New India Assurance Car Insurance Claim Procedure

New India Assurance Car Insurance Claim Procedure

Understanding New India Assurance Car Insurance Claims

New India Assurance is one of the leading providers of car insurance in India. With their wide range of policies and comprehensive coverage, they offer comprehensive protection to car owners against any financial losses that may occur due to an accident, theft, or any unforeseen circumstances. The company also provides a hassle-free claim settlement process that ensures that you get the most out of your insurance policy. In this article, we will explain the procedure for making a claim for New India Assurance car insurance in detail.

What are the Different Types of Claims Covered by New India Assurance Car Insurance?

New India Assurance car insurance provides coverage for a variety of claims, including accidental damage, theft, third-party liabilities, and personal accident cover. The coverage also includes coverage for repairs and replacement of the car in case of any damage. The company also provides coverage for medical expenses and loss of personal belongings in case of an accident.

How to Make a Claim with New India Assurance Car Insurance?

Making a claim with New India Assurance car insurance is a simple and straightforward process. The first step is to contact the company and inform them about the incident. You will then be required to provide all the necessary documents, including the police report, repair bills, and proof of ownership. The company will then evaluate the details and proceed with the claim process. Depending on the type of claim, the company may offer either cashless settlement or reimbursement of the expenses.

What is the Time Frame for Claim Settlement?

Once the claim is filed with New India Assurance, the company will process it as soon as possible. Generally, the process of claim settlement takes 10-15 days. The company may also ask for additional documents or information while processing the claim. It is important to provide all the required documents within the given time frame to ensure that the claim is processed without any delays.

What are the Documents Required for Claim Settlement?

The documents required for New India Assurance car insurance claim settlement include the insurance policy, repair bills, police report, and proof of ownership. The company may also ask for additional documents, such as medical bills, if the claim is related to personal accident cover. It is important to provide all the required documents to ensure that the claim is processed without any delays.

What is the Claim Process for New India Assurance Car Insurance?

The claim process for New India Assurance car insurance is straightforward and hassle-free. The process begins with filing a claim with the company. Once the claim is filed, the company will evaluate the details and process the claim. Depending on the type of claim, the company may offer either cashless settlement or reimbursement of the expenses. The entire process usually takes 10-15 days, depending on the complexity of the claim.

