Average Car Insurance Price In New York

Wednesday, January 22, 2025

Edit

Average Car Insurance Price in New York

What is the Average Car Insurance Price in New York?

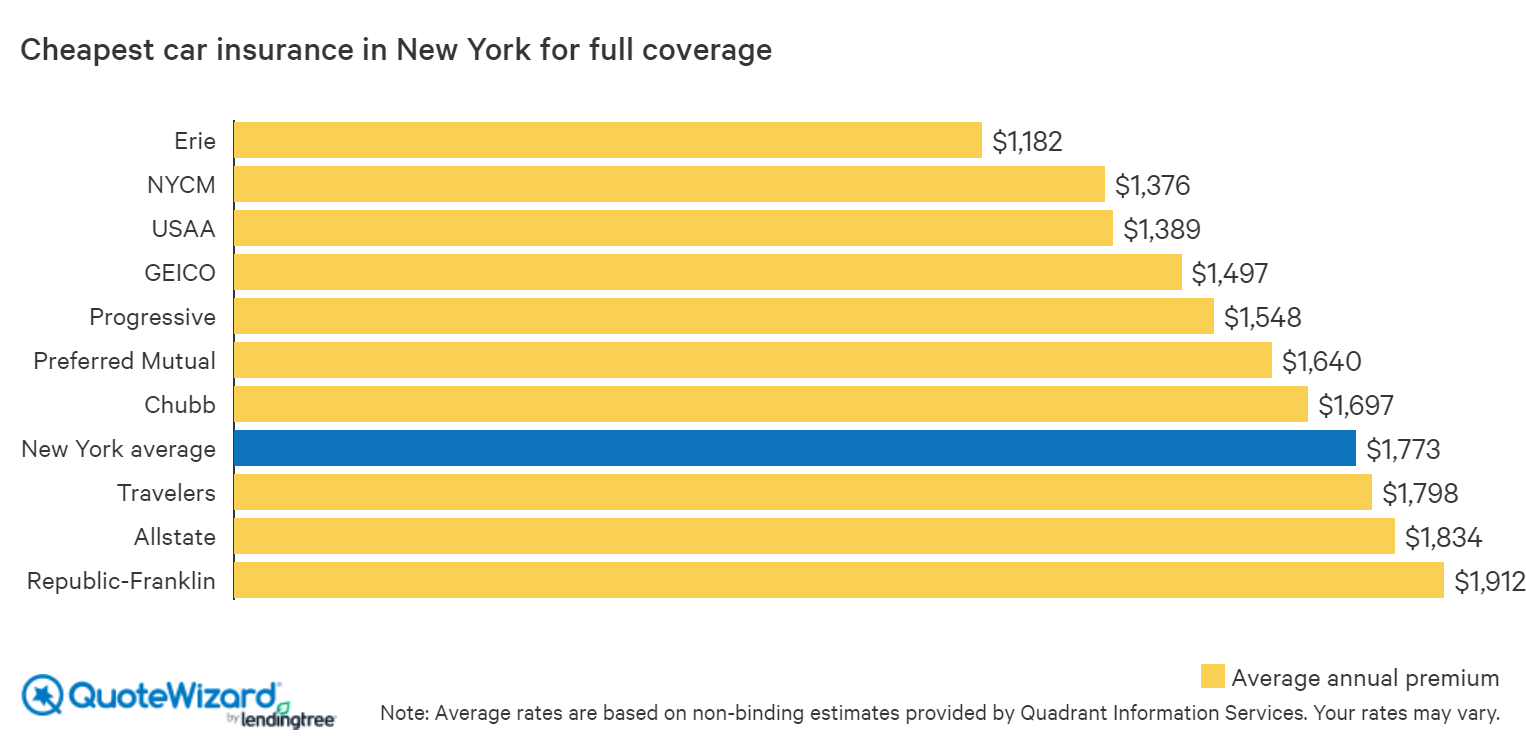

Car insurance prices in New York vary depending on the type of vehicle, the driver's driving record, and the insurance company chosen. On average, car insurance in New York State costs around $1,571 per year. This is slightly above the national average of $1,460. Prices can vary greatly depending on the type of vehicle, the driver's driving record, and the insurance company chosen.

