How To Cancel Vehicle Insurance Policy

Thursday, December 5, 2024

Edit

How To Cancel Vehicle Insurance Policy

The Reasons Behind Cancellation

Canceling vehicle insurance policy is a common thing, and there can be many reasons behind it. One of the most common reasons is when the insured vehicle is sold or otherwise disposed of. In such cases, the owner of the vehicle must cancel the insurance policy and obtain a new policy for the new vehicle. In some cases, the owner of the vehicle may decide to switch to another insurer for better coverage or lower rates. Other reasons for canceling a vehicle insurance policy may include financial hardship, moving to a different state, or simply wanting to change coverage types.

Cancellation Process

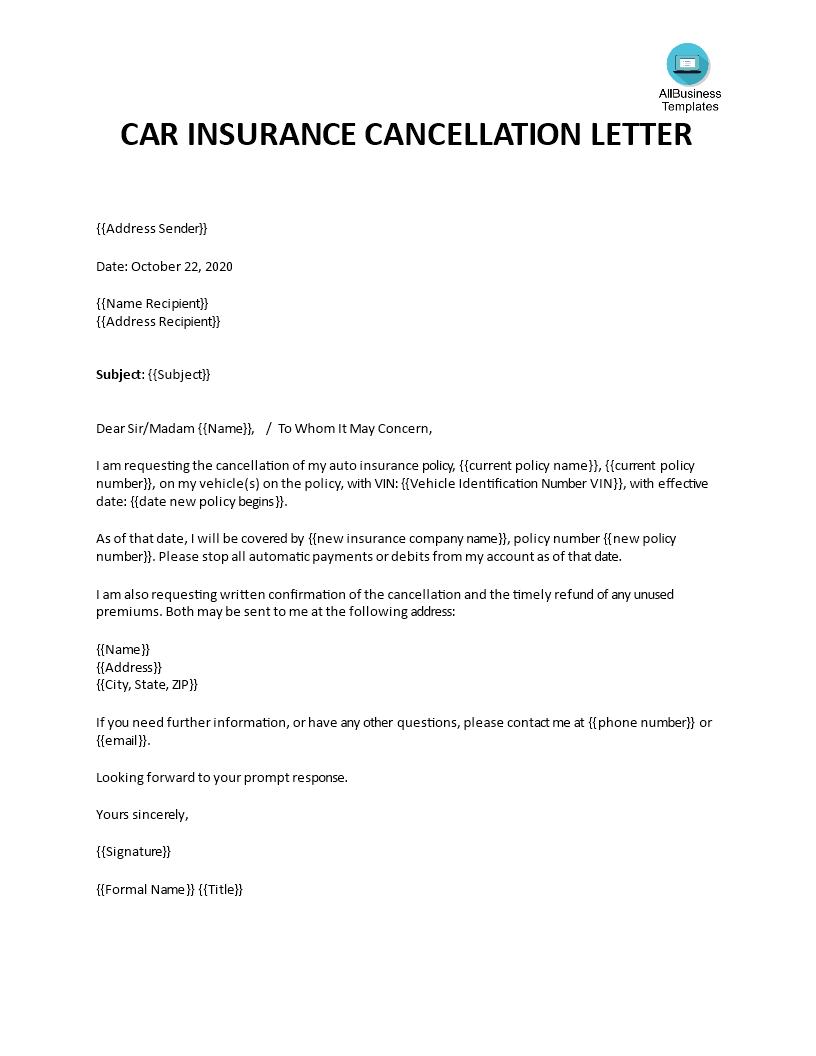

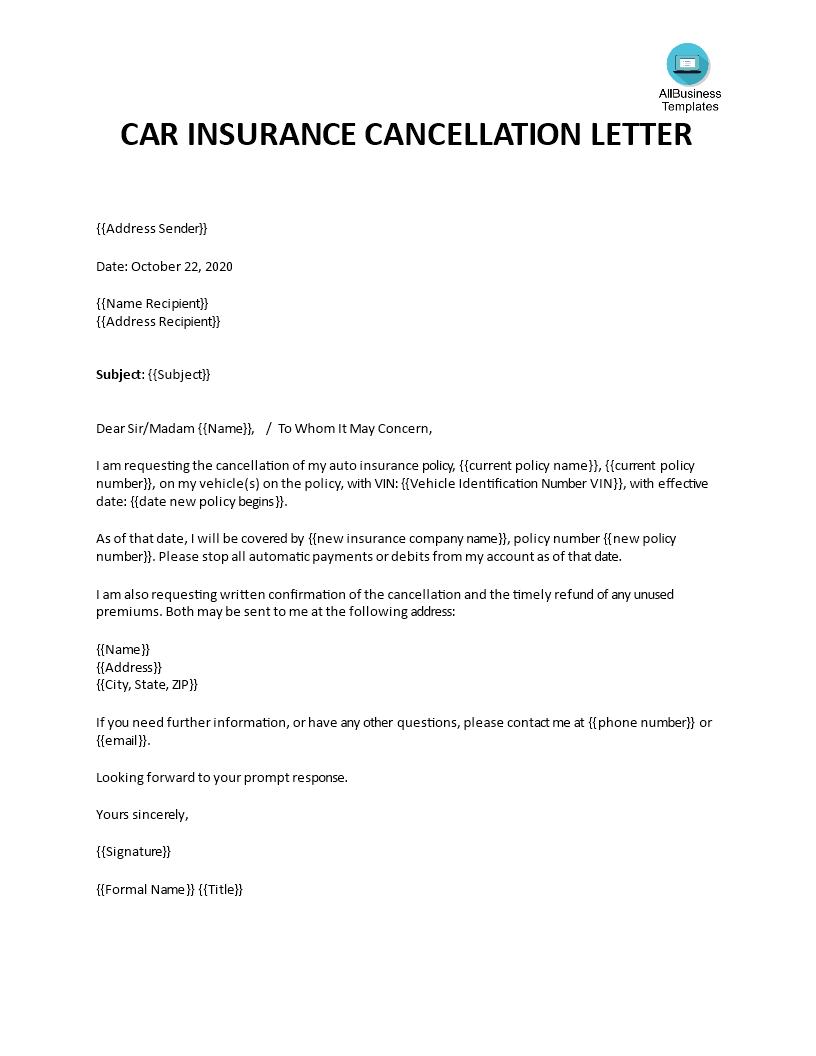

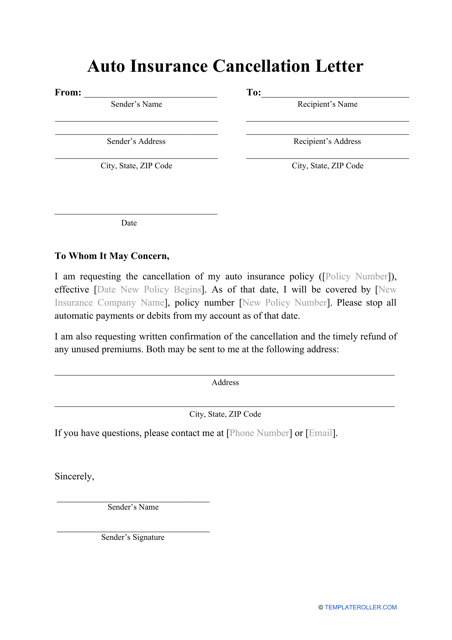

The process for canceling vehicle insurance policy varies from insurer to insurer. In most cases, the insured person must contact the insurer and provide the necessary information, such as the policy number and the reason for cancellation. The insurer may then provide written confirmation of the cancellation, which should be kept in a safe place for future reference.

In some cases, the cancellation may be done online or over the phone. If the cancellation is done online, the insured person must provide the insurer with the necessary information, such as the policy number, the reason for cancellation, and the date of cancellation. The insurer will then issue a confirmation of cancellation, which should be kept for future reference.

Cancellation Refunds