New India Assurance Motor Claim Form 2020 Pdf - Fill Online, Printable

Motor Accident Claim Format India

Motor Insurance: New India Motor Insurance Claim Form

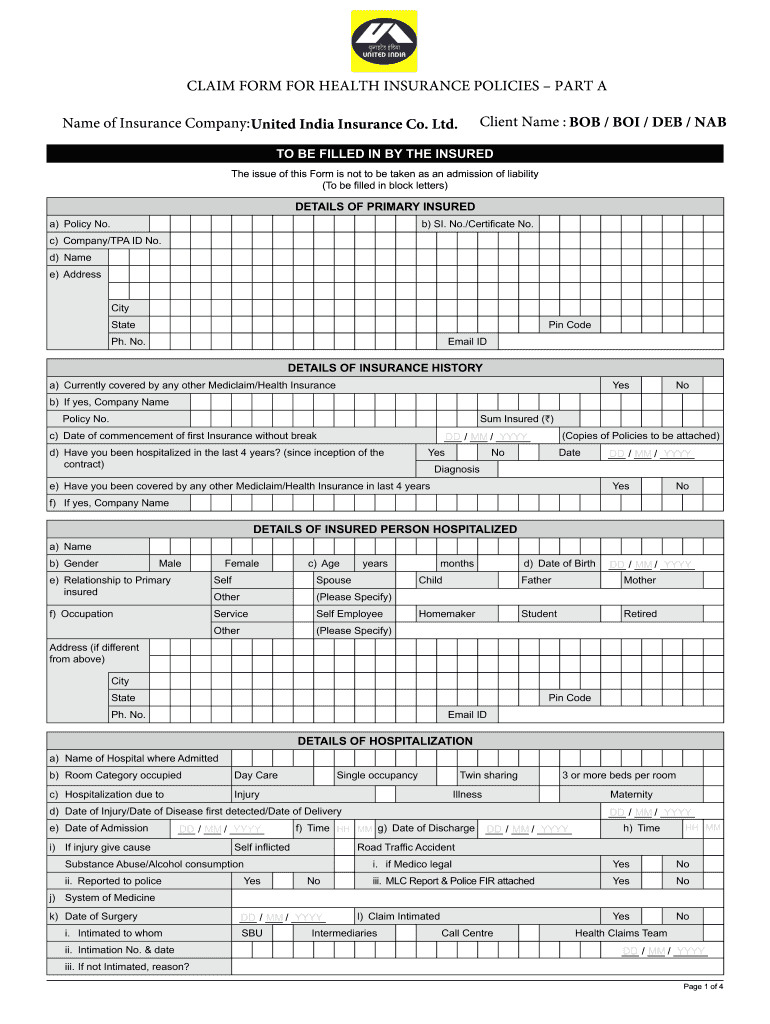

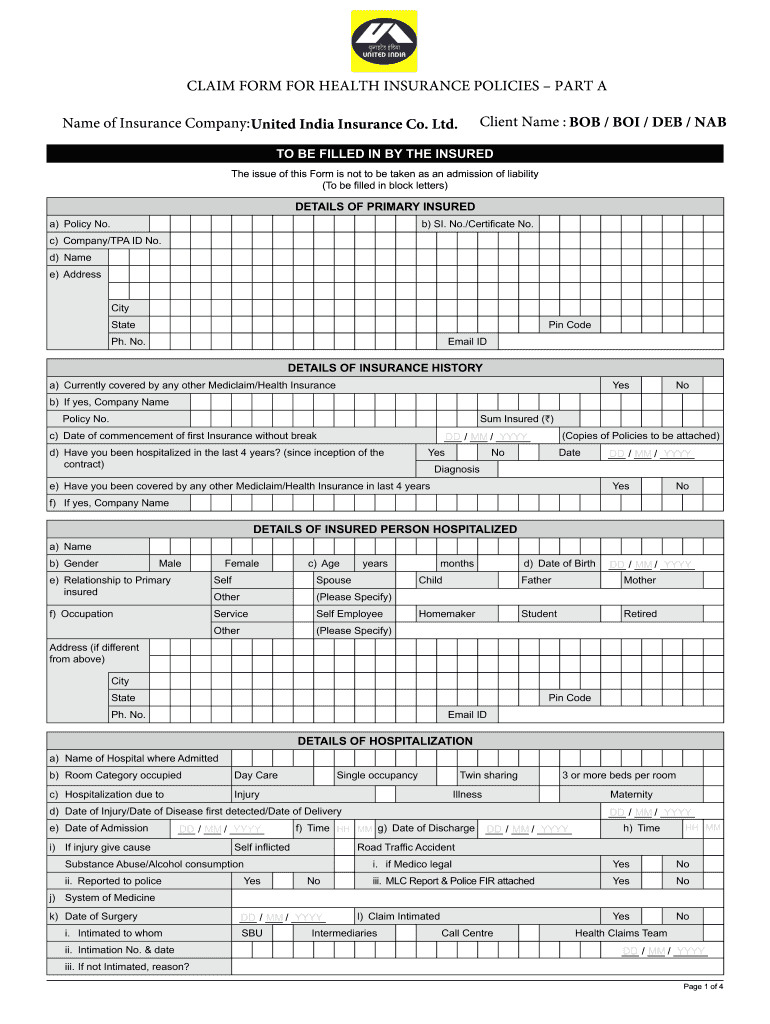

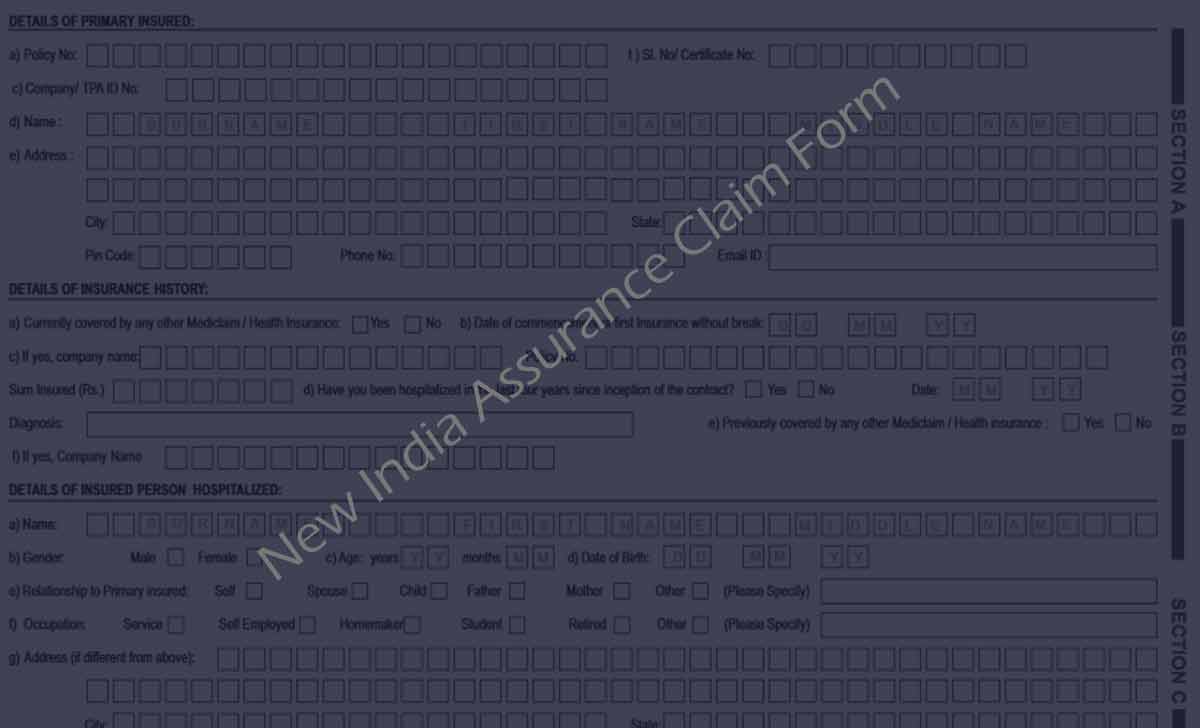

New India Assurance Claim Form for Health Insurance Policy

New India Assurance Car Insurance Comparison