Low Cost Liability Auto Insurance Texas

Low Cost Liability Auto Insurance in Texas

What is Liability Car Insurance?

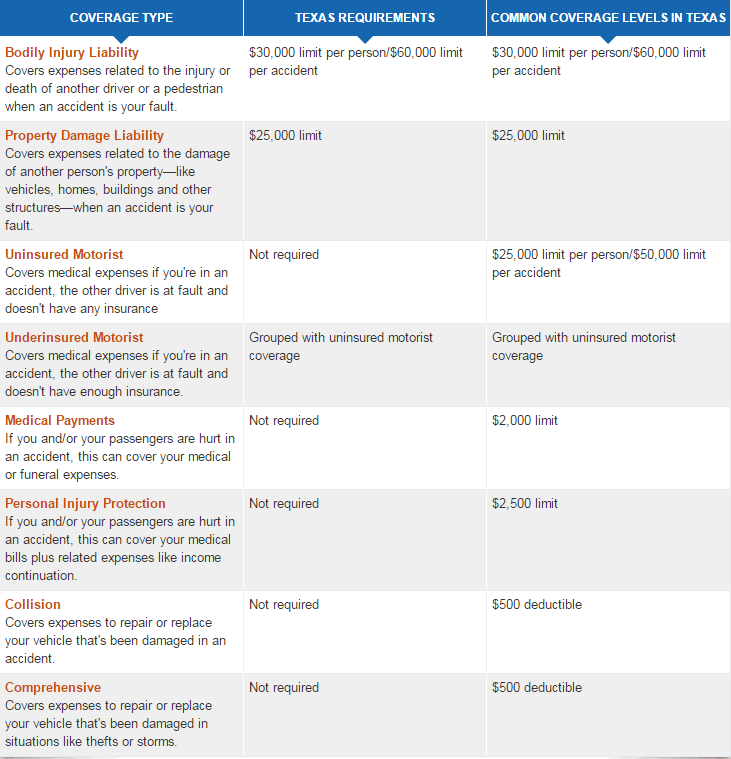

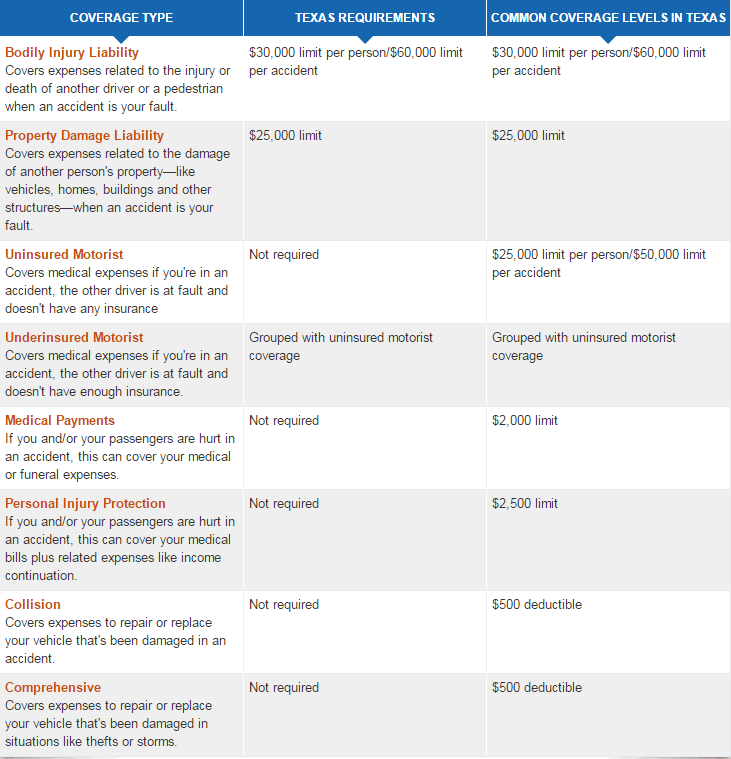

Liability car insurance is a type of auto insurance that covers financial losses that are the result of an accident caused by the policyholder. This includes property damage, medical expenses, and legal fees. Liability insurance is often required by state law and is typically the lowest level of insurance coverage available. It is important for every driver to understand what is covered under liability auto insurance and what is not, to ensure that they are adequately protected in the event of an accident.

Why Low Cost Liability Insurance is Important?

Low cost liability insurance is an important option for drivers who are budget-conscious or have limited resources. Liability insurance is generally much cheaper than comprehensive coverage, which makes it a great option for those who are trying to save money. Additionally, many states require that drivers carry some form of liability insurance, which makes it a necessary purchase for many drivers.

How to Find Low Cost Liability Auto Insurance in Texas?

