Can You Insure Rebuilt Title

Can You Insure Rebuilt Titles?

Are you considering buying a vehicle with a rebuilt title? You may be wondering if you can insure it and what the process looks like. The truth is, you can insure a vehicle with a rebuilt title, but it may cost you more than it would to insure a vehicle with a clean title. In this article, we’ll discuss how you can insure a rebuilt title and what you should know before you do.

What is a Rebuilt Title?

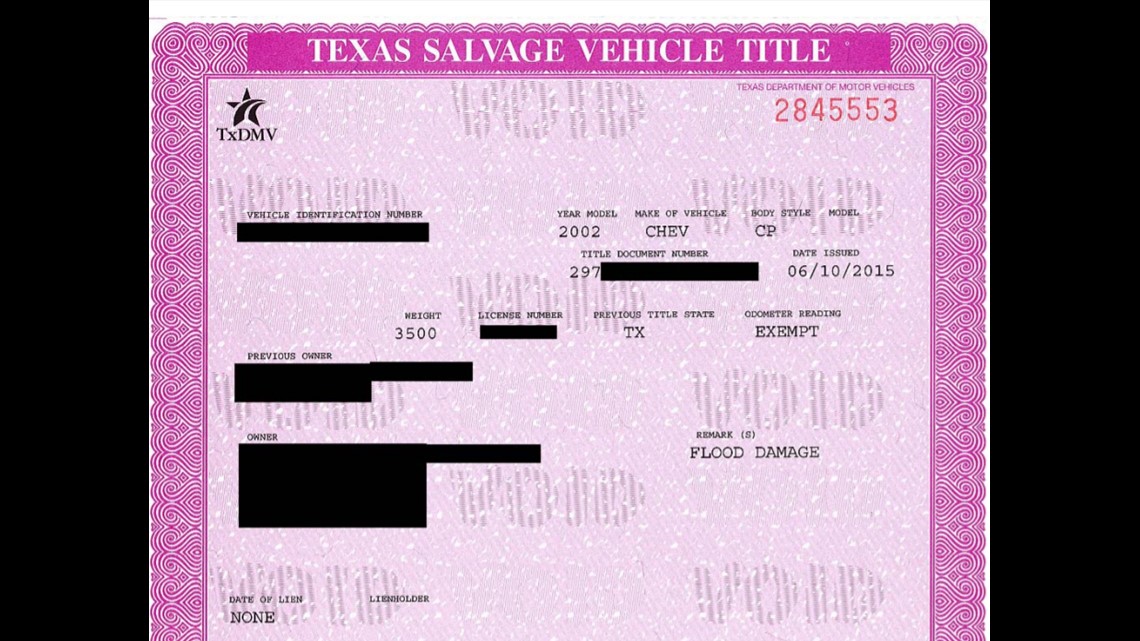

A rebuilt title is a title given to a vehicle that has been salvaged and repaired. The vehicle’s title is changed from a clean title to a rebuilt title to indicate that the vehicle has been damaged in the past. This could be due to a crash, flood, or other accident, or even theft. Rebuilt titles also may be referred to as “salvage titles” or “reconstructed titles.”

Insuring a Rebuilt Title

In most cases, you’ll be able to insure a vehicle with a rebuilt title. The only exception is if the vehicle has been deemed to be a total loss by the insurance company. When you’re ready to purchase insurance for your rebuilt title vehicle, you’ll need to provide proof of ownership and the vehicle’s title. You also will need to provide a list of repairs that have been made on the vehicle.

Cost of Insuring a Rebuilt Title

The cost of insuring a rebuilt title vehicle will vary depending on the age and make of the vehicle, the type of insurance you choose, and the state you live in. In general, you can expect to pay more for insurance on a rebuilt title vehicle than you would for a vehicle with a clean title. This is because insurance companies view rebuilt title vehicles as a higher risk, as they can’t accurately assess the car’s condition due to its history.

Things to Consider Before Insuring a Rebuilt Title

Before you purchase a vehicle with a rebuilt title, it’s important to do your research. Be sure to get a vehicle history report to get an accurate picture of the car’s history. You also should have the vehicle inspected by a qualified mechanic to make sure that the repairs have been done correctly. Once you have the vehicle inspected, you can make an informed decision about whether or not you should purchase the vehicle.

Conclusion

In most cases, you can insure a vehicle with a rebuilt title. However, you should be aware that you may pay more for insurance on a rebuilt title vehicle than you would for a vehicle with a clean title. Before you purchase a rebuilt title vehicle, it’s important to get a vehicle history report and have the vehicle inspected by a qualified mechanic. Doing your research can help ensure that you’re making a sound decision.

What is Rebuilt Title Car? How can your Insure one?

Texas Rebuilt Motorcycle Titles - MotorCycle Review

How To Sell A Rebuilt Title Car - Title Choices

Get The Right Auto Insurance In Bristol, CT, For A Rebuilt Salvage Title.

flowerdesignersnyc: What Is A Rebuilt Car Title