Best And Cheapest Full Coverage Car Insurance

Best and Cheapest Full Coverage Car Insurance

Understanding Full Coverage Car Insurance

Full coverage car insurance is a type of insurance plan that provides protection for your vehicle against accidents, theft, and other damages. It covers your vehicle for the total cost of repairs and replacement, and for any medical costs resulting from an accident. It also covers the other driver's vehicle and medical costs in the event of an accident. This coverage is usually more expensive than basic liability insurance, but provides more comprehensive protection for your vehicle.

Factors That Affect the Cost of Full Coverage Car Insurance

The cost of full coverage car insurance is determined by a variety of factors. Your driving record, the type of vehicle you drive, the amount of coverage you select, and the insurance company you choose can all affect the price of your policy. Additionally, the amount of coverage you select can also affect the cost. Generally, the more coverage you select, the higher the cost of your policy will be.

Tips for Finding the Best and Cheapest Full Coverage Car Insurance

When shopping for full coverage car insurance, it's important to compare rates from multiple insurance companies. Make sure to check the reputation of each company, as well as the customer service they provide. It's also important to know what discounts you may qualify for. Many insurance companies offer discounts for good drivers, vehicle safety features, and for purchasing multiple policies. Additionally, you can often save money by paying your premiums in full rather than in monthly installments.

Raise Your Deductible

One of the easiest ways to save money on full coverage car insurance is to raise your deductible. The deductible is the amount of money you are required to pay out-of-pocket before the insurance company will pay for any damages. Raising the deductible amount on your policy can significantly reduce the cost of your premiums. However, it is important to make sure that you have enough savings to cover the deductible amount in the event of an accident.

Take Advantage of Discounts

Many insurance companies offer discounts for a variety of reasons. Good drivers, drivers with a clean driving record, drivers who take defensive driving classes, drivers who bundle multiple policies, and drivers who purchase certain safety features on their vehicle can all qualify for discounts on full coverage car insurance. Be sure to ask your insurance company about any discounts you may qualify for.

Shop Around

The best way to find the best and cheapest full coverage car insurance is to shop around. Compare rates from multiple insurance companies and make sure to ask about any discounts you may qualify for. Additionally, make sure to read the fine print of any policy you are considering so you know exactly what is and isn’t covered. By taking the time to shop around and compare policies, you can be sure to get the best and cheapest full coverage car insurance for your needs.

Cheapest Full Coverage Car Insurance (November 2022)

