Cheapest Car Insurance Full Coverage

Tuesday, December 17, 2024

Edit

Cheapest Car Insurance Full Coverage

What is car insurance full coverage?

Car insurance full coverage is a type of insurance policy that provides the highest levels of protection for your vehicle. This type of policy typically covers both liability and physical damage coverage, with liability coverage mitigating the costs associated with any damage or injury you may cause to another person or property. Moreover, physical damage coverage helps protect your car from any potential damage caused by an accident, theft, fire, or other unexpected events. In short, full coverage car insurance is essentially the most comprehensive form of protection available for your automobile.

What are the benefits of car insurance full coverage?

Having car insurance full coverage can provide several benefits. For example, it can help you avoid costly repairs and medical bills if you are ever involved in an accident. Additionally, full coverage insurance can help protect you from financial losses due to vandalism, theft, and other unexpected events. Furthermore, full coverage policies often include additional benefits such as roadside assistance, rental car reimbursement, and even medical payments coverage. Ultimately, full coverage car insurance can be a great way to ensure that you and your vehicle are fully protected.

What kinds of coverage are included in car insurance full coverage?

Car insurance full coverage typically includes both liability and physical damage coverage. Liability coverage provides protection for you if you are found to be at fault in an accident, while physical damage coverage helps protect your car from any potential damage caused by an accident, theft, fire, or other unexpected events. Additionally, full coverage policies typically include additional benefits such as roadside assistance, rental car reimbursement, and even medical payments coverage.

How can I find the cheapest car insurance full coverage?

If you are looking for the cheapest car insurance full coverage, there are a few steps you can take. First, it is important to shop around and compare different policies to find the best coverage for the best price. Additionally, you should look for any discounts that may be available to you in order to lower your overall premiums. Furthermore, it may be beneficial to raise your deductible in order to reduce your monthly payments. Finally, consider bundling your car insurance with other types of insurance, such as home or life insurance, to get even more savings.

What are the risks of going with the cheapest car insurance full coverage?

While going with the cheapest car insurance full coverage may seem like a good way to save money, it is important to understand the risks involved. The most common risk is that the coverage may not be sufficient to cover the full cost of any repairs or medical bills if you are ever involved in an accident. Additionally, the policy may not include any additional benefits, such as roadside assistance or rental car reimbursement, which may be necessary in certain situations. Ultimately, it is important to make sure that you are adequately protected with your car insurance policy.

Conclusion

Finding the cheapest car insurance full coverage can be a great way to save money on your policy. However, it is important to make sure that you are getting the coverage you need and that the policy includes any additional benefits that may be necessary. By shopping around and looking for any discounts or bundles that may be available, you can help ensure you are getting the best deal on your policy.

