How Much A Month For Car Insurance

How Much Does Car Insurance Cost a Month?

Are you in the market for car insurance? If so, you may be wondering how much you’ll be paying each month for coverage. The cost of car insurance can vary substantially based on several factors, including your age, driving history, vehicle type, and more. In this article, we’ll explore the different variables that affect the cost of car insurance, and provide some ballpark figures to give you an idea of what you can expect to pay.

Factors That Affect Car Insurance Cost

The cost of car insurance can vary significantly from one person to the next. There are several factors that can cause prices to fluctuate, including:

- Age: Younger drivers tend to pay more for car insurance because of their lack of driving experience.

- Driving History: Drivers with a history of moving violations or accidents may be subject to higher rates.

- Location: Car insurance rates can differ from one state to the next.

- Vehicle Type: Luxury and sports cars typically cost more to insure than economy vehicles.

- Credit History: Drivers with poor credit may be subject to higher rates.

In addition to these factors, the type of coverage you choose and the amount of coverage you purchase can also affect the cost of car insurance. For example, comprehensive and collision coverage typically cost more than liability coverage.

Average Cost of Car Insurance

According to The Zebra’s State of Auto Insurance Report, the average cost of car insurance in the United States is $1,470 per year, or about $123 per month. This figure is based on a full coverage policy with a combined single limit of $100,000 for bodily injury and property damage and a $500 deductible for comprehensive and collision coverage.

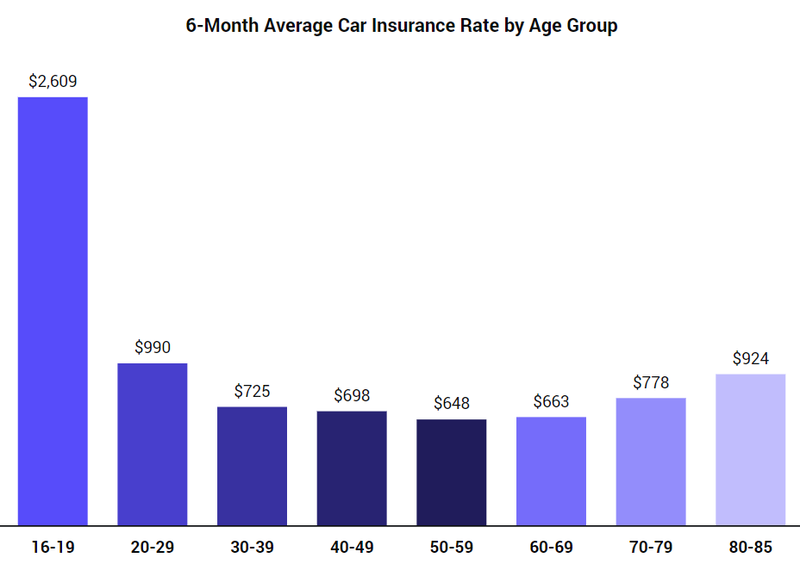

Cost by Age

The cost of car insurance also varies based on age. According to The Zebra’s study, drivers in the 16-25 age range pay an average of $2,999 per year, or about $250 per month. Meanwhile, drivers in the 50-65 age range pay an average of $1,203 per year, or $100 per month. These figures are based on a full coverage policy with a combined single limit of $100,000 for bodily injury and property damage and a $500 deductible for comprehensive and collision coverage.

Cost by State

The cost of car insurance also varies based on location. For example, drivers in Michigan pay an average of $2,693 per year, or about $224 per month. Meanwhile, drivers in Maine pay an average of $945 per year, or about $79 per month. These figures are based on a full coverage policy with a combined single limit of $100,000 for bodily injury and property damage and a $500 deductible for comprehensive and collision coverage.

How to Get the Best Car Insurance Rate

If you want to get the best car insurance rate possible, there are several steps you can take. First, shop around and compare rates from multiple insurance companies. Second, take advantage of discounts for good drivers, such as a safe driving discount or a defensive driving discount. Third, consider raising your deductible to lower your premium. Fourth, consider purchasing only the coverage you need. Finally, if you’re a student, be sure to ask about student discounts.

