Lv Car Insurance Change Of Home Address

Thursday, December 26, 2024

Edit

How to Change Your LV Car Insurance Home Address

What You Need to Know About Changing Your Home Address With LV Car Insurance

If you’re moving house and want to change your LV car insurance home address, you’re not alone. In fact, it’s one of the most common reasons why people contact their car insurer.

It’s an important process to get right as your address helps to determine the cost of your car insurance policy. As such, it’s essential to update your details with LV as soon as you move to make sure you’re getting the best value on your policy.

What Happens if You Don’t Update Your Home Address With Your Car Insurer?

You need to update your address with LV as soon as you move, otherwise you may be charged a higher premium than you need to be. This is because your postcode is a big factor in how much you pay for your car insurance.

If you don’t update your address with LV, you could be paying more than you need to. You may also find it difficult to make a claim on your car insurance if you’ve registered the wrong address.

What Happens When You Update Your Home Address With LV?

When you update your home address with LV, your car insurance premium will be recalculated based on your new postcode. This could mean you’re paying less for your car insurance, or it could mean that you’re paying more.

If it’s the latter, don’t worry – it’s simply a reflection of the different costs associated with the area you’re now living in. You may also be able to take advantage of any discounts or offers available in your new area.

How to Change Your Home Address With LV

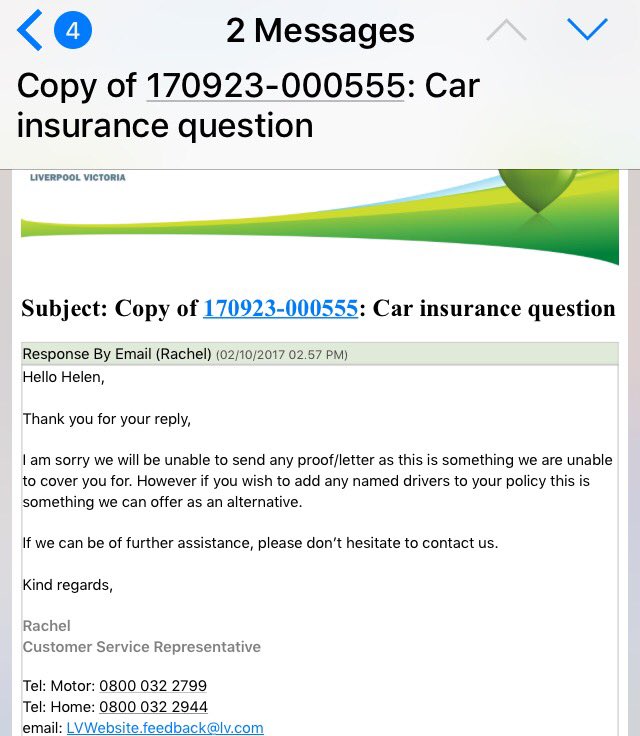

Changing your home address with LV is a straightforward process. All you need to do is contact LV and let them know the details of your new address. You may be asked to provide proof of your new address, such as a utility bill or a bank statement.

The LV team will then update your policy details and recalculate your premium. They may also offer you the chance to review your policy to make sure you’re getting the best value from it.

What Other Changes Can You Make to Your Car Insurance Policy?

As well as changing your home address, you can also make a number of other changes to your LV car insurance policy. You can add or remove drivers, update your vehicle details, add or remove optional extras and more.

When you make any changes to your policy, you’ll need to let LV know so that your premium can be updated accordingly. It’s important to make sure that you keep your policy up to date so that you’re always getting the best value.

Conclusion

If you’ve moved house and need to update your address with LV, you’ll need to contact them as soon as possible. They’ll update your details and recalculate your premium, and may also offer you the chance to review your policy.

You can also make a number of other changes to your policy, such as adding or removing drivers, updating your vehicle details and more. It’s important to keep your policy up to date so you’re always getting the best value.

LV Insurance Cancellation – 0843 557 3603 | FastCancel.co.uk

Lv Health Insurance - Help Health

Lv Car Insurance | semashow.com

Make £50 pure cash profit from LV = Life Insurance and Top CashBack

Lv Car Insurance Quote Phone Number | NAR Media Kit