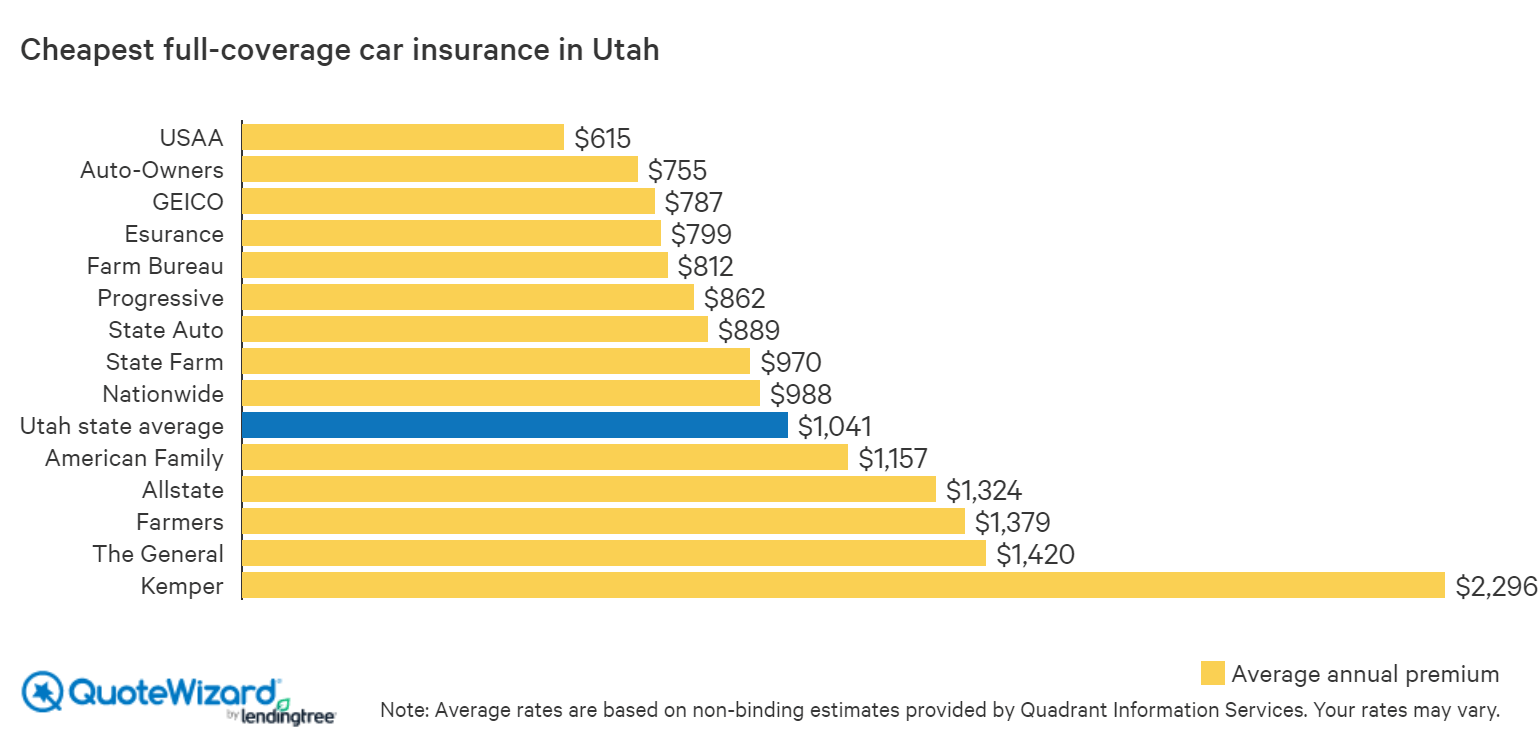

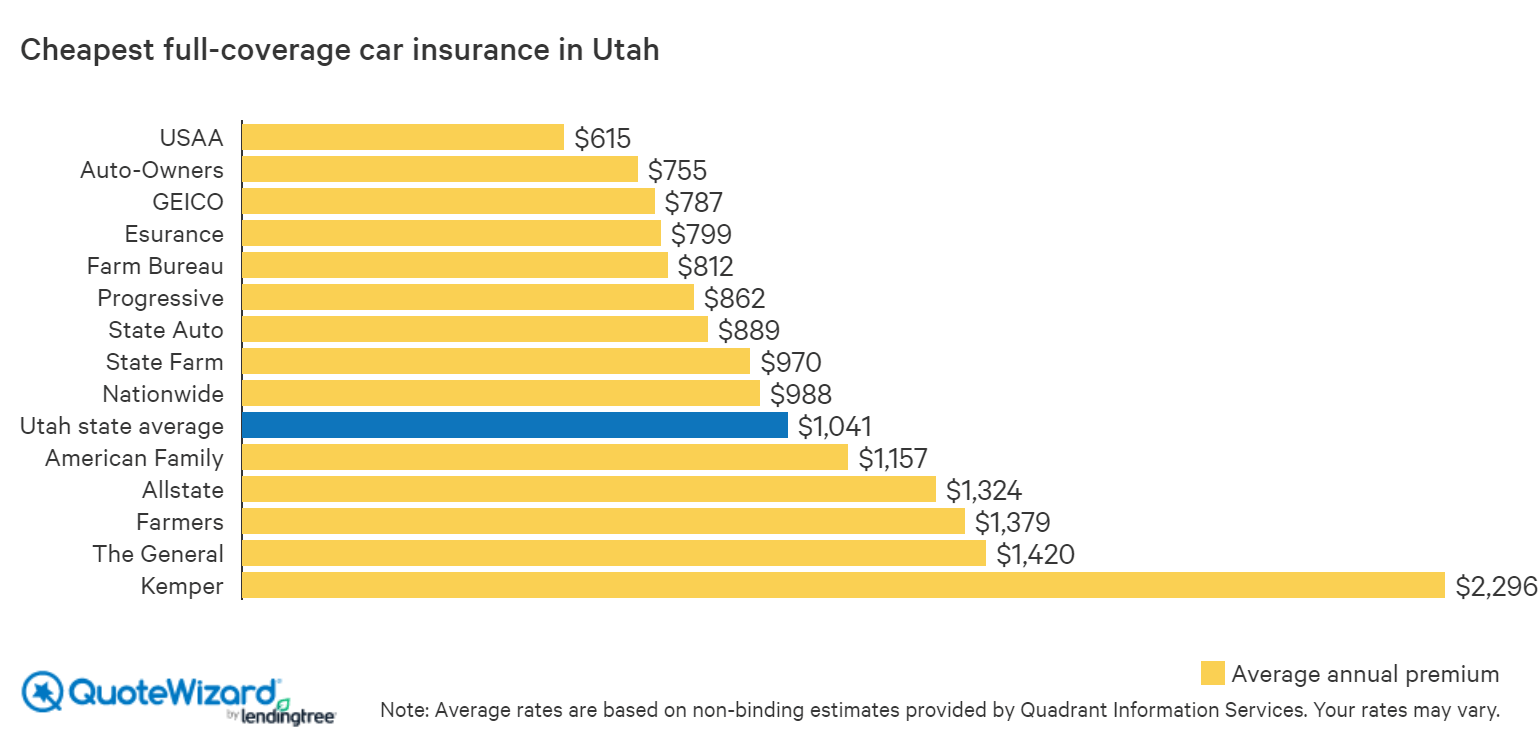

Where to Find Cheap