A Plan Car Insurance Cancellation Fee

Understanding A Plan Car Insurance Cancellation Fee

It's important to understand what a cancellation fee is when you're looking for car insurance. A cancellation fee is the amount of money that is charged by the insurance company if you cancel your car insurance before the end of the policy period. This fee can vary depending on the provider, the type of coverage you have, and other factors. It's important to understand the cancellation fee when considering whether to switch car insurance providers or stay with the same one.

A Plan Car Insurance is one of the most popular providers in the UK. They offer a wide range of car insurance policies, including comprehensive cover, third party only cover, and third party fire and theft cover. They also offer a number of optional extras, such as breakdown cover, legal protection, and windscreen cover. As with any insurance policy, you should make sure that you read the terms and conditions of your policy carefully before taking out cover.

What Is A Plan Car Insurance Cancellation Fee?

A Plan Car Insurance Cancellation Fee is the amount that you will be charged if you decide to cancel your policy before the end of the policy period. This fee is usually a percentage of the total cost of the policy and it is usually non-refundable. The exact amount of the cancellation fee will depend on the type of policy that you have taken out, the length of the policy period, and the provider.

It is important to note that there may be additional charges if you cancel your policy after the cooling off period has ended. This means that if you cancel your policy within the first 14 days after taking it out, you will not be liable for any cancellation fees. However, if you cancel after this period, you may be liable for the cancellation fee.

How Much Is The Cancellation Fee With A Plan Car Insurance?

The exact amount of the cancellation fee with A Plan Car Insurance will depend on the type of policy that you have taken out and the length of the policy period. As a general rule, the fee will be a percentage of the total cost of the policy. It is important to note that the cancellation fee is non-refundable, so it is essential that you read the terms and conditions of your policy carefully before taking out cover.

What Should I Do If I Need To Cancel My Policy?

If you need to cancel your policy with A Plan Car Insurance, you should contact their customer services team as soon as possible. They will be able to advise you on the best way to proceed with your cancellation and the amount of the cancellation fee that you will be liable for. It is important to note that you may be liable for additional charges if you cancel your policy after the cooling off period has ended.

In addition to contacting A Plan Car Insurance, you should also contact the Financial Ombudsman Service if you are unhappy with the amount of the cancellation fee. The Financial Ombudsman Service is an independent organisation that deals with complaints about financial services companies. They can help to ensure that you receive a fair outcome.

It is important to understand the cancellation fee when you are looking for car insurance. A Plan Car Insurance is one of the most popular providers in the UK and they offer a range of policies, including comprehensive cover, third party only cover, and third party fire and theft cover. The cancellation fee with A Plan Car Insurance will depend on the type of policy that you have taken out and the length of the policy period. If you need to cancel your policy, you should contact their customer services team as soon as possible and the Financial Ombudsman Service if you are unhappy with the amount of the cancellation fee.

What is the cancellation fee for Progressive auto insurance if I

Insurance Cancellation Letter Template - Format Sample & Example (2022)

Can You Cancel Car Insurance And Get A Refund - Car Retro

Insurance Policy Cancellation Types

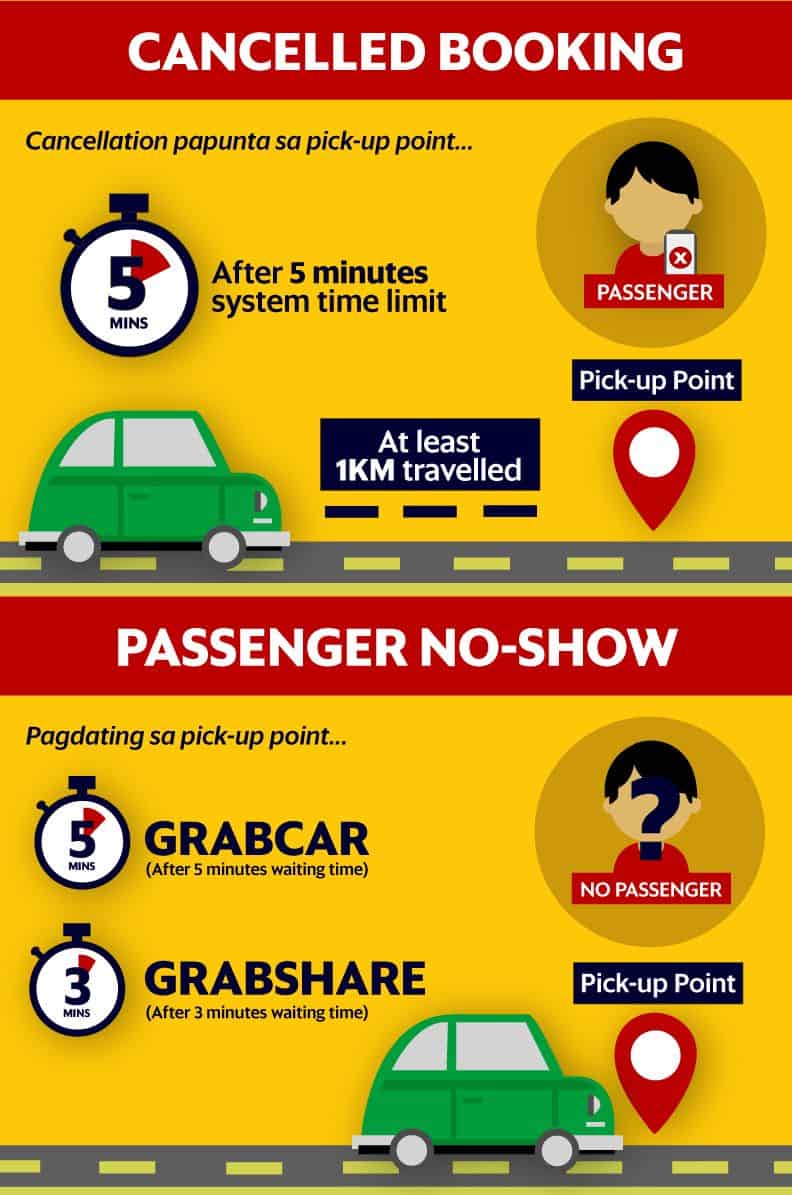

Passenger Cancellation Fee | Grab PH