Hdfc Ergo Motor Insurance Policy Status

HDFC ERGO Motor Insurance Policy Status

What is HDFC ERGO Motor Insurance?

HDFC ERGO Motor Insurance is a comprehensive motor insurance policy offered by HDFC ERGO General Insurance Company Limited. It provides coverage for any damage or loss caused to your vehicle due to an accident, natural disasters, theft or any other unforeseen event. It also provides protection against third-party liabilities. The policy also offers additional benefits such as personal accident cover, legal assistance, cashless repair, and roadside assistance.

What is the Policy Status?

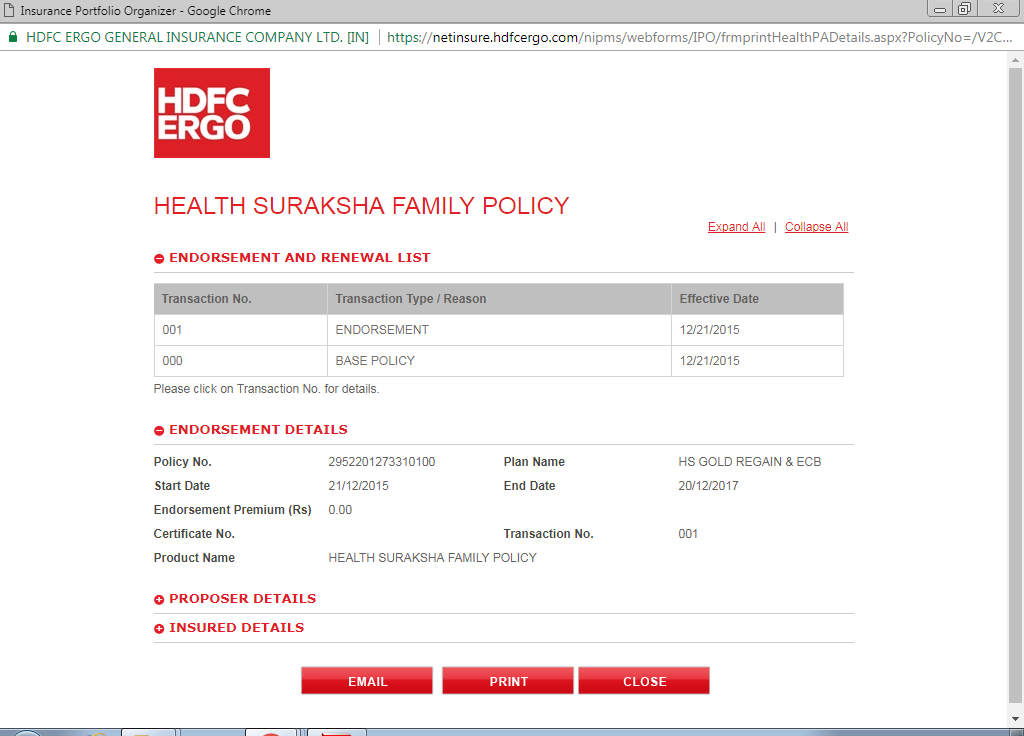

The policy status of your HDFC ERGO Motor Insurance policy can be checked online. You can log into your HDFC ERGO account and click on the ‘My Policies’ tab to check the status of your policy. You can also check the policy status by calling the HDFC ERGO customer care number.

What Information Do You Need to Check the Status?

