Cancel Car Insurance Mid Policy

Canceling Your Car Insurance Mid Policy: Everything You Need to Know

Car insurance is an important investment for any driver. It’s a safety net that can protect you, your passengers, and your vehicle in the event of an accident. However, there are times when you might need to cancel your car insurance mid policy. You may be moving to a new state or changing insurance providers, or maybe you just need to cut costs. Whatever the reason, understanding how and when to cancel your car insurance is essential.

Staying on Top of Your Policy

Before you cancel your car insurance, take a few minutes to review your policy. Make sure you understand the specifics of the coverage, including the duration and the cost of the policy. It’s also important to note if any fees will be applied if you cancel your coverage early. If you’re unsure about any of the details of your policy, contact your insurance provider for clarification.

The Cancellation Process

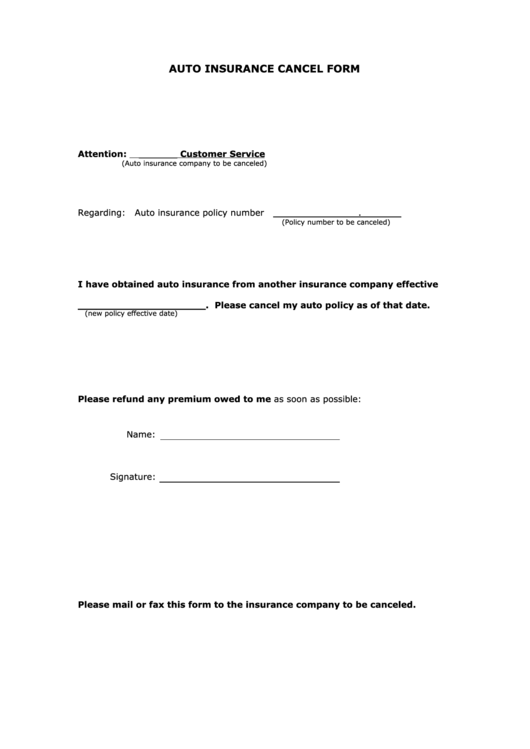

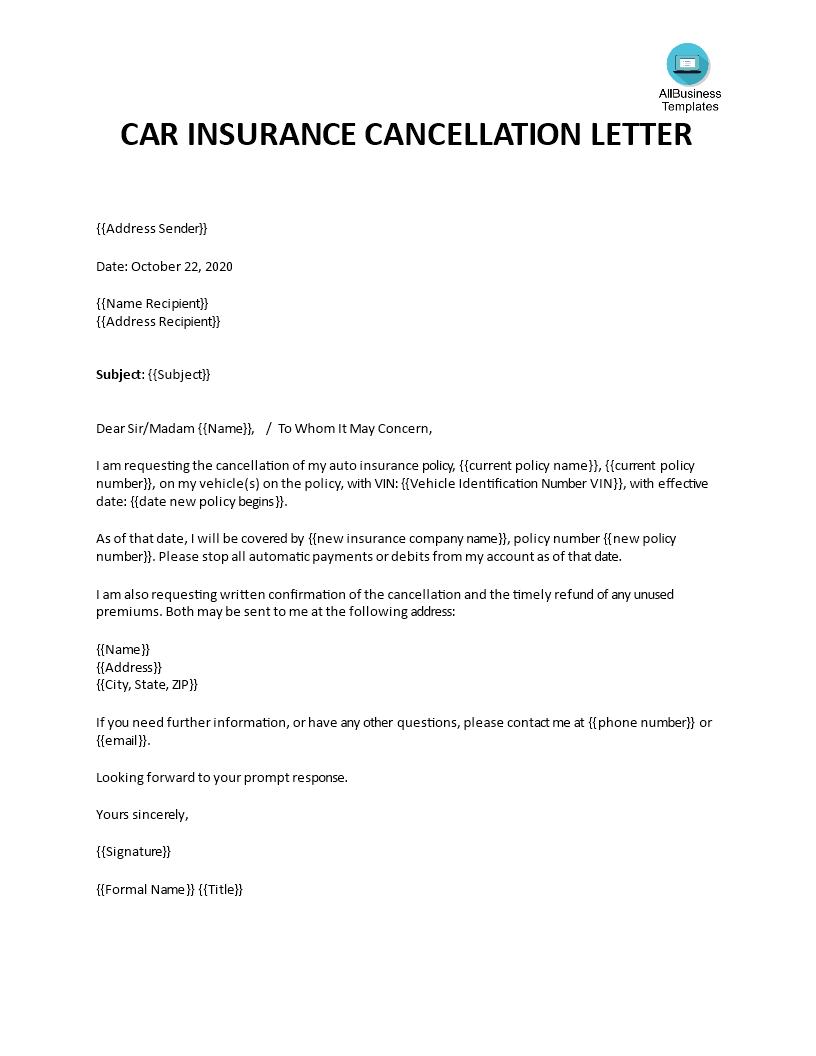

Once you’re ready to cancel your policy, contact your insurance provider directly. You will need to provide them with the necessary information to cancel your coverage. This may include your policy number and a valid reason for cancellation. You may need to provide proof of a new policy, if you are switching carriers. Your insurance provider should be able to walk you through the cancellation process.

Monitoring Your Credit

Once you have canceled your policy, it’s important to make sure your credit report is updated correctly. You should check your credit report for any discrepancies or errors. If you find any mistakes, contact the credit bureaus to report them. This can help you make sure your credit report is accurate and up-to-date.

Paying Your Bill

Once you cancel your policy, you may be responsible for any outstanding payments. Make sure to read the terms and conditions of your policy to understand your payment obligations. Depending on your policy, you may be able to pay your premiums in full or in installments. Contact your insurance provider to discuss payment options.

Filing a Claim

If you have a claim pending when you cancel your policy, you may still be able to receive coverage. Contact your insurance provider to discuss the details of your claim and to see if your policy is still active. Depending on the circumstances, you may still be eligible for coverage.

Canceling your car insurance mid policy can be a complicated process. It’s important to understand the details of your policy and to contact your insurance provider with any questions. Additionally, make sure to monitor your credit report for any mistakes and pay any outstanding bills. Taking the time to understand the cancellation process can help you avoid any unexpected fees or penalties.

Fillable Auto Insurance Cancel Form printable pdf download

Car Insurance Cancellation Letter | Templates at allbusinesstemplates.com

Right process to cancel the car insurance policy

Can I Cancel My Auto Insurance Policy And Switch To Rideshare Insurance

If You Cancel Car Insurance Do You Get A Refund - Classic Car Walls