The cost of car insurance can vary based on a number of factors, including age, driving history, location, and vehicle type. The average cost of car insurance in the United States is $1,470 per year, or about $123 per month. If you’re looking to get the best car insurance rate possible, shop around, take advantage of discounts, consider raising your deductible, and purchase only the coverage you need.

How Much Is Car Insurance Per Month For A 18 Year Old ~ news word

Average Price Of Car Insurance Per Month - designby4d

How Much Is Car Insurance Per Month For A 18 Year Old ~ news word

How Much Is It For Car Insurance Per Month - Car Retro

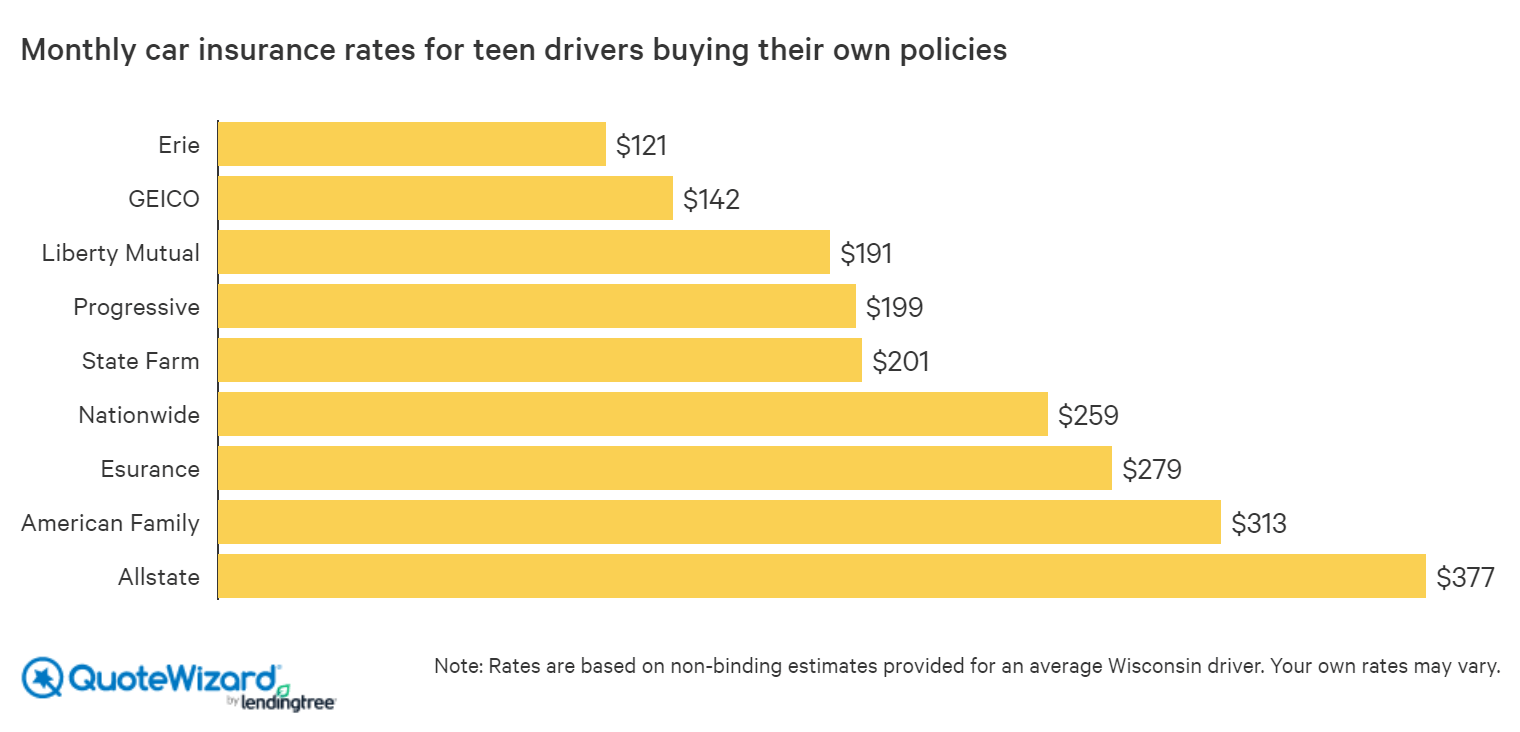

Best Car Insurance for Teens | QuoteWizard