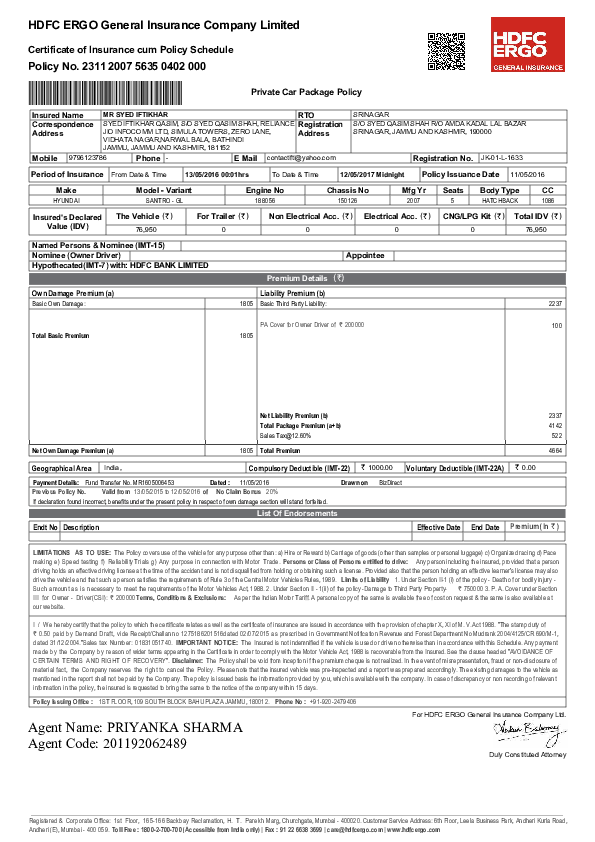

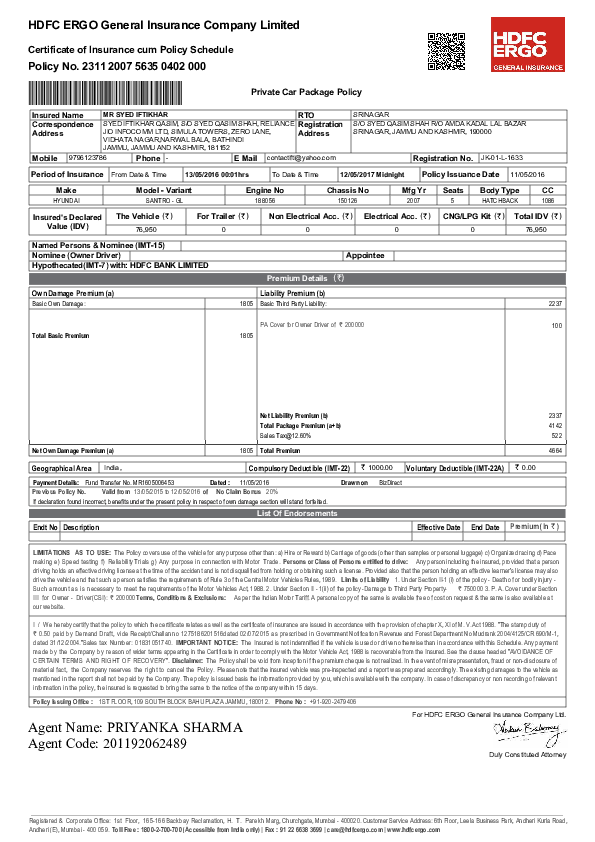

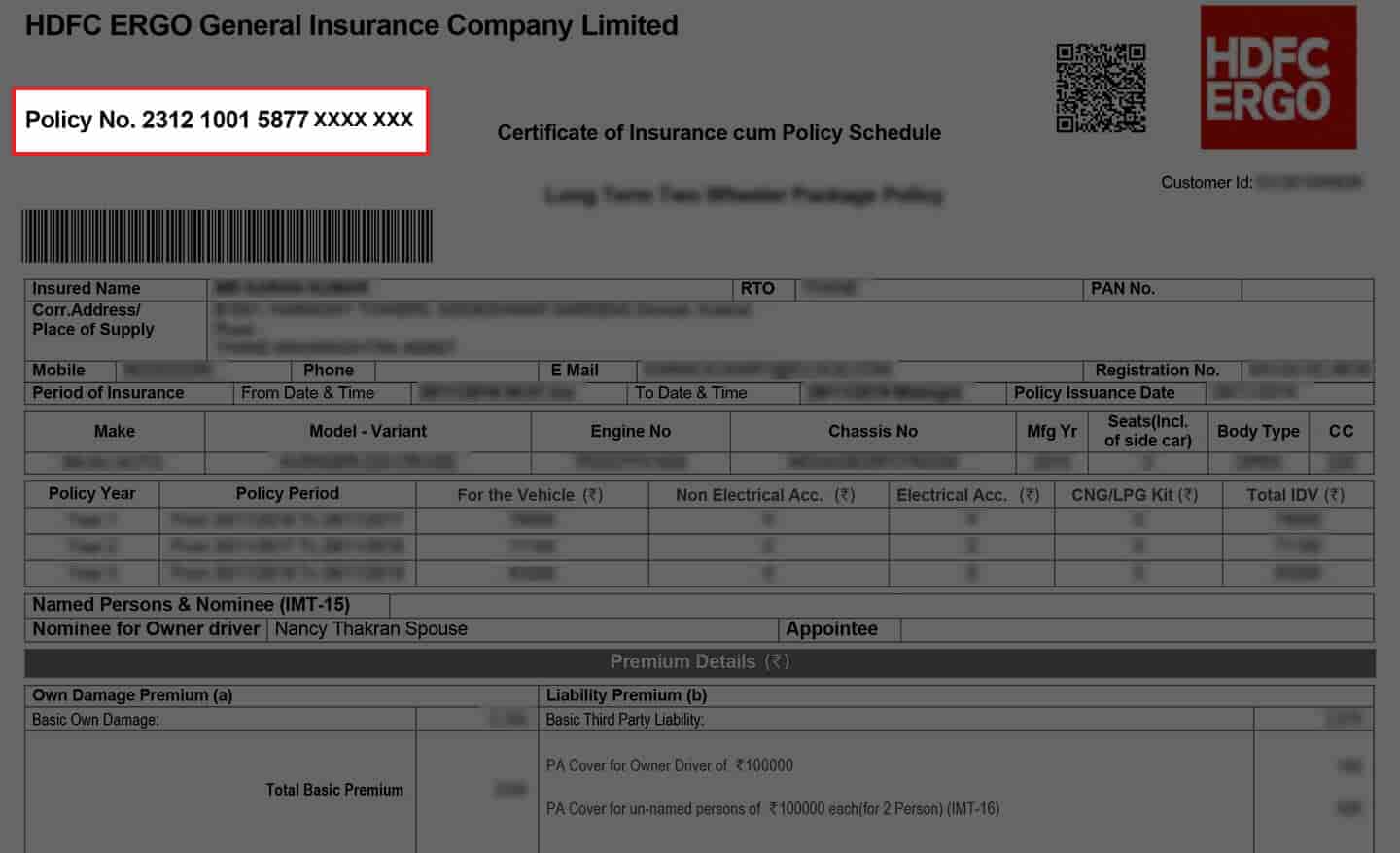

In order to check the status of your HDFC ERGO Motor Insurance policy, you will need the policy number. This can be found on the policy documents that have been issued to you. You will also need to provide your personal details such as your name, contact number and email address.

What Does the Policy Status Mean?

The policy status of your HDFC ERGO Motor Insurance policy can help you understand the status of your policy and the validity of the cover. The policy status will indicate whether the policy is active and in force or not. It will also give you information about the policy period, the premium amount, the sum assured and the coverages that are included in the policy.

How Can You Make Changes to Your Policy?

If you need to make changes to your HDFC ERGO Motor Insurance policy, such as changing the policy period or the sum assured, you can do so online. You can log into your HDFC ERGO account and click on the ‘My Policies’ tab. Here, you can make changes to your policy as per your requirements.

What Are the Benefits of HDFC ERGO Motor Insurance?

HDFC ERGO Motor Insurance offers a range of benefits to policyholders. It provides financial protection in case of an accident or theft of your vehicle. It also provides protection against third-party liabilities. The policy also offers additional benefits such as personal accident cover, legal assistance, cashless repair and roadside assistance.

Hdfc Insurance Claim Form Pdf

HDFC Ergo Bike Renew Policy - Motor Insurance Claim | Motor Insurance

HDFC ERGO CGL Proposal Form - 2018 2019 Student Forum

A Few Reasons Why You Should Buy Car Insurance From HDFC ERGO | Visual.ly

Hdfc Ergo Health Insurance Login Partner Portal