Does Insurance Follow The Car Or The Person

Monday, December 30, 2024

Edit

Does Insurance Follow The Car Or The Person?

What is Insurance?

Insurance is a type of risk management primarily used to hedge against the risk of a contingent or uncertain loss. Insurance is defined as the equitable transfer of the risk of a loss, from one entity to another, in exchange for a premium, and can be thought of as a guaranteed and known small loss to prevent a large, potentially financially devastating loss. Insurance is a form of risk management primarily used to hedge against the risk of a contingent, uncertain loss.

Insurance is used to protect the financial security of an individual, business or other entity in the case of unexpected loss. Insurance policies provide protection against financial losses resulting from certain events, such as death, injury, illness, property damage, and legal liability. Insurance is a contract between two parties, the insurer and the insured, in which the insurer agrees to pay the insured a sum of money in the event of a specified loss.

The Difference Between Car Insurance and Personal Insurance

Car insurance and personal insurance are two very different types of insurance. Car insurance is specifically designed to provide financial protection for vehicles and their drivers, while personal insurance is designed to protect individuals and their families from various risks.

Car insurance covers losses or damages caused to a vehicle, including damage caused in an accident, theft, or vandalism. It also provides financial protection for the driver in the event of an accident. Personal insurance, on the other hand, covers a wide range of risks, such as medical bills, loss of income due to disability, and legal liability.

Does Insurance Follow the Car or the Person?

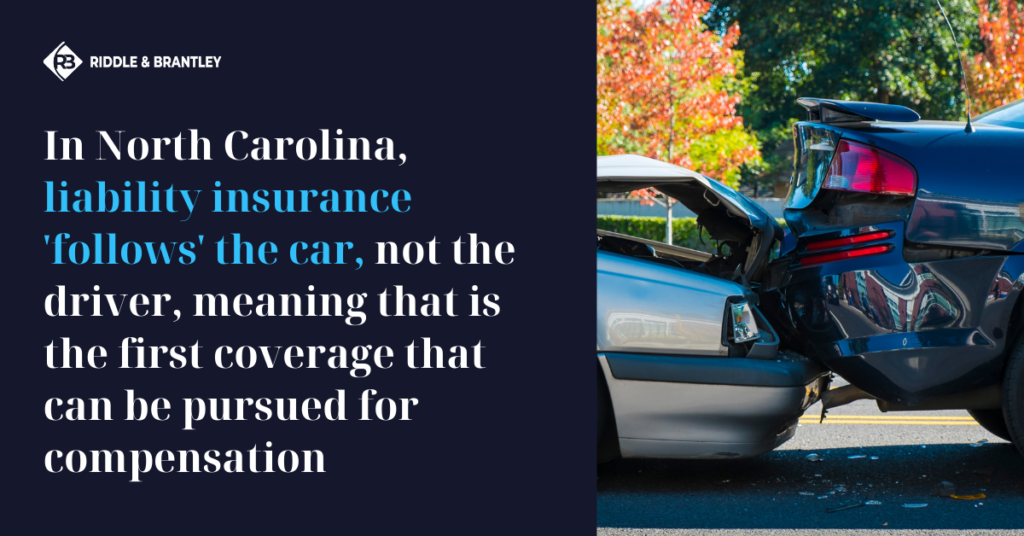

The answer to this question depends on the type of insurance being discussed. In general, car insurance follows the car, while personal insurance follows the person.

Car insurance is specific to the vehicle it covers, so if a person sells their car, their car insurance policy is no longer valid. The new owner of the car must purchase their own car insurance policy. Personal insurance, on the other hand, is not specific to any particular vehicle and remains valid regardless of whether the person drives their own car or someone else's.

What Does This Mean For You?

This means that it is important to understand the type of insurance you have and what it covers. If you have car insurance, you should be aware that it does not cover you if you drive someone else's car. If you do not have personal insurance, you should consider purchasing a policy to protect yourself from unexpected losses, such as medical bills or legal fees.

It is also important to understand that car insurance does not cover all types of losses. For example, if you are involved in a car accident and the other driver is at fault, their car insurance will cover their liability, but not yours. In this case, you may need to purchase a personal liability policy to protect yourself.

Conclusion

In conclusion, car insurance follows the car and personal insurance follows the person. It is important to understand the type of insurance you have and what it covers in order to ensure you are properly protected in the event of an unexpected loss. If you do not have the right type of insurance, you should consider purchasing a policy to protect yourself.

Does Insurance Follow The Car Or The Driver? - Michigan Auto Law

Does Insurance Follow the Car or the Driver in North Carolina? | Riddle

Does Insurance Follow The Car Or The Driver? - Michigan Auto Law

20 Tips for Obtaining Cheap Car Insurance | TheSelfEmployed.com

Does Insurance Follow The Car Or The Driver In Missouri - Car Retro