Car Insurance in Utah | QuoteWizard

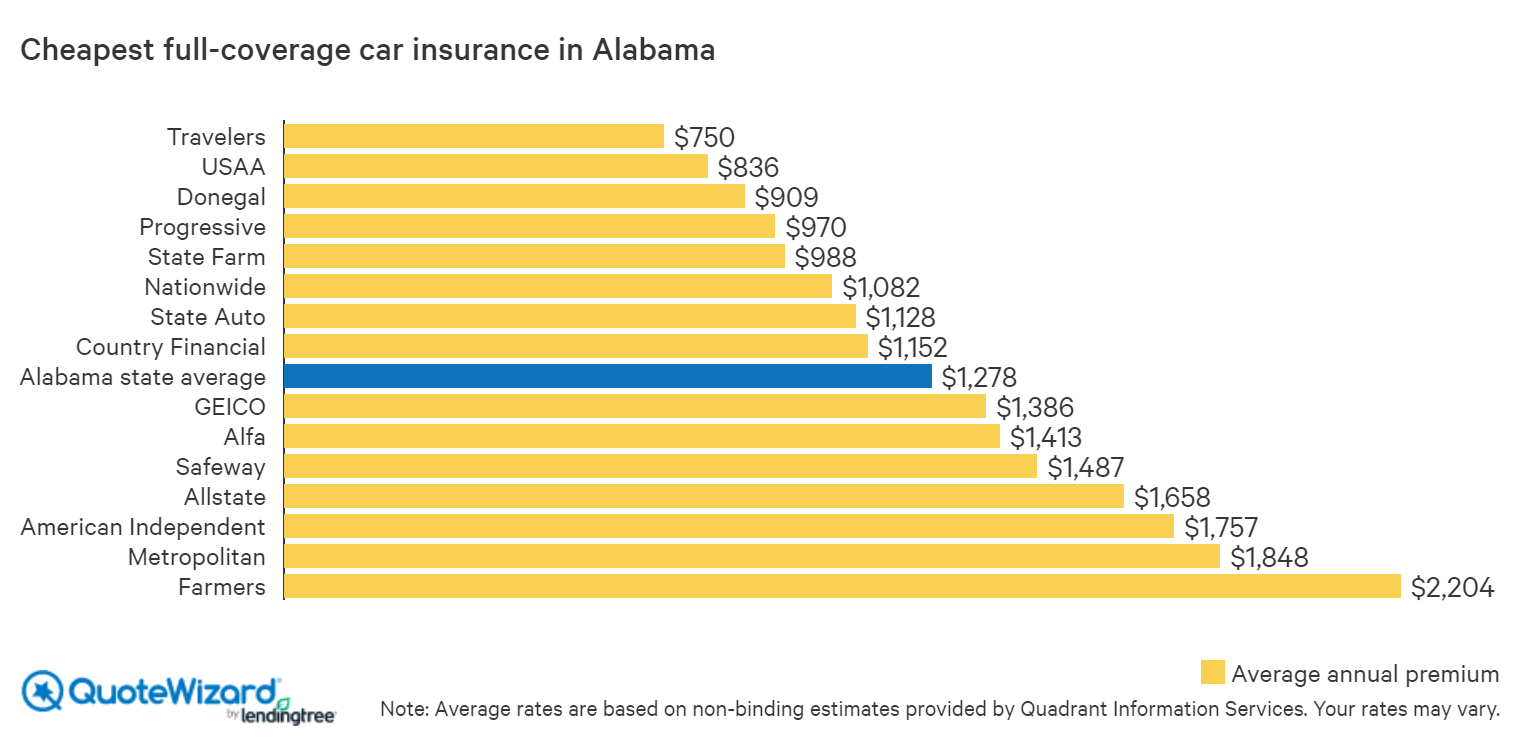

Find Cheap Car Insurance