Average Price Of Car Insurance In Canada

Wednesday, January 15, 2025

Edit

Average Price Of Car Insurance In Canada

What Is Car Insurance And How Does It Work?

Car insurance is an agreement between you and your insurance provider that protects you from financial losses incurred from a car accident or other incidents. In exchange for your premium payments, your insurance company agrees to pay for your losses as outlined in your policy. Generally, car insurance covers damages caused to both you and your vehicle in the event of an accident, as well as damages caused to the other party. It also covers other scenarios, such as theft, vandalism, and natural disasters.

Car insurance is an important investment for any car owner. It not only helps to protect you financially in the event of an accident, but it also helps to protect your car and other drivers on the road. It is important to remember that the amount of coverage you have will depend on the type of policy you purchase, as well as the amount of money you are willing to pay.

Average Price Of Car Insurance In Canada

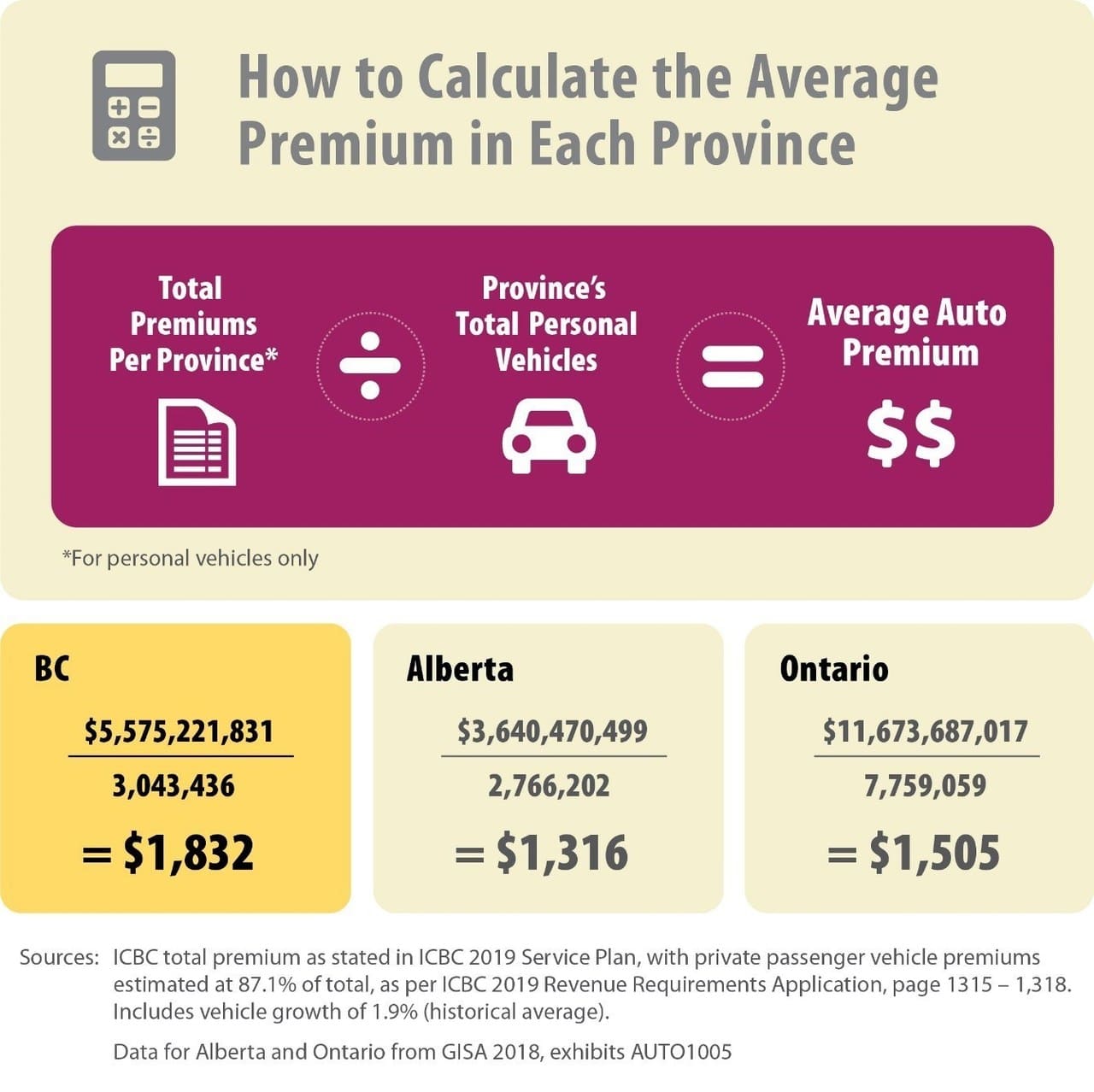

The average price of car insurance in Canada varies depending on a number of factors, including age, gender, driving record, and the type of car you drive. Generally, the average cost of car insurance in Canada is around $1,400 per year. It is important to note that the amount you pay for your insurance may be higher or lower than the average, depending on your individual circumstances.

For example, drivers who are younger than 25 are often considered to be higher risk, and therefore may pay more for their car insurance. Additionally, drivers with a poor driving record, or those who drive a car with a higher risk of theft, may also end up paying more for their insurance.

Factors That Influence Car Insurance Rates

There are several factors that insurance companies consider when determining car insurance rates. These include the type of car you drive, your age, your driving record, and the amount of coverage you choose.

The type of car you drive is important, as cars that are more expensive to repair or replace, or those that are considered to be higher risk, will typically have higher insurance rates. Additionally, cars that are considered to be “safer”, such as those with a good safety rating, will usually have lower insurance rates.

