Third Party Car Insurance Premium Price

Tuesday, December 24, 2024

Edit

Third Party Car Insurance Premium Price

What is Third Party Car Insurance?

Third party car insurance is a type of insurance that covers the insured person for any liability that may arise from an accident that involves a third party. This type of coverage is typically required by law in most countries, and it is also the most basic level of insurance that one can purchase. It is a great way to protect yourself and your car from any potential damages that may occur as a result of an accident.

Third party car insurance is designed to protect the insured person from any liability that may arise from an accident that involves another person or their property. This type of coverage will cover the insured person’s medical bills, any repair bills that may be incurred, and any legal fees that may be associated with the claim. It will also cover any damages that may be caused to the other person’s vehicle or property as a result of the accident.

How Much Does Third Party Car Insurance Cost?

The cost of third party car insurance varies depending on the type of coverage that is chosen, the age of the driver, the type of vehicle being driven, the type of area in which the vehicle is being driven in, and the amount of coverage that is chosen. The insurance premium will also depend on the type of company that is chosen to provide the coverage.

The cost of third party car insurance can range from a few hundred dollars to thousands of dollars depending on the type of coverage that is chosen and the amount of coverage that is chosen. It is important to compare different companies and different types of coverage to find the best deal possible.

What Factors Affect Third Party Car Insurance Premium Price?

There are several factors that can affect the premium price of third party car insurance. The most important factor is the type of coverage that is chosen. The amount of coverage that is chosen will also have an effect on the price. The type of vehicle that is being driven, the age of the driver, and the type of area in which the vehicle is being driven in will also affect the premium price.

The amount of coverage that is chosen will also have an effect on the price. If a higher amount of coverage is chosen, the premium price will generally be higher. If a lower amount of coverage is chosen, the premium price will generally be lower. It is important to compare different types of coverage and different companies to find the best deal possible.

How to Get Cheap Third Party Car Insurance Premium Price?

There are several ways to get a cheaper third party car insurance premium price. The first way is to shop around and compare different companies and different types of coverage. By comparing different companies and different types of coverage, you can find the best deal possible.

Another way to get a cheaper third party car insurance premium price is to look for discounts. Many insurance companies offer discounts for a variety of reasons such as having a good driving record, having multiple vehicles, or being a student. It is important to ask the insurance company about any discounts that may be available.

What is the Difference Between Third Party and Comprehensive Car Insurance?

The main difference between third party car insurance and comprehensive car insurance is the amount of coverage that is provided. Third party car insurance only covers liability that may arise as a result of an accident involving another person or their property. Comprehensive car insurance, however, covers not only liability, but also any damages that may be caused to the insured’s vehicle or property as a result of an accident.

Comprehensive car insurance is generally more expensive than third party car insurance, but it provides a higher level of protection and coverage. It is important to compare different types of coverage and different companies to find the best deal possible.

Conclusion

Third party car insurance is an important type of coverage that is required by law in most countries. It provides protection from any liability that may arise from an accident involving another person or their property. The cost of third party car insurance varies depending on the type of coverage that is chosen, the age of the driver, the type of vehicle being driven, the type of area in which the vehicle is being driven in, and the amount of coverage that is chosen. It is important to compare different companies and different types of coverage to find the best deal possible.