in Alabama | QuoteWizard

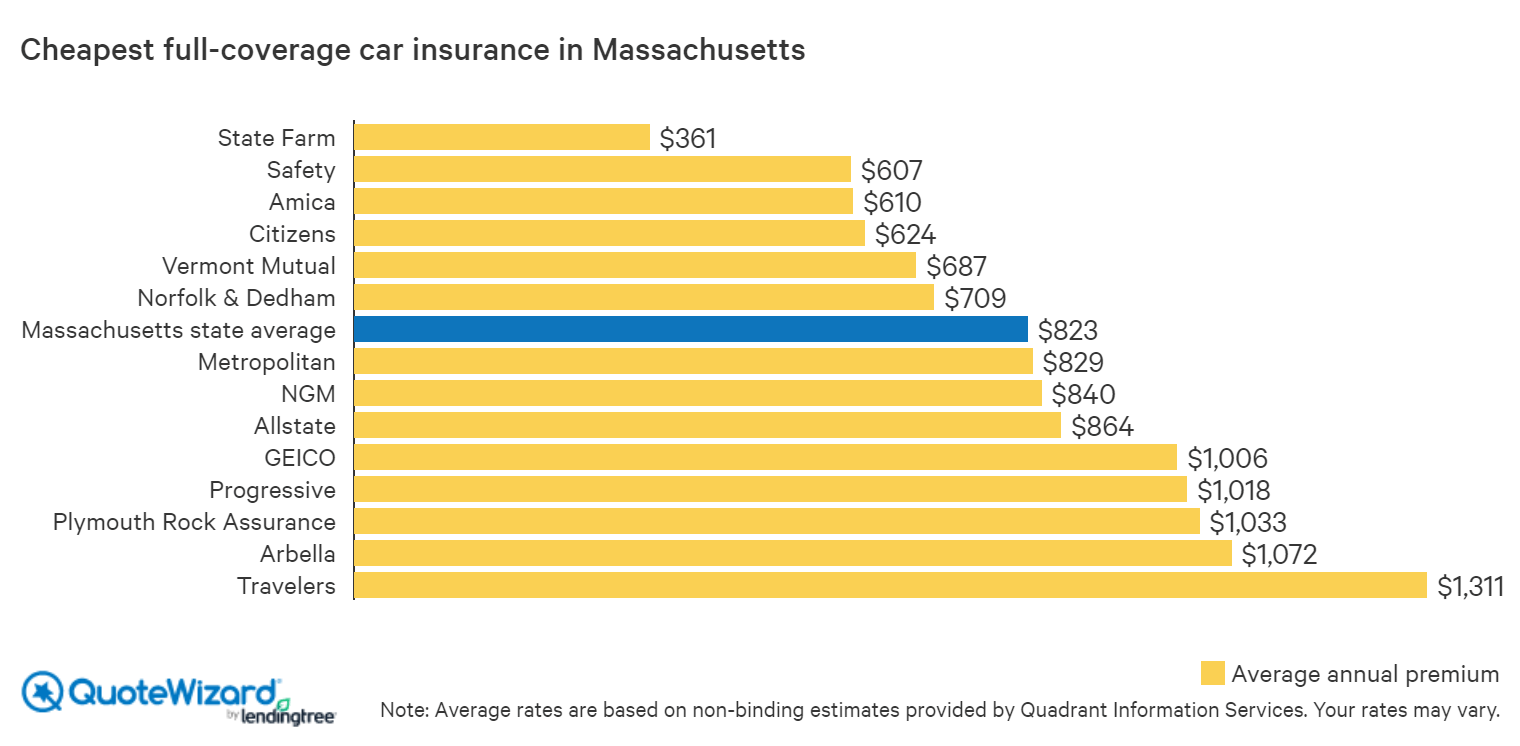

Cheapest Car Insurance in Massachusetts | QuoteWizard

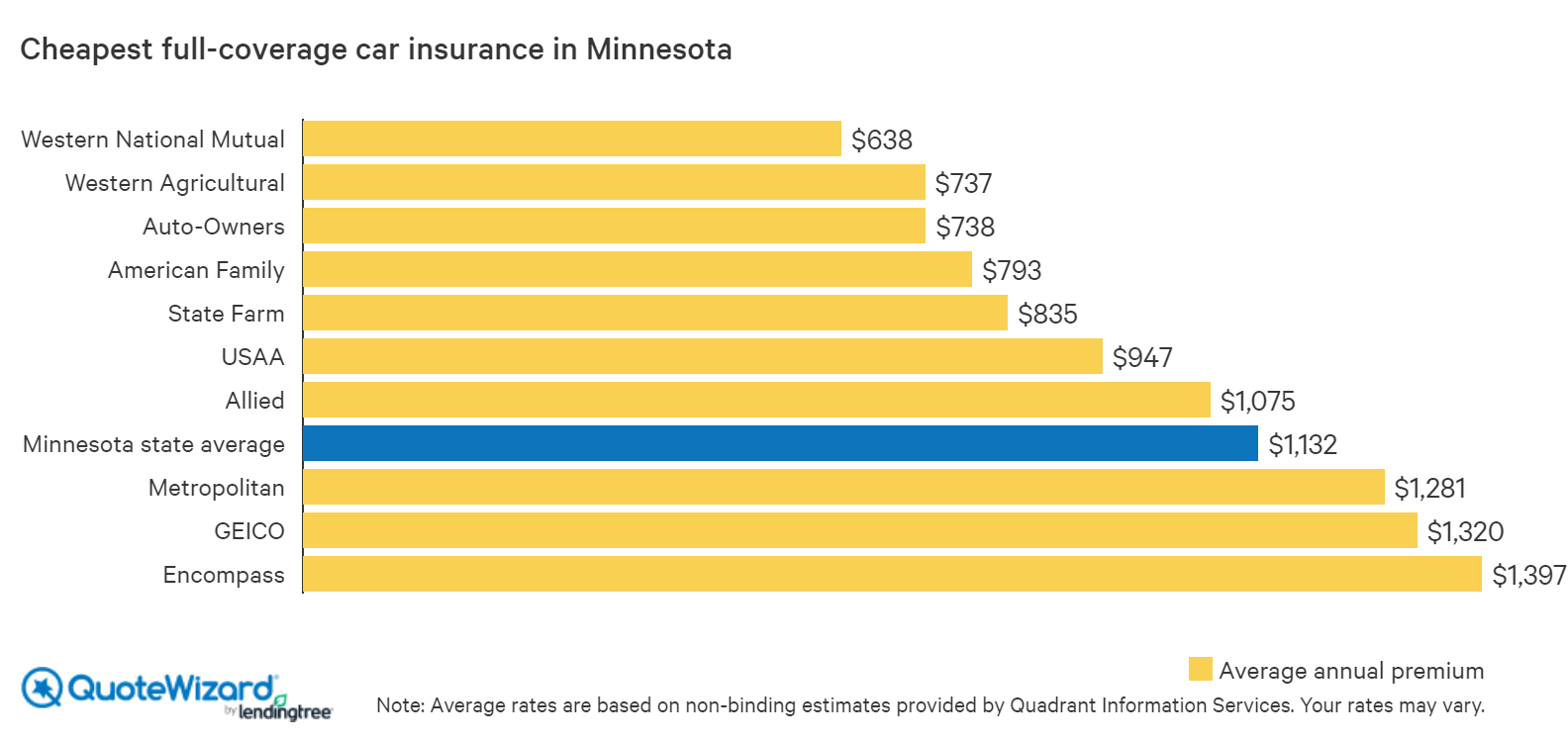

Get Cheap Car Insurance in Minnesota | QuoteWizard

