Cheapest Liability Only Auto Insurance

Cheapest Liability Only Auto Insurance

What is Liability Only Auto Insurance?

Liability only auto insurance is a form of coverage that provides protection from financial losses associated with an accident. It pays for the other party’s medical bills, property damage, and other related expenses if you are found at fault in an accident. Liability only auto insurance does not cover your own car or medical bills, and it does not provide collision or comprehensive coverage. Liability only coverage is the minimum required by law in most states and is typically the least expensive form of auto insurance.

How Can I Make My Liability Only Auto Insurance Cheaper?

The best way to make your liability only auto insurance policy cheaper is to shop around and compare rates from different providers. Many companies offer discounts for multiple policies, such as combining home and auto insurance, or for safety features on your vehicle. Additionally, some companies offer discounts if you have a clean driving record or if you’re a safe driver. Finally, increasing your deductible can also lower your premiums.

What Are My Other Options For Cheaper Insurance?

If you’re looking for cheaper auto insurance, you may want to consider other types of coverage. A full coverage policy will provide more protection, including collision and comprehensive coverage, but it will cost more. Additionally, you may want to consider an umbrella policy, which provides extra liability coverage on top of your existing policy. This can be helpful if you are found liable for an accident that costs more than your liability policy limits.

What Should I Look For When Shopping For Liability Only Auto Insurance?

When shopping for liability only auto insurance, it is important to compare quotes from multiple companies to find the best rate. Make sure to ask about any discounts that may be available. Additionally, make sure to read through the policy details to make sure you understand the coverage limits, deductibles, and other important information. Finally, make sure to read through any fine print to make sure you understand the terms and conditions of the policy.

What Are the Benefits of Liability Only Auto Insurance?

The main benefit of liability only auto insurance is that it is typically the cheapest type of auto insurance. Additionally, it is the minimum required by law in most states. This type of coverage will protect you from financial losses if you are found at fault in an accident. Finally, it can provide peace of mind knowing that you are protected if you are ever in an accident.

Conclusion

Liability only auto insurance is the cheapest and most basic form of auto insurance available. It provides protection from financial losses associated with an accident if you are found at fault. Shopping around and comparing rates from different providers is the best way to find the cheapest liability only auto insurance. Additionally, make sure to read through the policy details and any fine print to make sure you understand the coverage limits and other important information.

PPT - Cheapest Liability Car Insurance Texas PowerPoint Presentation

PPT - Cheapest Liability Car Insurance Texas PowerPoint Presentation

canonprintermx410: 25 Luxury Cheap Liability Auto Insurance

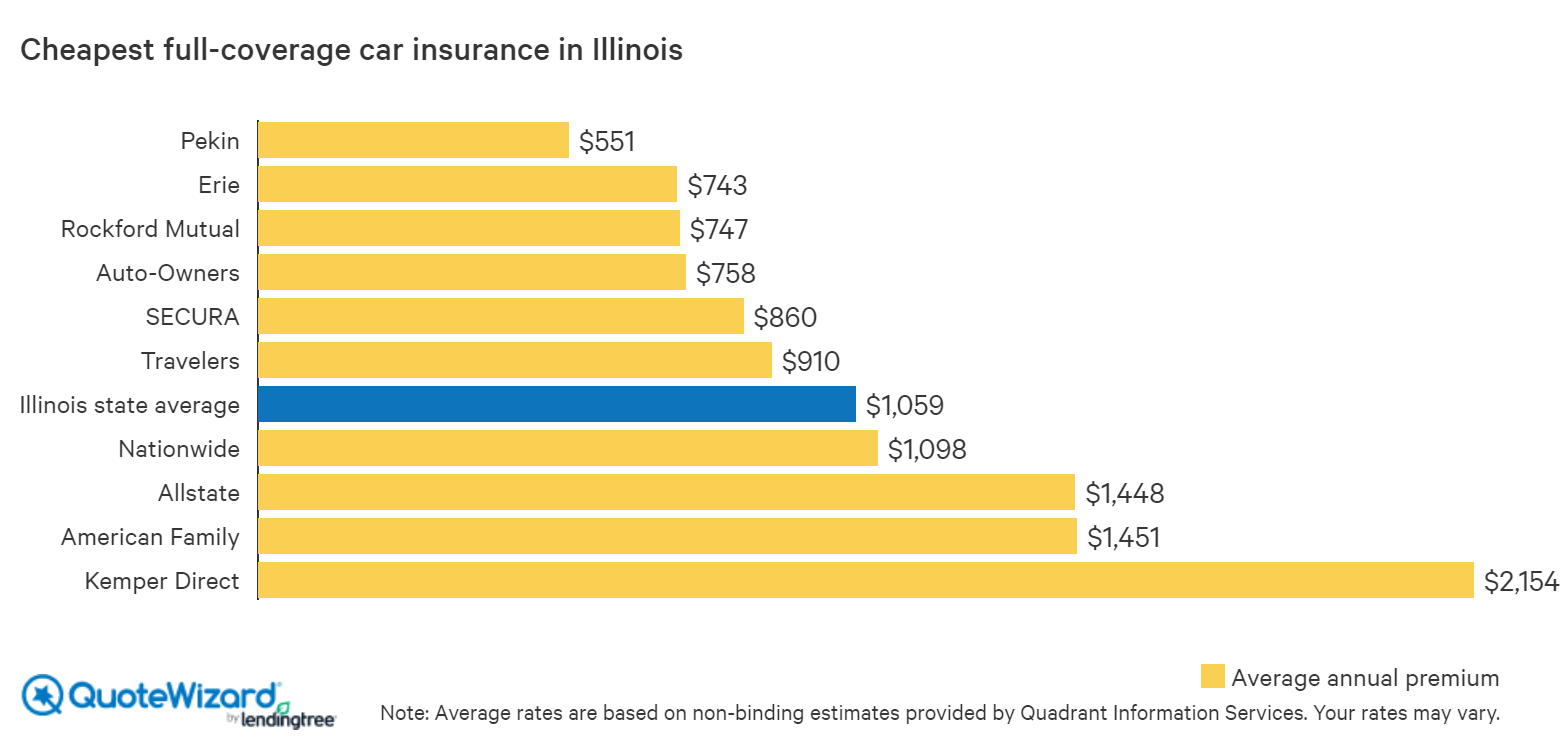

Find Cheap Car Insurance in Illinois | QuoteWizard

Cheapest Liability Only Car Insurance