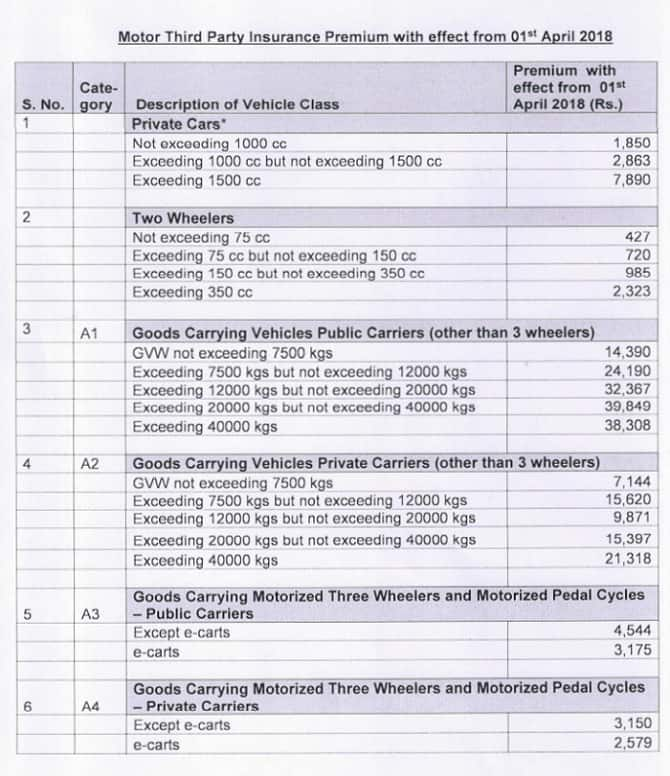

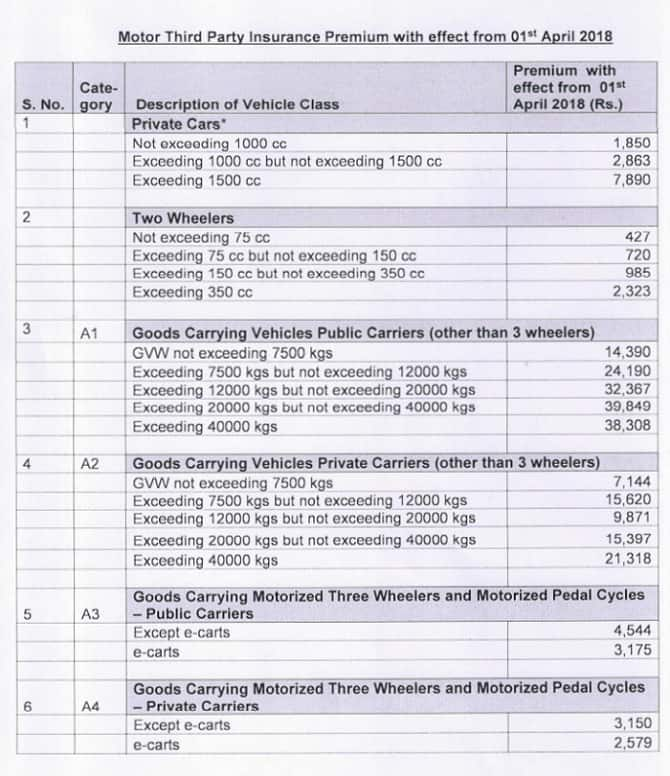

Exclusive | Third party insurance premium on commercial vehicle could

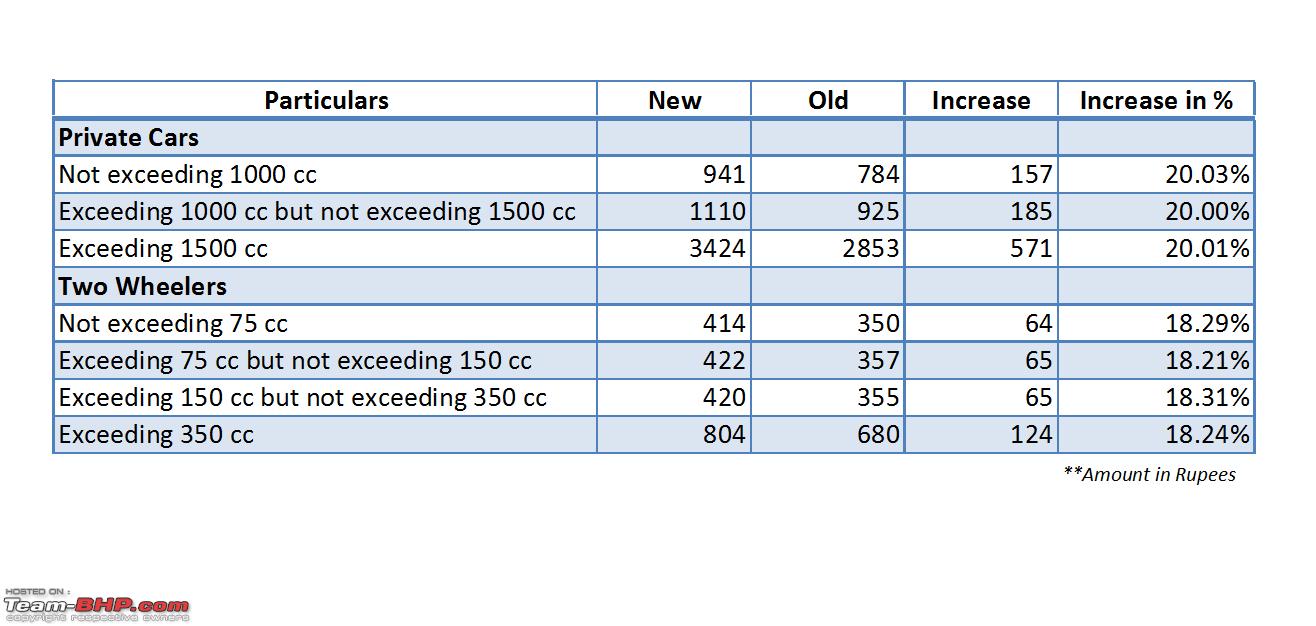

Third Party Insurance Premium to go up W.e.f 1st April 2013 - Team-BHP

Third Party Property Car Insurance | iSelect

Reasons why you should buy third party insurance online in 2020

What's the average cost of car insurance in the US? - Business Insider