For example, drivers of luxurious sports cars tend to pay higher premiums than those of more economical cars. If a driver has a spotty driving record, or has had multiple accidents, they may be subject to higher car insurance rates. Additionally, some insurance companies charge higher rates than others.

What Factors Determine the Price of Car Insurance in New York?

Car insurance companies use a variety of factors to determine car insurance prices in New York. Some of the most common factors include the type of car driven, the driver's age, driving record, credit score, and the place of residence.

The type of car driven is an important factor in determining car insurance rates. Luxury cars, sports cars, and high-performance cars tend to cost more to insure than economy cars. Additionally, cars with added safety features, such as airbags, may be eligible for discounts.

The driver's age is another important factor in determining car insurance rates. Typically, drivers under the age of 25 are subject to higher premiums than those over the age of 25. This is because younger drivers are considered to be more of a risk than older drivers.

The driver's driving record is also taken into consideration when determining car insurance rates. Drivers with a clean driving record tend to pay lower premiums than those with a spotty driving record. Additionally, drivers with multiple accidents may be subject to higher car insurance rates.

Credit scores are also taken into consideration when determining car insurance rates. Drivers with good credit scores tend to pay lower premiums than those with poor credit scores. This is because drivers with good credit scores are considered to be less of a risk than drivers with poor credit scores.

