Average State Farm Car Insurance Cost

Sunday, February 16, 2025

Edit

Average Cost of State Farm Car Insurance

What Is State Farm Car Insurance?

State Farm car insurance is a form of auto insurance provided by the State Farm Mutual Automobile Insurance Company. State Farm is one of the largest and most popular providers of car insurance in the United States. State Farm offers a variety of insurance products, including liability, collision, comprehensive, and medical coverage. State Farm also offers discounts for safe drivers, multiple-car policies, and good students.

What Does State Farm Car Insurance Cover?

State Farm car insurance covers a variety of things. It provides liability coverage, which pays for damages to other people's property and medical costs if you are at fault in an accident. It also provides collision coverage, which pays for damages to your car if you are in an accident with another vehicle. Comprehensive coverage pays for non-collision damage, such as theft, vandalism, or damage caused by animals. Finally, State Farm car insurance provides medical coverage for both you and other people injured in an accident that you caused.

How Much Does State Farm Car Insurance Cost?

The average cost of State Farm car insurance varies depending on your location, driving record, credit score, and the type of coverage you select. Generally, the average cost of State Farm car insurance is around $1,200 per year. However, this amount can vary greatly depending on the type of coverage you select, the age of your vehicle, and the amount of coverage you need. For example, if you select comprehensive coverage, the cost of your State Farm car insurance may be higher than if you only selected liability coverage.

What Factors Affect the Cost of State Farm Car Insurance?

There are several factors that can affect the cost of State Farm car insurance. These include the age of your vehicle, the amount of coverage you need, your driving record, your credit score, and the type of coverage you select. Additionally, the cost of State Farm car insurance may vary depending on the state you live in and the discounts available in your area. For example, if you live in a state that offers a safe-driving discount, you may be able to receive a lower rate on your State Farm car insurance.

How Can I Get the Best Rate on State Farm Car Insurance?

There are several steps you can take to get the best rate on State Farm car insurance. First, you should shop around and compare rates from different insurers. Additionally, you should ask about any discounts that you may qualify for. You may be able to receive a lower rate if you have a good driving record, maintain a high credit score, or have multiple cars insured with State Farm. Finally, you should consider increasing your deductible to reduce your overall insurance costs.

Conclusion

State Farm car insurance is a popular and reliable option for auto insurance. The cost of State Farm car insurance varies depending on many factors, including your location, driving record, and the type of coverage you select. To get the best rate on State Farm car insurance, you should shop around, ask about discounts, and consider increasing your deductible.

State Farm Auto & Home Insurance Review: Quality Service and Lots of

State Farm Insurance Rates By Vehicle

State Farm Insurance: Rates, Consumer Ratings & Discounts

State Farm Car Insurance Review [The Complete Guide]

![Average State Farm Car Insurance Cost State Farm Car Insurance Review [The Complete Guide]](https://res.cloudinary.com/quotellc/image/upload/insurance-site-images/aiorg-live/State-Farm-_page-0001.jpg)

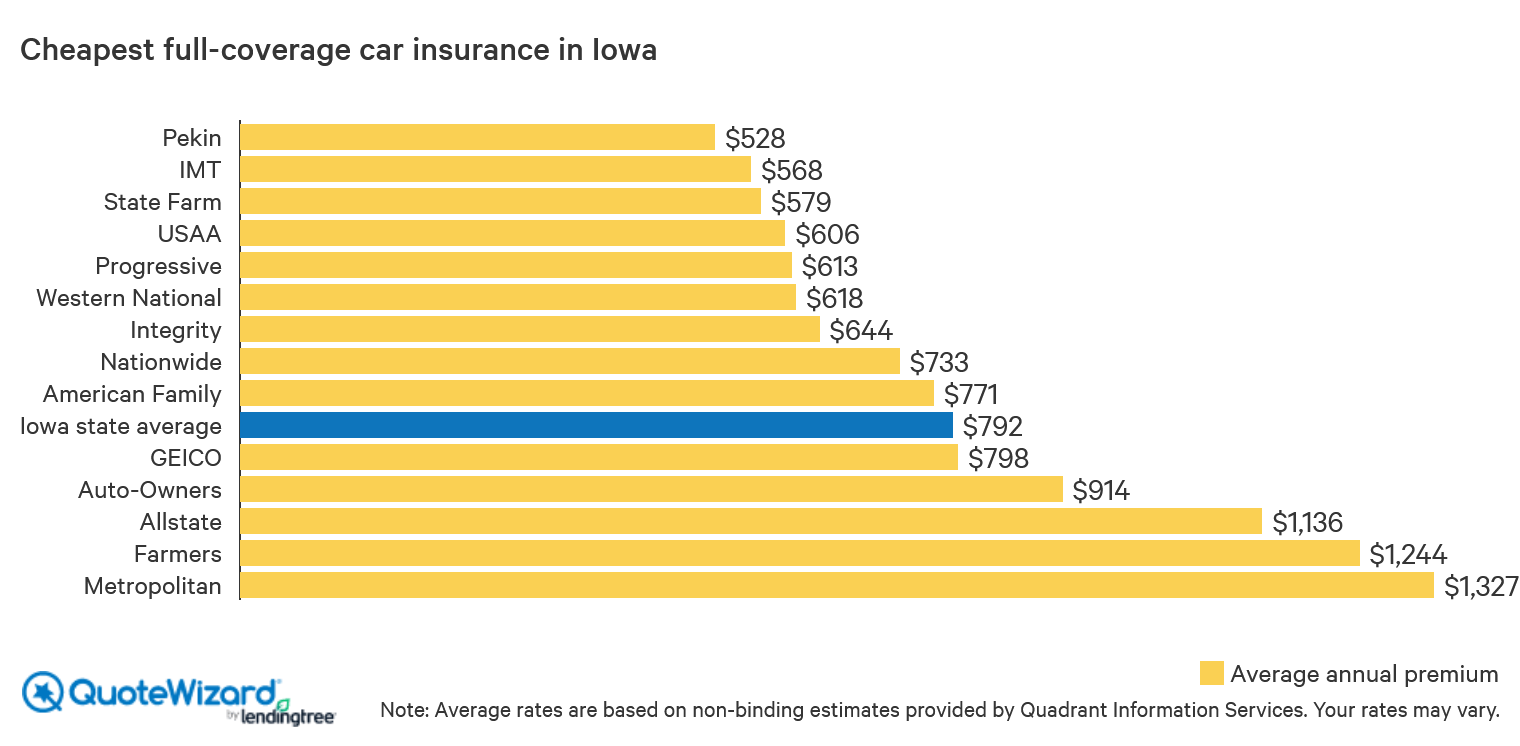

Get Cheap Auto Insurance in Iowa | QuoteWizard