Does State Farm Cover Deer Accidents

Tuesday, December 24, 2024

Edit

Does State Farm Cover Deer Accidents?

What Does State Farm Insurance Cover?

State Farm Insurance provides a wide range of coverage for your vehicle and other property. The insurance company offers collision coverage, which covers you for damage to your vehicle if you are involved in an accident with another vehicle or object, such as a deer. The company also provides comprehensive coverage, which covers you for damage to your vehicle caused by something other than a collision, such as theft, vandalism, fire, or hail.

State Farm also offers liability coverage, which pays for damages to another person or their property if you are at fault in an accident. It also provides medical payments coverage, which pays for medical expenses for you and your passengers if you are injured in an accident. Finally, the company also offers uninsured motorist coverage, which pays for medical expenses and other damages if you are in an accident with an uninsured or underinsured driver.

Does State Farm Insurance Cover Deer Accidents?

Yes, State Farm Insurance provides coverage for deer accidents. The company offers collision coverage, which covers you for damage to your vehicle if you are involved in an accident with a deer. State Farm also provides comprehensive coverage, which covers you for damage to your vehicle caused by a deer, as well as other events, such as theft, vandalism, fire, or hail.

What Does State Farm Insurance Not Cover?

State Farm Insurance does not cover damages to another person or their property if you are at fault in an accident. For this type of coverage, you must purchase liability insurance. Also, State Farm does not provide coverage for medical expenses for you and your passengers if you are injured in an accident. To get this type of coverage, you must purchase medical payments coverage. Finally, State Farm does not provide coverage for medical expenses and other damages if you are in an accident with an uninsured or underinsured driver. To get this type of coverage, you must purchase uninsured motorist coverage.

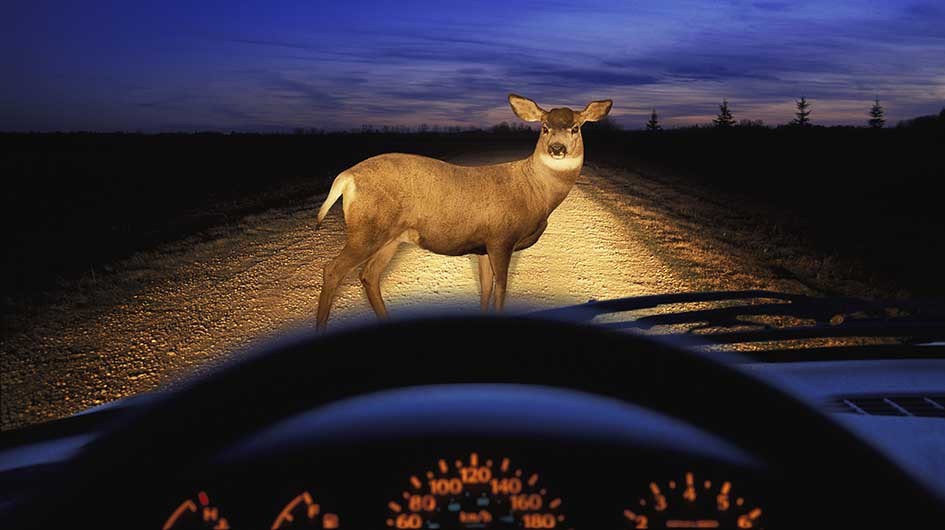

What Should You Do After an Accident With a Deer?

If you are involved in an accident with a deer, it is important to remain calm and take the following steps:

1. Call the police and file a report.

2. Take pictures of the damage to your vehicle and the deer.

3. Contact your insurance company and file a claim.

4. Get an estimate for repairs to your vehicle.

5. If you are able to, move your vehicle to a safe location.

Conclusion

State Farm Insurance provides a variety of coverage for your vehicle and other property. The company offers collision coverage, which covers you for damage to your vehicle if you are involved in an accident with a deer. State Farm also provides comprehensive coverage, which covers you for damage to your vehicle caused by a deer, as well as other events, such as theft, vandalism, fire, or hail. However, State Farm does not cover damages to another person or their property if you are at fault in an accident, nor does it provide coverage for medical expenses for you and your passengers if you are injured in an accident. If you are involved in an accident with a deer, it is important to remain calm and take the appropriate steps.

States with the most deer accidents – The Bull Elephant

Driver-Deer Collisions On The Rise: State Farm | WSLM RADIO

Deer Drive Damage Claim Costs Up | State Farm

Video captures deer’s shocking collision with police cruiser - The