How Much Is Full Coverage Insurance

How Much Is Full Coverage Insurance?

Full coverage insurance is an important purchase for any car owner. It offers comprehensive coverage in the event of an accident, theft or natural disaster, and it can provide peace of mind to drivers. However, the cost of full coverage insurance can vary depending on a variety of factors. Let’s take a look at what goes into calculating the cost of full coverage insurance, and how much you can expect to pay.

Factors That Affect Full Coverage Insurance Rates

The cost of full coverage insurance is determined by a variety of factors. Insurance companies will use different criteria to calculate a person’s full coverage insurance rate, including:

- The type of car being insured

- The driver’s age, gender and driving history

- The driver’s credit score

- The area where the driver lives

- The driver’s coverage limits

- The driver’s deductibles

By understanding these factors, you can better prepare yourself for the cost of full coverage insurance. For example, if you live in an area with a higher crime rate, you can expect your full coverage insurance rate to be higher than if you lived in a rural area. Similarly, if you have a poor driving record, you can expect to pay a higher rate than those with a clean driving record.

Average Cost of Full Coverage Insurance

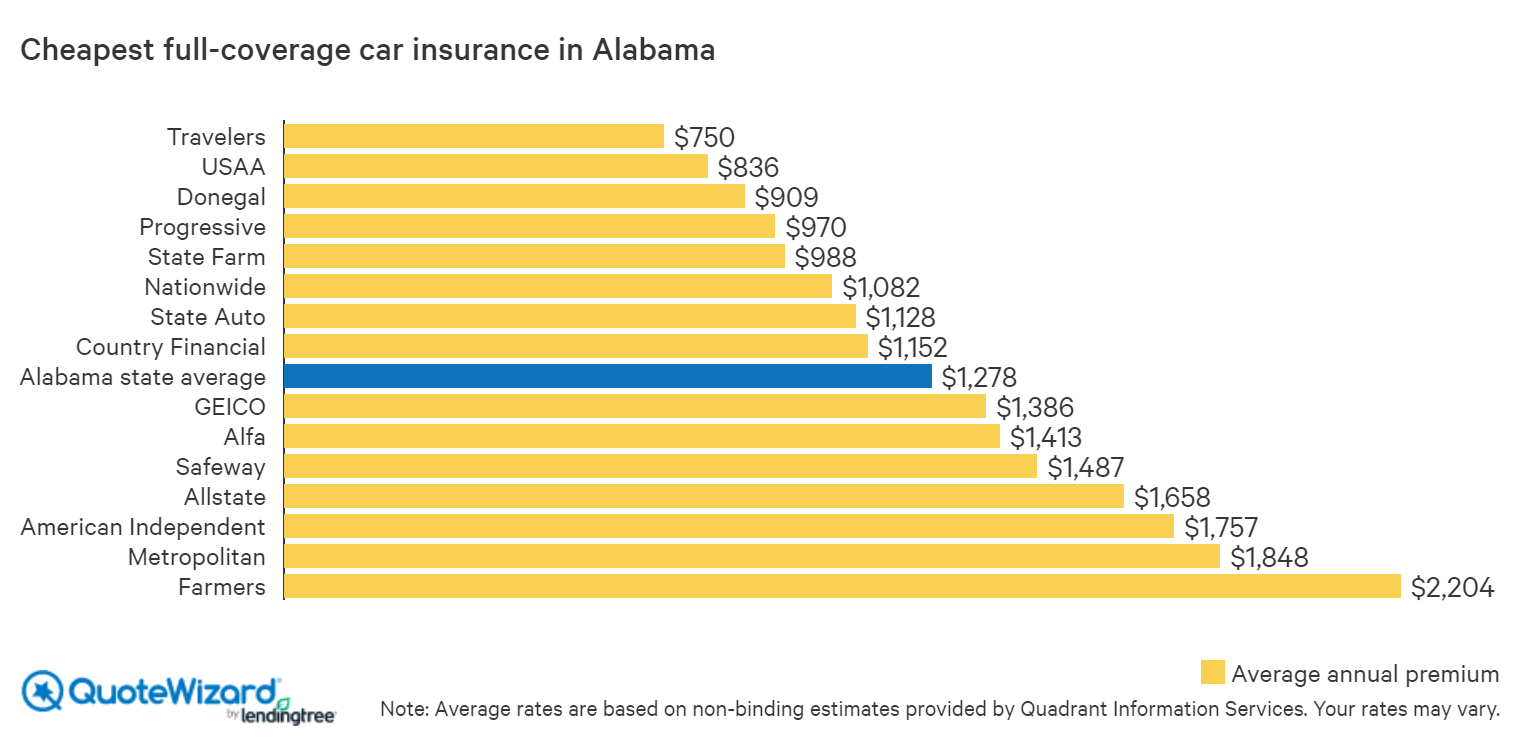

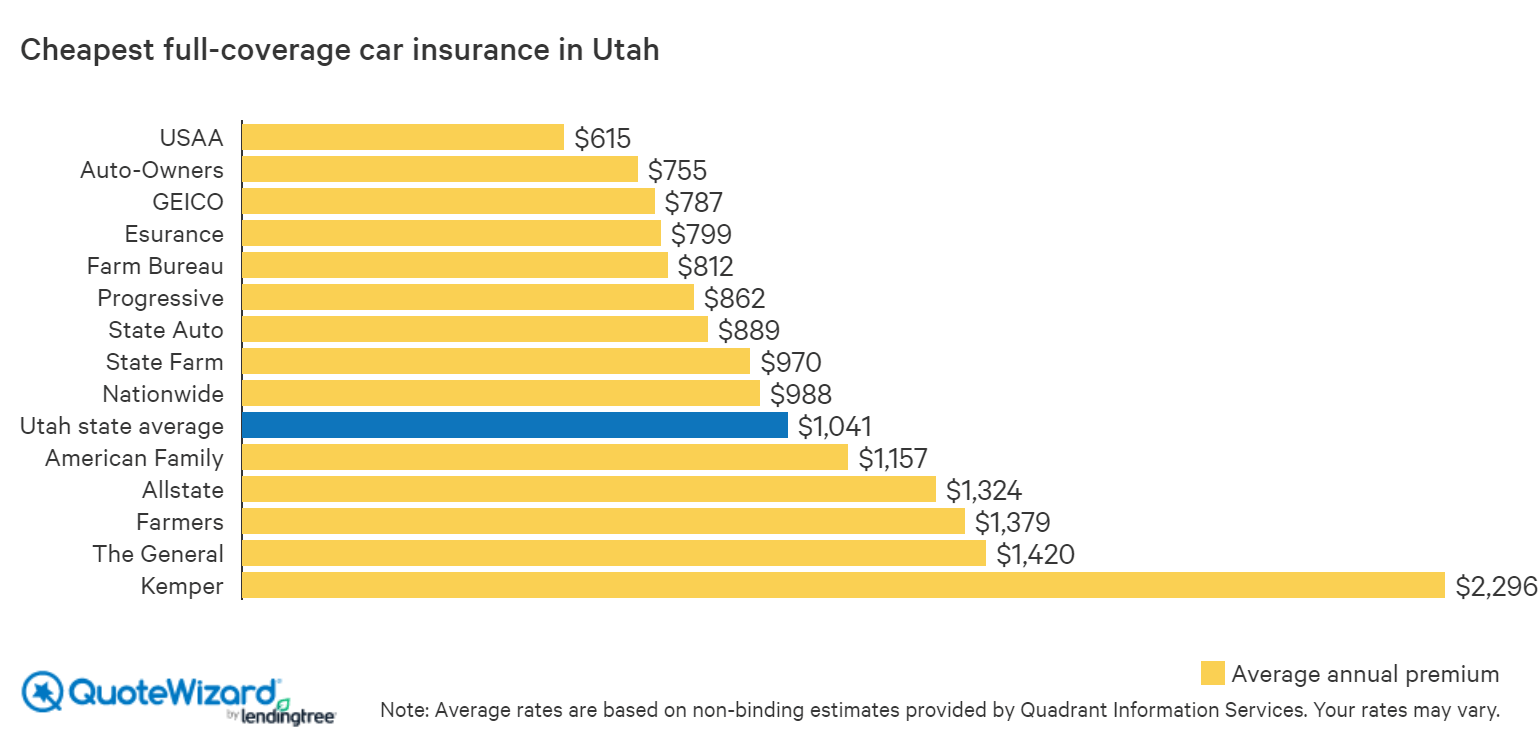

While the cost of full coverage insurance can vary widely, the average cost for a full coverage policy is around $1,300 per year. This estimate is based on a variety of factors, including the type of car being insured, the driver’s age, driving history, and other factors. However, this number can vary depending on your individual circumstances.

How to Find the Best Full Coverage Insurance Rate

The best way to find the best full coverage insurance rate is to shop around and compare quotes from different insurance companies. By comparing multiple quotes, you can get a better idea of the cost of full coverage insurance and find the policy that best fits your needs and budget. Additionally, you may be able to get discounts if you bundle multiple insurance policies with the same company, or if you have a good driving record.

Full coverage insurance is an important purchase for any car owner. It offers comprehensive protection in the event of an accident, theft or natural disaster, and can provide peace of mind for drivers. Fortunately, there are a variety of ways to save on full coverage insurance, making it more affordable for drivers of all ages and backgrounds.

18+ Full Coverage Car Insurance Quotes - Best Day Quotes

Full coverage car insurance in california by Promax Insurance Agency

Where to Find Cheap Car Insurance in Utah | QuoteWizard

List Of How Much Is Full Coverage Insurance Geico References - SPB

Metropolitan Casualty Insurance Company Auto - kenyachambermines