Why Having Car Insurance Is Important? - Affordable Comfort

Recommended Car Insurance Coverage

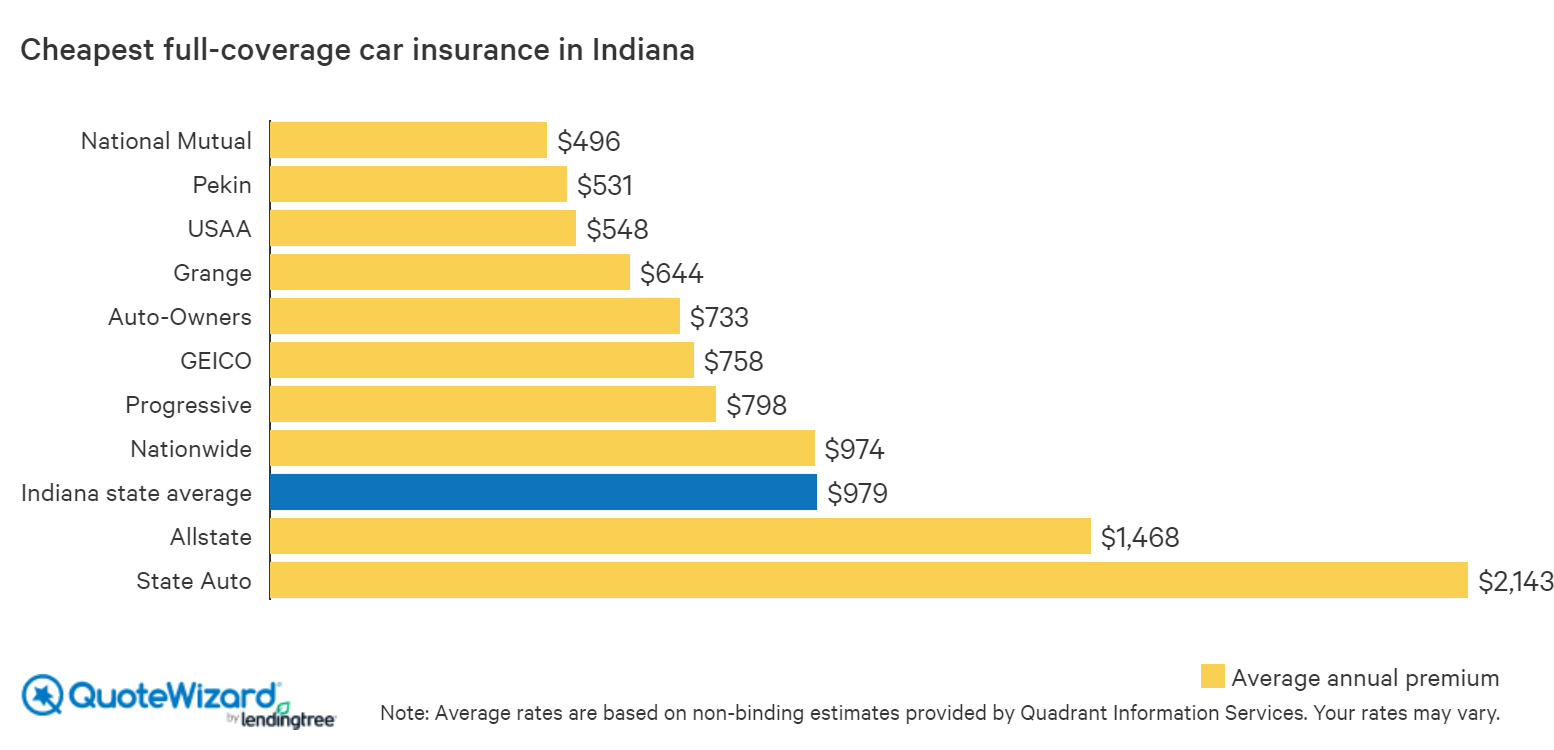

Where to Get Cheap Car Insurance in Indiana | QuoteWizard

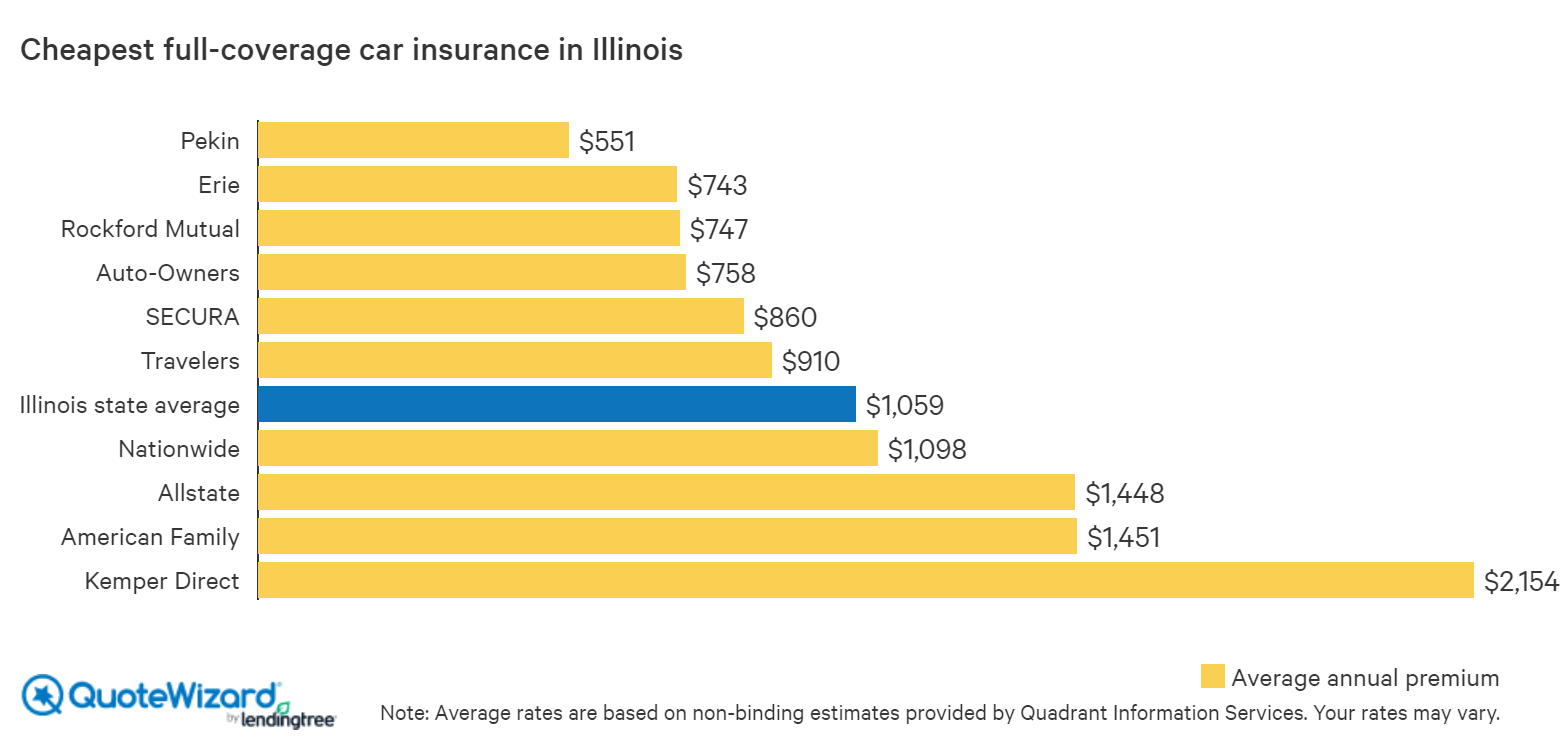

Find Cheap Car Insurance in Illinois | QuoteWizard