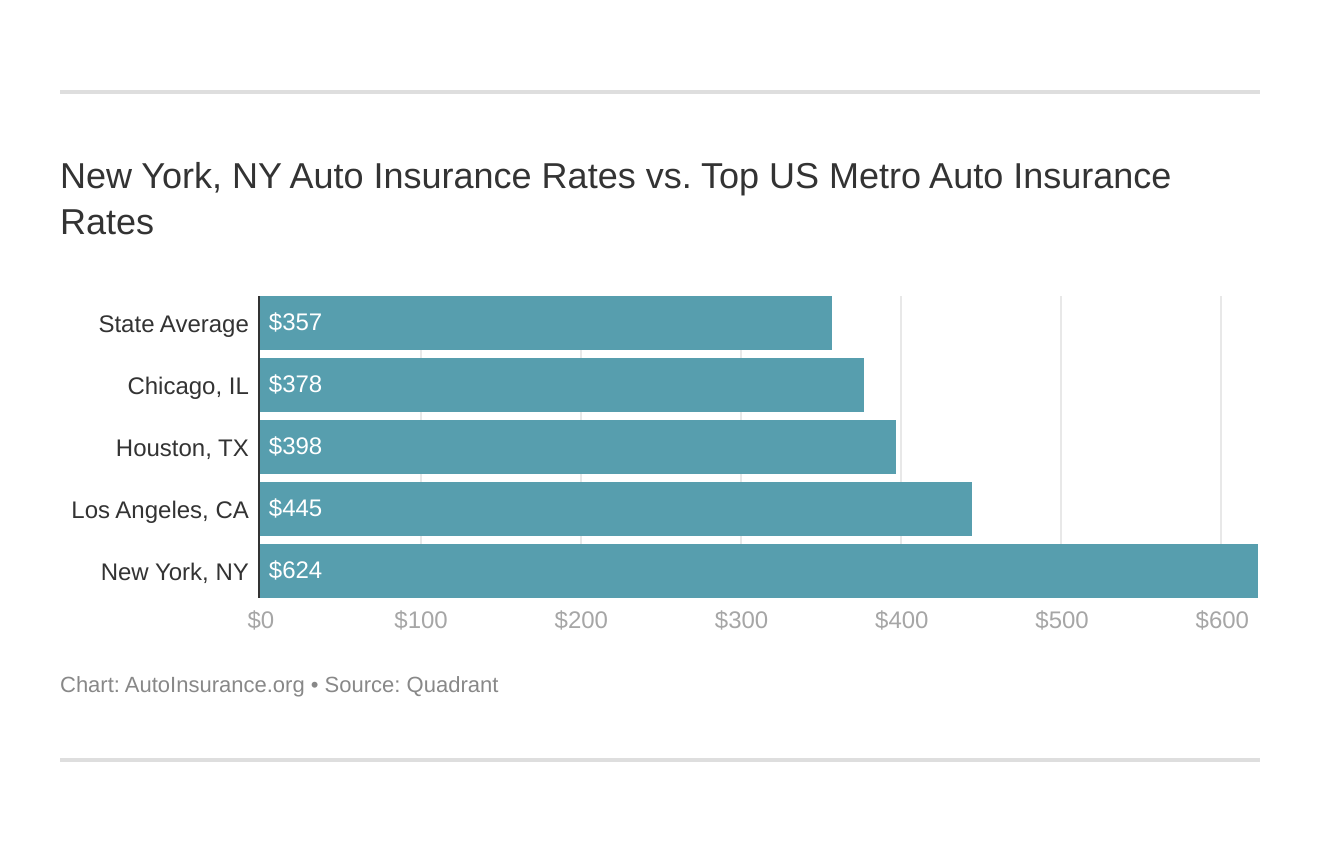

Finally, the place of residence is an important factor in determining car insurance rates. Drivers living in urban areas tend to pay higher premiums than those living in rural areas. This is because urban areas tend to have higher rates of crime, which can lead to higher car insurance rates.

What Are the Different Types of Coverages Available in New York?

When shopping for car insurance in New York, there are several different types of coverages that drivers can choose from. These include liability coverage, personal injury protection (PIP) coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and roadside assistance coverage.

Liability coverage is the most common type of coverage and is required by law in New York. This coverage pays for any damages or injuries that a driver may cause to another person or property in an accident.

Personal injury protection (PIP) coverage is an optional coverage that pays for medical expenses and lost wages for the driver and passengers in the event of an accident.

Collision coverage pays for any damages to the driver's car resulting from an accident. Comprehensive coverage pays for any damages to the driver's car resulting from something other than an accident, such as theft or vandalism.

Uninsured/underinsured motorist coverage pays for any damages or injuries caused by an uninsured or underinsured driver. Roadside assistance coverage pays for any towing or repair services needed in the event of a breakdown or flat tire.

What Are the Different Types of Discounts Available in New York?

Car insurance companies in New York offer a variety of discounts to help lower car insurance rates. Some of the most common discounts include multi-car discounts, good driver discounts, safe driver discounts, and good student discounts.

Multi-car discounts are available to drivers who insure multiple cars on the same policy. Good driver discounts are available to drivers who have a clean driving record. Safe driver discounts are available to drivers who practice safe driving habits, such as avoiding distracted driving.

Good student discounts are available to drivers who maintain good grades in school. Additionally, some insurance companies offer discounts for drivers who install anti-theft devices in their cars, or who take defensive driving courses.

How Can Drivers Save Money on Car Insurance in New York?

There are several ways that drivers in New York can save money on car insurance. The most common way is to shop around and compare car insurance rates from different insurance companies. Additionally, drivers should look for discounts, such as multi-car discounts, safe-driver discounts, and good-student discounts.

Drivers should also consider raising their deductible, as this can lower their car insurance premiums. Finally, drivers should consider bundling their car insurance with other types of insurance, such as homeowners or renters insurance, as this can also help to lower their premiums.

Who Has the Cheapest Auto Insurance Quotes in New York? - ValuePenguin

How Much Is Car Insurance In Nyc Per Month - New York City Car

The Cheapest Car Insurance in New York | QuoteWizard

The Best Average Cost Of Car Insurance 2022 - Dakwah Islami