Your age and driving record are also important factors that influence car insurance rates. Generally, drivers who are younger than 25 are often considered to be higher risk, and therefore may pay more for their car insurance. Additionally, drivers with a poor driving record, or those who have been involved in multiple accidents, may also pay more for their insurance.

Finally, the amount of coverage you choose will also affect your car insurance rates. Generally, the more coverage you have, the more expensive your insurance will be. However, it is important to remember that having more coverage can help to protect you financially in the event of an accident, so it is important to make sure you have the right amount of coverage for your needs.

How To Save Money On Car Insurance

Saving money on car insurance can be done by taking steps to reduce your risk profile. For example, if you are a driver under the age of 25, you may be able to take a defensive driving course, which can help to lower your rates. Additionally, if you have a good driving record, you may be eligible for discounts on your car insurance.

You may also be able to save money by shopping around for car insurance. Different insurance companies offer different rates, so it is important to compare quotes from several different companies to find the best deal. Additionally, if you have multiple vehicles, you may be able to get a multi-car discount, which can help to reduce your overall insurance costs.

Conclusion

The average price of car insurance in Canada is around $1,400 per year, although this can vary depending on a number of factors, including age, gender, driving record, and the type of car you drive. There are several steps you can take to reduce your car insurance costs, such as taking a defensive driving course and shopping around for car insurance. It is important to make sure you have the right amount of coverage for your needs, as this will help to protect you financially in the event of an accident.

Alberta Car Insurance Premiums Under NDP and UCP Governments : Edmonton

These are the Average Car Insurance Premiums in Canada | To Do Canada

Find The Best Car Insurance Quotes in Canada (September, 2021)

McNeill Life Stories Are Insurance Rates Soaring in BC - McNeill Life

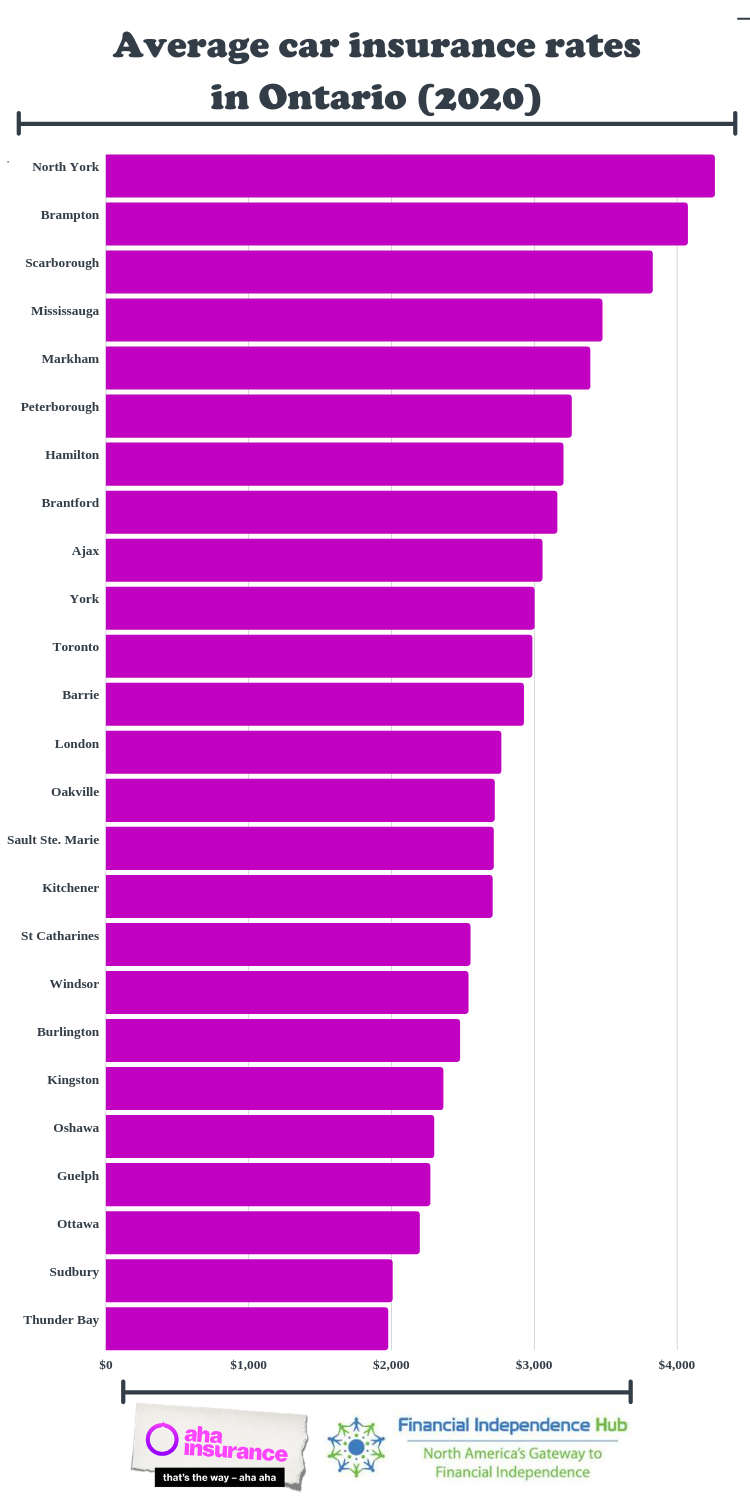

New data shows location has a big impact on car insurance - Financial