some policies may provide discounts for advanced driving courses, which can help you save money and improve your driving skills.

What is the Cost of Provisional Licence Insurance?

The cost of a provisional licence insurance policy will depend on a number of factors, including the type of car you are driving, the type of cover you require and your personal details. Generally, the cost of a policy will be lower if you are a young driver or a learner driver. Additionally, some insurers may offer discounts for having a good driving record or for taking an approved driving course.

It is important to shop around and compare quotes from different insurers before you decide on a policy. This will help you find the best deal and ensure that you get the cover you need.

How Can I Get the Best Deal on Car Insurance for Provisional Licence?

When looking for car insurance for provisional licence, it is important to compare quotes from different insurers. This will ensure that you get the best deal and the cover you need. Additionally, it is important to read the policy documents carefully to make sure that you are aware of all the terms and conditions.

It is also a good idea to compare policies that offer additional benefits such as access to a 24-hour helpline or discounts for advanced driving courses. This can help you save money and get the most out of your insurance policy.

Insurance Companies That Insure Provisional Drivers - noclutter.cloud

Provisional licence insurance - Confused.com

Insurance Companies That Insure Provisional Drivers - noclutter.cloud

Number of driving licences revoked on medical grounds up 50 per cent

Apply for your Provisional Driving Licence