Long Term Care Insurance Washington State

Understanding Long Term Care Insurance in Washington State

What is Long Term Care Insurance?

Long term care insurance is a type of insurance plan designed to cover the costs of medical care and services that individuals may need over an extended period of time. It covers a wide range of services, including in-home care, assisted living, nursing homes, and other long-term care services. Long term care insurance is an important tool to help protect individuals and families from the financial burden of long-term care costs. In Washington State, there are several different types of long term care insurance policies to choose from, each offering different levels of coverage.

Who Should Consider Long Term Care Insurance in Washington?

Long term care insurance is an important tool for anyone who may need long-term care services in the future. This may include individuals who are concerned about protecting their assets from the high costs of long-term care or those who have a family history of long-term care needs. It is also important for elderly individuals who are looking to maintain their independence and quality of life.

Long term care insurance is also beneficial for those who may not be able to afford the high costs of long-term care services out of pocket. It is important to remember that Medicare and other government programs do not typically cover the costs of long-term care, so long term care insurance can be a valuable resource for individuals and families who are looking to protect their financial security in the event of a long-term care need.

What Does Long Term Care Insurance Cover in Washington?

The coverage provided by long term care insurance policies will vary depending on the policy and the specific provider, but typically these policies will cover a range of services including in-home care, assisted living, nursing home care, and other long-term care services. Most policies will also provide coverage for medical equipment and supplies, as well as transportation to and from medical appointments.

It is important to understand that long term care insurance policies may have limits on the amount of coverage they provide, and that the services covered may also vary depending on the policy. It is important to carefully review the policy to understand what services are covered and what limits may apply.

How Much Does Long Term Care Insurance Cost in Washington?

The cost of long term care insurance will depend on a variety of factors, including the type of coverage chosen, the age of the policyholder, and the amount of coverage needed. Generally, the younger the policyholder is when they purchase the policy, the lower the premiums will be.

It is important to understand that long term care insurance policies may have a waiting period before the coverage begins, and that premiums may increase over time as the policyholder ages. It is also important to understand that long term care insurance policies are not always available for everyone, as some policies may have medical or health requirements that must be met in order to qualify.

How Do I Get Long Term Care Insurance in Washington?

The best way to get long term care insurance in Washington is to speak to an insurance agent who specializes in long term care policies. A qualified agent will be able to answer all of your questions about the different types of policies available, the coverage options, and the costs associated with the policy.

It is also important to compare different policies to find the one that best meets your needs and budget. An insurance agent can help you compare different policies and determine which one is right for you.

Conclusion

Long term care insurance is a valuable tool to help protect individuals and families from the financial burden of long-term care costs. In Washington State, there are a variety of different types of long term care insurance policies to choose from, each offering different levels of coverage. It is important to speak to an insurance agent who specializes in long term care policies in order to find the one that best meets your needs and budget.

By understanding the different types of long term care insurance policies available in Washington State, individuals and families can be better prepared for the future and have peace of mind knowing that their financial security is protected.

