How Much Car Insurance Coverage As An Real Estate Agent

Real Estate Agents Need Car Insurance

Real estate agents are typically on the go and need to be able to get from one house showing to another quickly. That is why it is important for them to have a reliable car and the right amount of car insurance coverage. Car insurance coverage for real estate agents does not have to be expensive, but it does need to be the right amount to protect you financially.

Why Do Real Estate Agents Need Car Insurance?

Real estate agents need car insurance in order to protect themselves financially if they are involved in an auto accident. Car insurance can also help protect real estate agents from being sued if they are responsible for an accident. Most states require drivers to have a minimum amount of car insurance coverage, which helps to ensure that if a driver is found responsible for an accident, they will be able to pay for any damages that occur.

Minimum Car Insurance Coverage Requirements

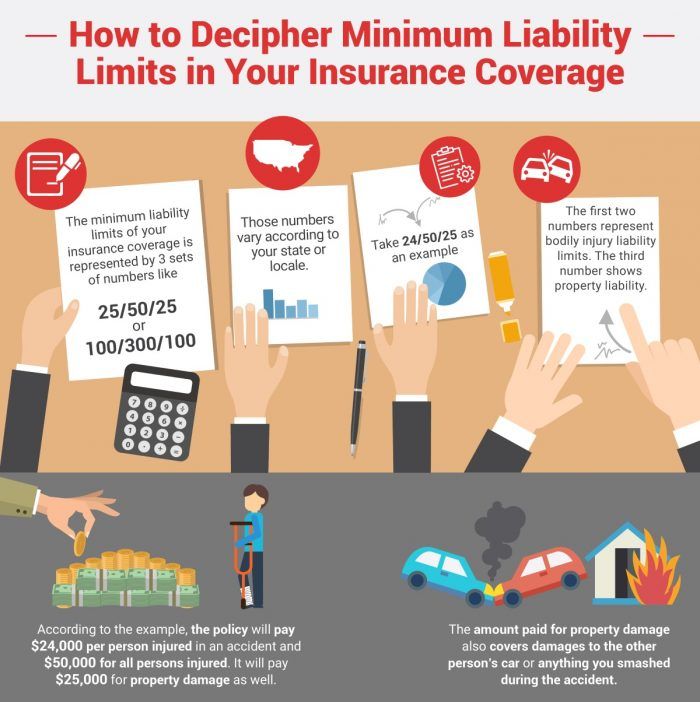

Most states require drivers to have a minimum amount of car insurance coverage. This minimum amount of coverage is usually called liability insurance. Liability insurance is designed to cover any damages that occur as a result of an accident that is caused by the driver. Generally, states require drivers to have a minimum of $25,000 per person and $50,000 per accident for bodily injury liability and $25,000 for property damage liability. This coverage is usually referred to as 25/50/25 coverage.

Additional Coverage Options

While the minimum amount of coverage is all that is required by law, there are additional coverage options that real estate agents may want to consider. Collision and comprehensive coverage can help pay for any damages that occur to the driver’s vehicle if they are involved in an accident. Uninsured motorist coverage can help pay for any damages that occur if the driver is in an accident with another driver who does not have insurance.

What To Look For In A Car Insurance Policy

When shopping for a car insurance policy, there are a few things that real estate agents should look for. The first is to make sure that the policy covers the minimum amount of coverage required by the state. The second is to make sure that the policy covers the types of coverage that the real estate agent is looking for. The third is to make sure that the policy offers an affordable premium. Lastly, real estate agents should look for a policy that offers good customer service and is easy to understand.

Conclusion

Real estate agents need car insurance coverage in order to protect themselves financially if they are involved in an auto accident. Most states require drivers to have a minimum amount of car insurance coverage, which helps to ensure that if a driver is found responsible for an accident, they will be able to pay for any damages that occur. When shopping for a car insurance policy, real estate agents should look for a policy that covers the minimum amount of coverage required by the state, offers the types of coverage that they are looking for, has an affordable premium, and offers good customer service and is easy to understand.

Full Coverage Car Insurance Cost / What S The Average Cost Of Car

List of the Best Car Insurance

How Much Car Insurance Do You Need? | Car Insurance Guidebook

Liability Insurance

Car insurance infographic | 20 Miles North Web Design