Car Insurance Average Cost Monthly

The Average Cost of Car Insurance Per Month

Car insurance is an essential part of owning and driving a car, as it helps protect you and your vehicle in the event of an accident. Though the cost of car insurance varies from person to person, on average, most drivers pay around $80 per month for their car insurance premiums. Of course, many factors can affect the rate of your car insurance, such as the type of car you drive, your age and driving history, and the coverage amount you choose. Read on to learn more about the average cost of car insurance per month, and how you can lower your monthly premiums.

Factors That Affect the Average Cost of Car Insurance

There are several factors that can affect the average cost of car insurance. One of the most important factors is the type of car you drive. Generally, luxury cars, sports cars, and other high-end vehicles have higher insurance rates than more affordable cars. Additionally, the age of your car will play a role in the cost of your insurance premiums; older vehicles typically have lower premiums, whereas newer cars tend to have higher premiums. Other factors that can influence your car insurance premiums include your age, driving history, and the type of coverage you choose.

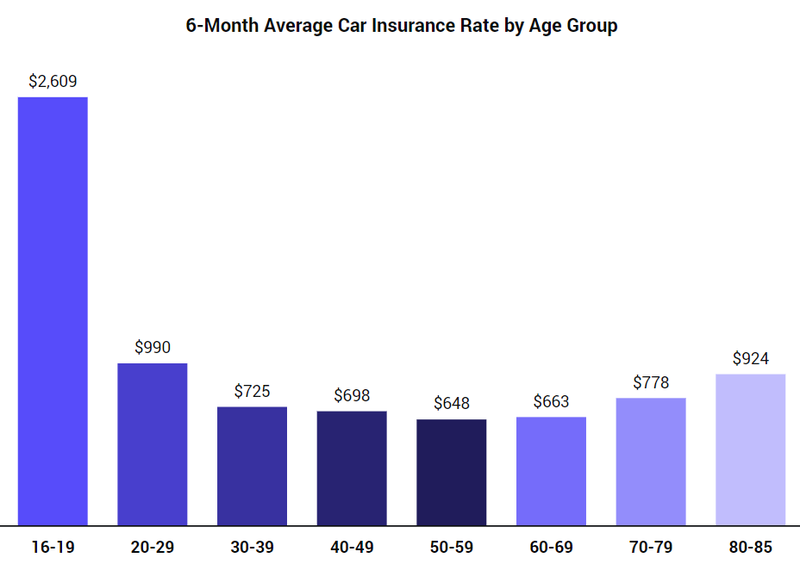

Average Cost of Car Insurance by Age

Your age is one of the major factors that can determine the cost of your car insurance premiums. Generally, drivers in their 20s tend to pay the highest rates, as they are considered to be the riskiest drivers. On the other hand, drivers in their 40s and 50s tend to pay the lowest rates, as they are considered to be the safest drivers. Additionally, younger drivers are more likely to be involved in an accident, which can lead to higher premiums.

Average Cost of Car Insurance by Coverage Amount

The amount of coverage you choose can also affect the average cost of car insurance. Generally, the higher the coverage amount, the higher the premiums. However, it is important to remember that the cost of your insurance premiums is determined by the amount of coverage you choose, not the amount you actually pay out of pocket. For example, if you choose to have a $50,000 liability limit, your monthly premium will be higher than if you choose to have a $25,000 liability limit.

Average Cost of Car Insurance for High-Risk Drivers

High-risk drivers are typically drivers who have had multiple driving violations, or drivers who have been involved in multiple accidents. These drivers tend to pay higher premiums than other drivers, as they are considered to be higher risks. Additionally, high-risk drivers may also be required to purchase additional coverage, such as uninsured motorist coverage, which can increase the cost of their premiums.

Tips for Lowering Your Car Insurance Premiums

Though the cost of car insurance can vary from person to person, there are several steps you can take to lower your car insurance premiums. One of the best ways to lower your premiums is to shop around and compare rates from different insurance companies. Additionally, if you have a clean driving record, you may be able to get discounts on your car insurance. You can also lower your premiums by increasing your deductible, or by choosing a higher coverage limit. Finally, if you are a safe driver, you may be able to get discounts for taking a driver safety course. By taking the time to compare rates and explore your options, you can ensure that you are getting the best deal on your car insurance.

ALL You Need to Know About the Average Car Insurance Cost

The Best Average Cost Of Car Insurance 2022 - Dakwah Islami

Average Price Of Car Insurance Per Month - designby4d

How Much Is It For Car Insurance Per Month - Car Retro

Average Monthly Car Insurance Rate