Can You Get Gap Insurance Through Progressive

Can You Get Gap Insurance Through Progressive?

What is Gap Insurance?

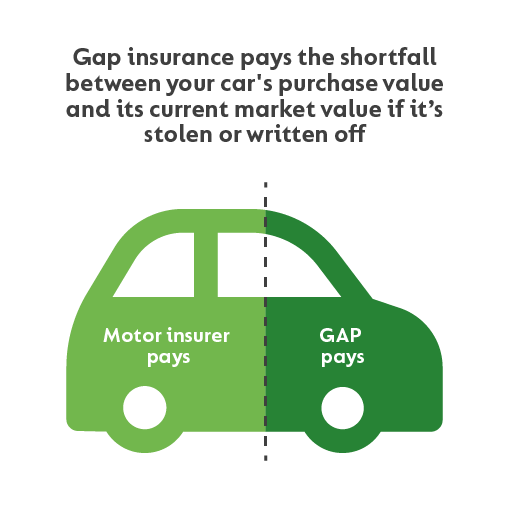

Gap insurance, also known as loan/lease gap coverage, is a form of automobile insurance that helps protect you if your car is stolen or totaled in an accident. Gap insurance bridges the gap between the actual cash value of your car and the amount you still owe on your car loan or lease. It is especially helpful if you have a loan or lease with a large down payment, long-term loan or lease, or negative equity.

Do I Need Gap Insurance?

Gap insurance is not required by law, however it can be a smart choice for certain drivers. If you have a long-term loan or lease and/or a large down payment, you could be at risk of owing more money than your car is worth if it’s stolen or totaled in an accident. In that case, gap insurance can help protect you from the financial burden of paying off a loan on a car that you no longer have. It can also be beneficial if you experience sudden and significant depreciation of your car’s value.

Can You Get Gap Insurance Through Progressive?

Yes, you can get gap insurance through Progressive. Progressive’s gap insurance is called Loan/Lease Payoff coverage, and it’s available as an optional add-on to your existing auto insurance policy. It covers the difference between the actual cash value of your car and the outstanding balance of your loan or lease, up to $25,000.

How Much Does Gap Insurance Cost?

The cost of gap insurance will vary depending on several factors, including the value of your car, the length of your loan or lease, and your deductible. Generally speaking, gap insurance is relatively affordable, and typically costs between $20 and $40 per year. When considering the cost of gap insurance, it’s important to remember that it can potentially offer you greater peace of mind and financial protection in the event of an accident or theft.

What Else Should I Know About Gap Insurance?

It’s important to note that gap insurance will not cover the full amount of your loan or lease if you still owe more than the actual cash value of your car when it’s stolen or totaled. Additionally, if your car is stolen and not recovered, gap insurance will not cover the actual cash value of your car. Lastly, gap insurance only covers the value of your car, not any additional parts or accessories.

Conclusion

Gap insurance can help protect you from the financial burden of owing more money than your car is worth if it’s stolen or totaled in an accident. Progressive offers gap insurance coverage for an affordable price, and it can be added on to your existing auto insurance policy. Be sure to consider all the details when deciding if gap insurance is right for you.

Gap insurance: The ins and outs | Progressive

GAP Insurance - Explained in a Complete Guide | TotalLossGap

Understanding Auto Insurance "Gap Coverage"

Gap Insurance at GoCompare | What is Gap Insurance and How Does it Work?

Gap Insurance Meaning Auto Gap, Sometimes Called Gap Insurance, Helps

.jpg)