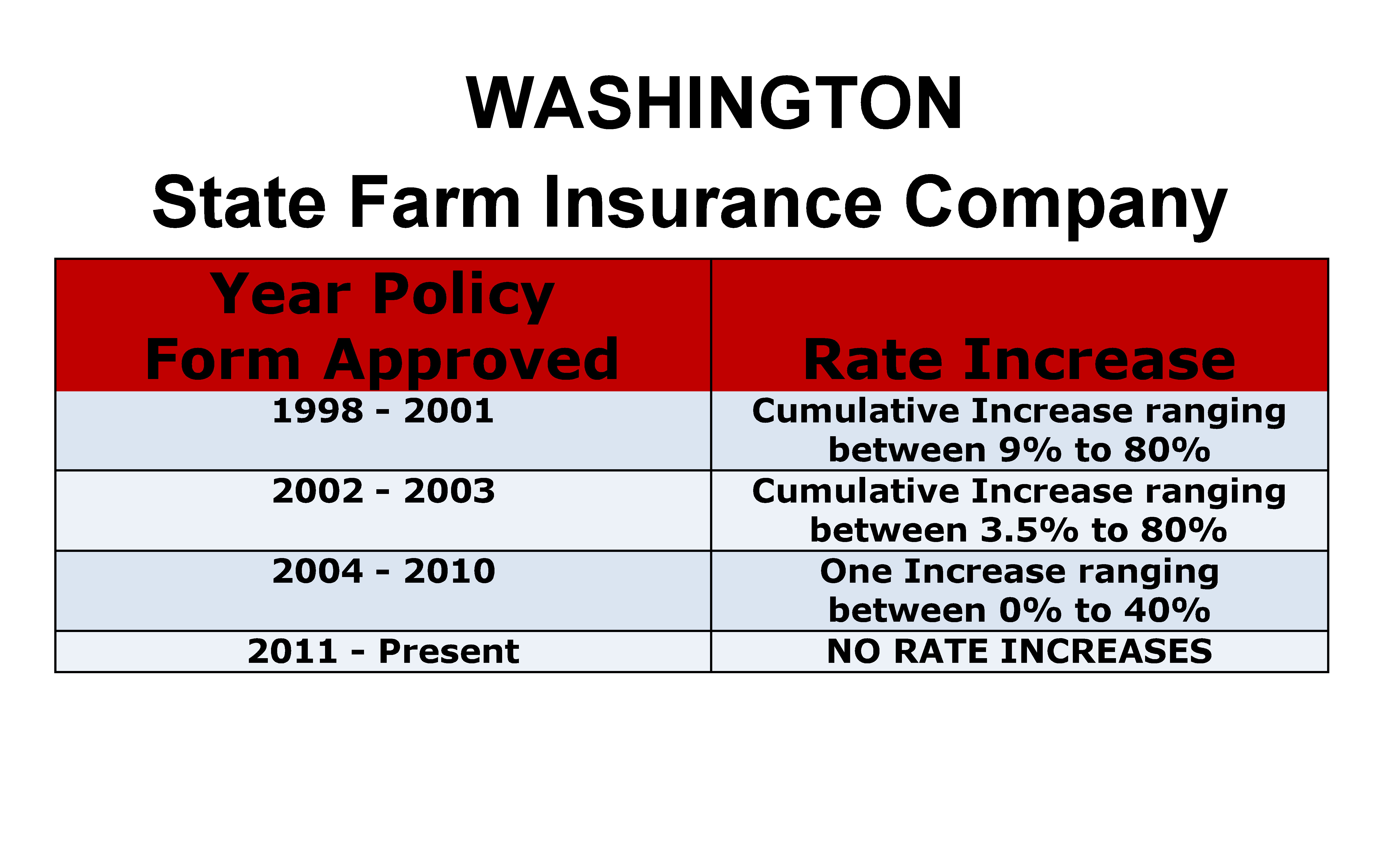

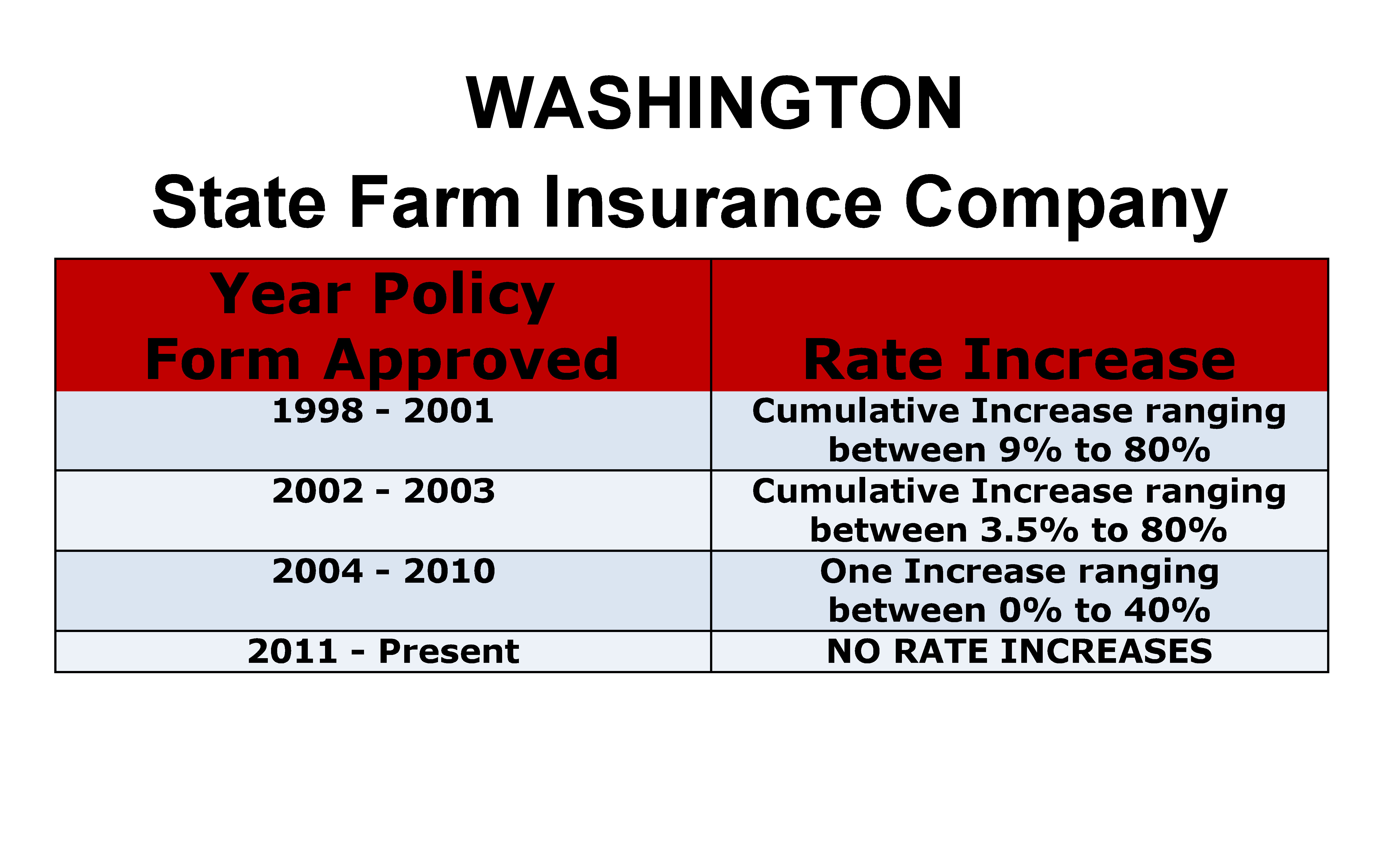

State Farm Long Term Care Insurance Rate Increases Washington

Industry Update: Washington State’s Long-Term Care Act | Pinney Insurance

Long Term Care Insurance Washington State Quote

The Current State of Long-Term Care Insurance

Long Term Care Insurance - Learn About LTC - SAFE HARBOR INSURANCE AND