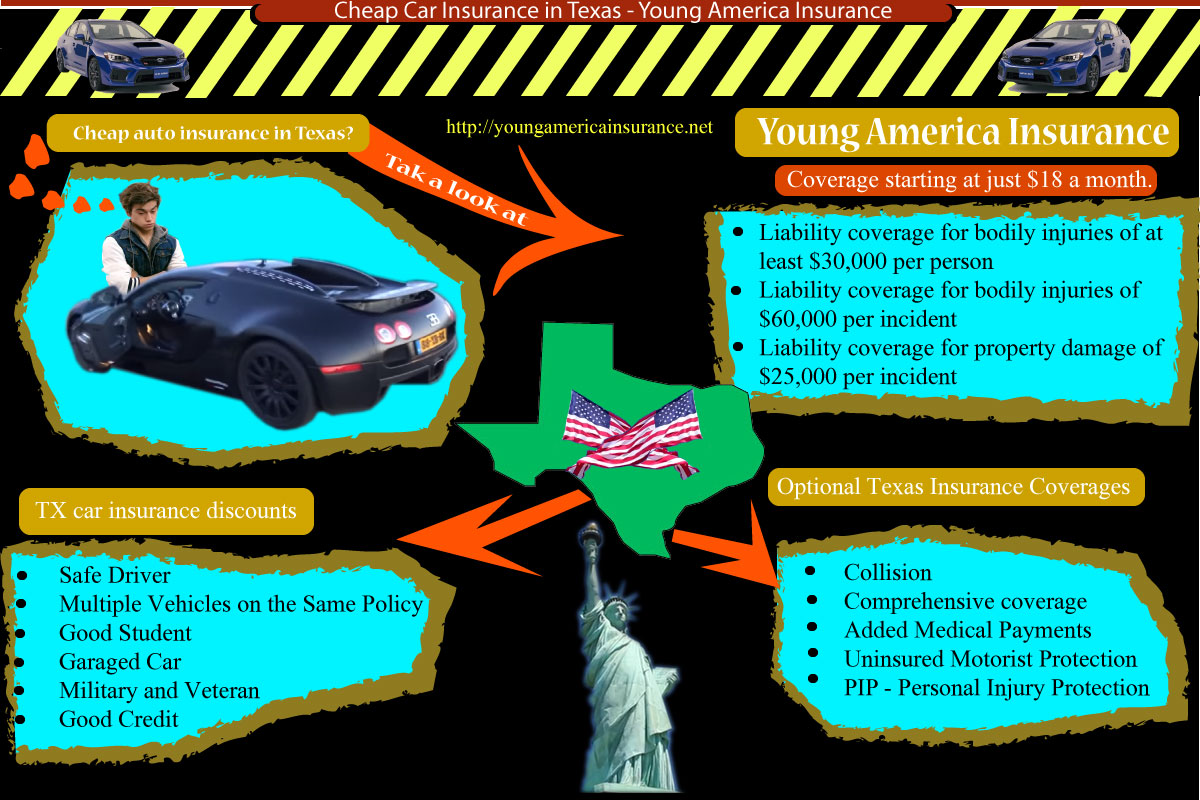

Texas is home to many different insurance companies, which means that drivers have plenty of options when it comes to finding low cost liability auto insurance. The best way to find a policy that fits your budget is to shop around and compare quotes from several different providers. It is also important to consider the coverage limits, deductibles, and other factors that can affect the cost of the policy. Additionally, many insurance companies offer discounts and incentives to customers who are willing to take steps to reduce their risk of being involved in an accident.

What are the Benefits of Low Cost Liability Auto Insurance in Texas?

Low cost liability auto insurance in Texas is beneficial for drivers who are trying to save money while still getting the coverage they need. Liability insurance can help to protect drivers from financial losses in the event of an accident, and it is typically much cheaper than other types of coverage. Additionally, many insurance companies offer discounts to drivers who take steps to reduce their risk of being involved in an accident, such as enrolling in a defensive driving course.

What are the Requirements for Low Cost Liability Auto Insurance in Texas?

The requirements for low cost liability auto insurance in Texas vary by provider, but most companies require that drivers have a valid driver’s license, a clean driving record, and proof of insurance before they can purchase a policy. Additionally, most companies require that drivers maintain a minimum level of coverage at all times, and that they pay their premiums on time. It is important to read the policy carefully to make sure that you understand all of the requirements before agreeing to purchase a policy.

Conclusion

Low cost liability auto insurance in Texas is an important option for drivers who are trying to save money while still getting the coverage they need. It is important to compare quotes from several different providers and to understand the requirements for purchasing a policy before agreeing to purchase one. Additionally, many insurance companies offer discounts and incentives to customers who are willing to take steps to reduce their risk of being involved in an accident. By understanding the coverage limits, deductibles, and other factors that can affect the cost of the policy, drivers can save money and ensure that they are adequately protected in the event of an accident.

texas car insurance

PPT - Cheapest Liability Car Insurance Texas PowerPoint Presentation

Texas liability auto insurance - insurance

Texas Liability Insurance Card Allstate | Qualads

Texas Liability Auto Insurance : Liability vs Full Coverage: What You