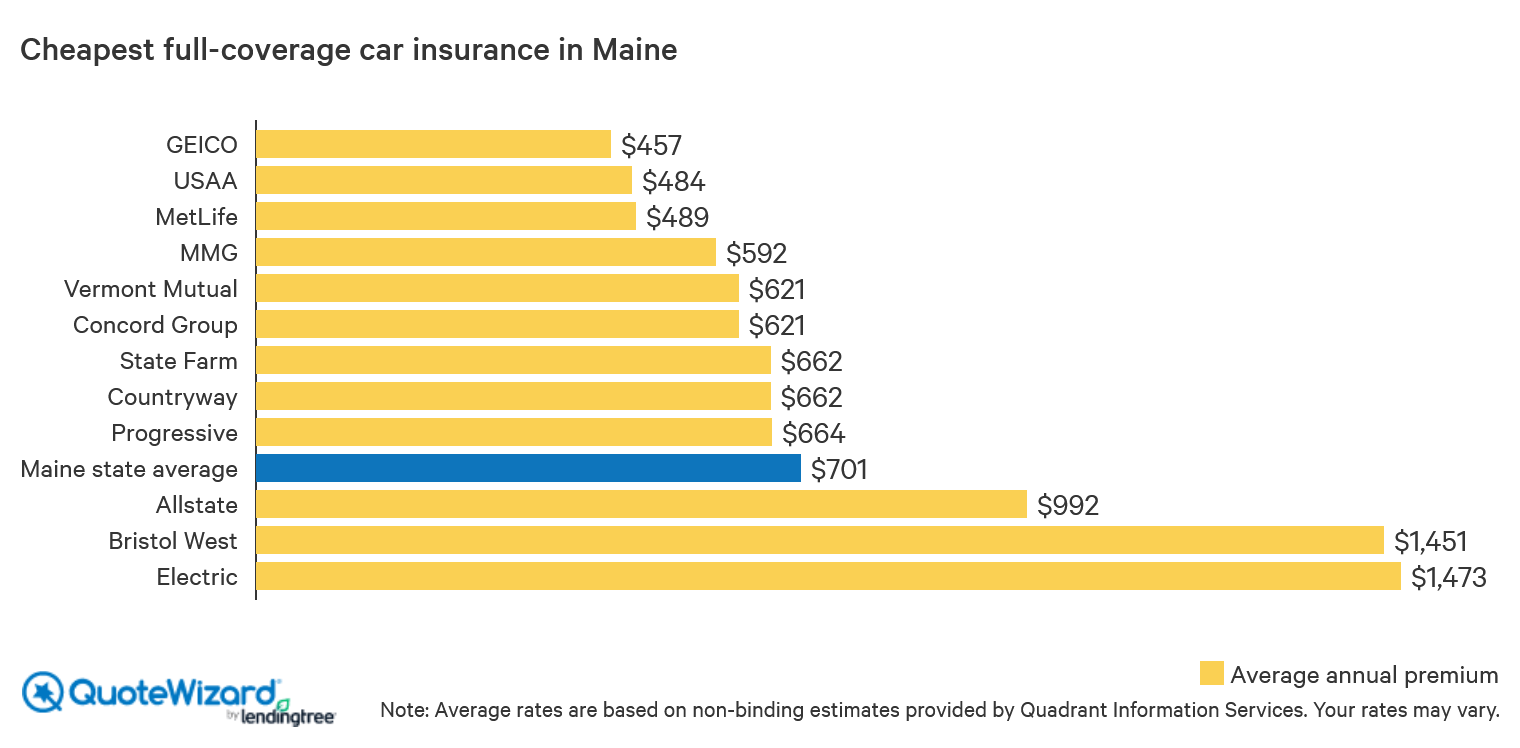

Where to Get Cheap Car Insurance in Maine | QuoteWizard