In some cases, the insurer may issue a refund for the unused portion of the policy. The amount of the refund may depend on the type of policy, the length of the policy, and other factors. In most cases, the refund is pro-rated based on the amount of coverage remaining on the policy at the time of cancellation. It is important to understand that the refund is not always available, and the insured person should contact the insurer to determine if a refund is available.

Continuous Insurance Requirements

In some states, it is necessary to maintain continuous insurance coverage on vehicles in order to comply with state laws. It is important to understand the requirements of the state before canceling a vehicle insurance policy. In some states, the insured person may be required to provide proof of insurance from another insurance company in order to cancel the existing policy.

Cancellation Fees

In some cases, the insurer may charge a cancellation fee for canceling a vehicle insurance policy. This fee is usually a percentage of the policy premium, and it is designed to cover the costs of processing the cancellation. The cancellation fee may vary from insurer to insurer, so it is important to understand the policy before canceling.

Conclusion

Canceling vehicle insurance policy is a common thing and there can be many reasons behind it. The process of canceling varies from insurer to insurer and in some cases, a refund or cancellation fee may be applicable. It is important to understand the cancellation process, the requirements in the state, and the potential fees before canceling a vehicle insurance policy.

Keyword for Car Insurance Template

Auto Insurance Cancellation Letter Template Download Printable PDF

45 Professional Cancellation Letters (Insurance, Order, Contract, Event

Insurance Cancellation Letter Template - Cover Letters

Life Insurance Cancellation Letter Sample Reasons Why Life Insurance