Uk Car Insurance For Non Resident Drivers

Sunday, December 22, 2024

Edit

UK Car Insurance For Non Resident Drivers

Do Non Residents Need UK Car Insurance?

If you are a non-resident driver looking to drive in the UK, you will need to take out UK car insurance for your vehicle. In the UK, all vehicles must be insured for the period of time that they are being driven. This means that regardless of whether you are a resident or not, you will need to be insured if you wish to drive in the UK.

What Are The Requirements For Non Residents?

If you are a non-resident driver, the requirements for car insurance are the same as for UK residents. You will need to have a valid driving licence and a valid car insurance policy. The insurance policy must cover the vehicle for the period of time that it is being driven. You may also need to provide proof of residence, such as a passport or visa, if you are not a UK resident.

How To Get UK Car Insurance For Non Residents?

You can get car insurance for non-residents in the UK by searching online for companies that offer this type of policy. There are many companies that offer car insurance for non-residents, so it is important to shop around and compare policies to get the best deal. When comparing policies, make sure that you check the terms and conditions as some policies may have different requirements for non-residents.

What Does UK Car Insurance Cover For Non Residents?

UK car insurance for non-residents usually covers the same things as car insurance for UK residents. This includes liability cover, which covers you for any damage caused to other people or their property. It also covers collision cover, which covers you for any damage caused to your vehicle, as well as any third party damage. Other cover options may include personal injury cover, uninsured driver cover and breakdown cover.

How Much Does UK Car Insurance Cost For Non Residents?

The cost of car insurance for non-residents in the UK will depend on a number of factors, including the type of vehicle being driven, the age and experience of the driver and the type of cover being taken out. Generally, the cost of car insurance for non-residents will be higher than for UK residents, as non-residents are seen as a higher risk. It is important to shop around and compare policies to get the best deal.

What Are The Benefits Of UK Car Insurance For Non Residents?

The main benefit of taking out car insurance for non-residents in the UK is that it provides peace of mind when driving in the UK. Taking out a car insurance policy means that you are covered if something goes wrong while driving, and it can help to protect you financially if you are involved in an accident. It is also important to remember that having car insurance is a legal requirement in the UK, so it is important to make sure that you have the right cover in place.

What Is Non-Owner Car Insurance and Do You Need It? | RamseySolutions.com

Car Insurance 101: Car Insurance for First-Time Drivers

Hired & Non-Owned Auto Insurance | Insurance in 60 seconds - YouTube

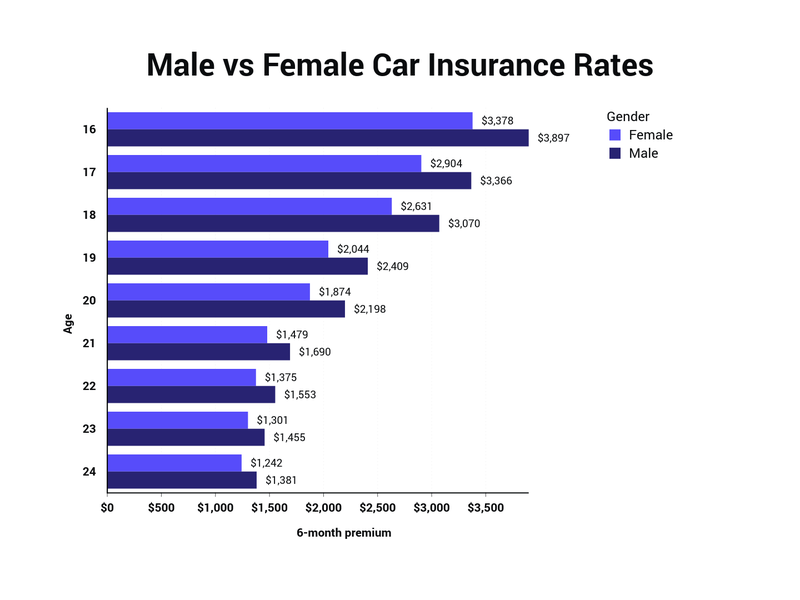

Car Insurance Rates By Age And Gender - Average Cost of UK Car

Insurance Company Find Affordable Insurance Coverage For Your Car