Turo Car Rental Insurance Requirements

Turo Car Rental Insurance Requirements

What is Turo?

Turo is a car rental platform that lets people rent out their personal vehicles to others. It’s a great way for anyone to make some extra money, or to save some money if you need to rent a car. But when you’re renting someone’s personal vehicle, it’s important to know that you’ll be protected in case something goes wrong. That’s why Turo has specific insurance requirements for both renters and hosts.

Insurance Requirements for Renters

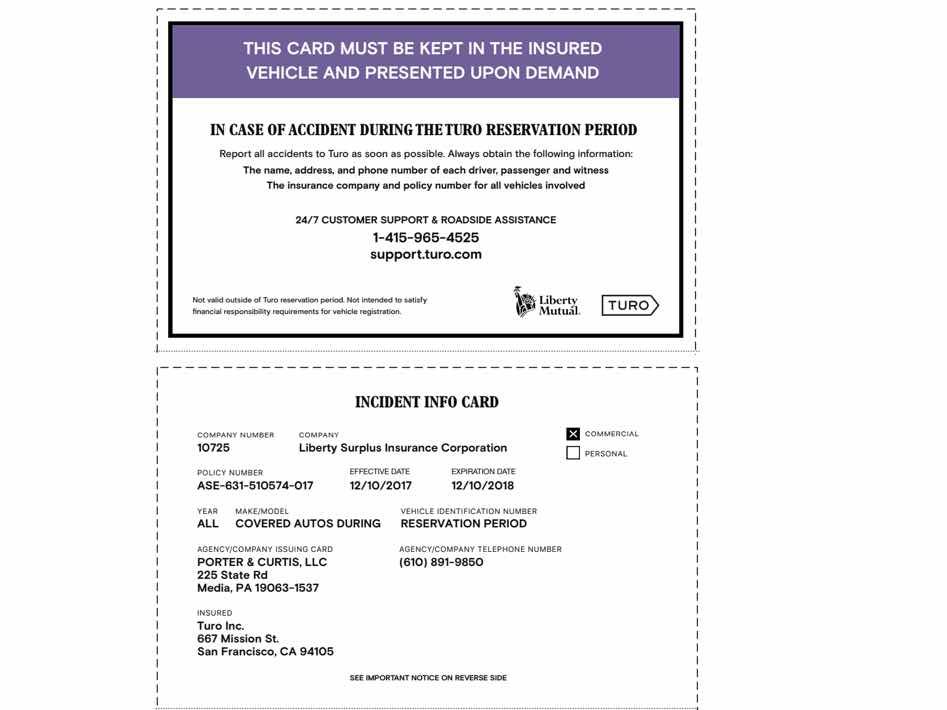

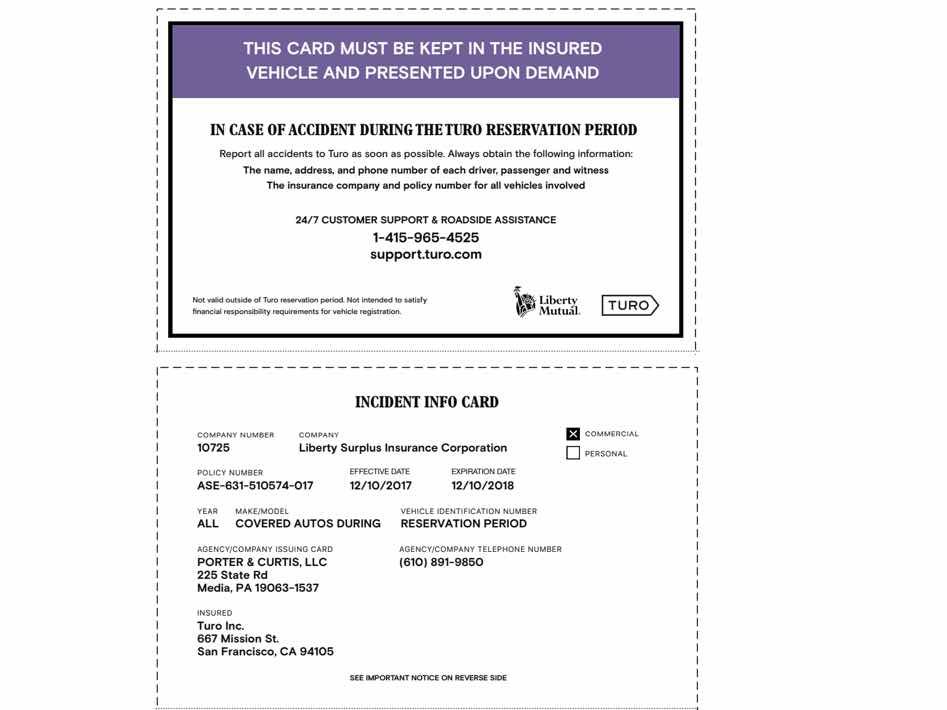

When you rent a car through Turo, you’re guaranteed to be covered by insurance. Every rental includes up to $1 million in liability coverage and physical damage coverage. This coverage is provided by Turo’s insurance partner, Liberty Mutual. The company also offers optional coverage for windshield repair, key replacement, and tire and wheel protection. The cost of the optional coverage will vary depending on the type of car you’re renting.

Insurance Requirements for Hosts

When you list your car on Turo, you’ll be required to purchase a Turo Host Protection policy. This policy provides up to $1 million in coverage for physical damage and liability. It also includes up to $25,000 in coverage for lost keys, lock-out service, and towing. The cost of the policy will depend on the type of car you’re listing, but it’s usually less than $20 per day.

What Does the Insurance Cover?

Turo’s insurance coverage is designed to protect both renters and hosts from financial losses caused by things like theft, vandalism, and accidents. The coverage applies to both the renter and the host, and it covers the cost of any repairs that are needed to the vehicle. It also covers any legal fees that might be incurred as a result of an accident or other incident.

What Isn’t Covered?

Turo’s insurance policies don’t cover damage caused by reckless driving, driver intoxication, or intentional damage to the vehicle. The policies also don’t cover damage to personal belongings, so it’s important to make sure that any personal items are removed from the car before it’s rented out. Additionally, the policies don’t cover any medical expenses that might be incurred as a result of an accident.

Conclusion

Turo’s car rental insurance requirements are designed to provide both hosts and renters with peace of mind. The comprehensive coverage ensures that both parties are protected in case something goes wrong. It’s important to note, however, that the coverage doesn’t apply to all situations, so it’s important to read the fine print before signing up for a rental.

Pros and Cons of Turo Car Rental for Travellers – Sling Adventures

The Airbnb of Cars: How to Use Turo to Save on Car Rentals

Turo Review: How Renting Out Our Cars on Turo Turned Into a Free Tesla