Cheap Full Coverage Car Insurance For High Risk Drivers

Friday, December 6, 2024

Edit

Cheap Full Coverage Car Insurance For High Risk Drivers

What is High Risk Car Insurance?

High risk car insurance is designed for drivers who are deemed to be a higher risk than other drivers on the road. This is usually because they have a history of violating traffic laws and regulations, or have been involved in multiple accidents. Some drivers may also be considered high risk if they have struggled to maintain a consistent driving record over the years. High risk car insurance policies may cost more than standard car insurance policies, but they can provide protection and peace of mind for those who need it.

Why is High Risk Car Insurance More Expensive?

High risk car insurance is more expensive because it is seen as a higher risk to insurance companies. Drivers who are deemed to be high risk are more likely to be involved in an accident and make a claim on their insurance. As such, insurance companies will charge a higher premium to cover the increased risk. High risk car insurance policies usually have higher deductibles and premiums, which can make them more expensive than standard car insurance policies.

How Can I Find Cheap Full Coverage For High Risk Drivers?

Finding cheap full coverage for high risk drivers can be a challenge, but it is possible. The first step is to shop around and compare quotes from different insurers. Look for companies that specialize in providing car insurance for high risk drivers, and ask about any special discounts or incentives that may be available. It is also important to check the coverage limits and deductibles on each policy to make sure you are getting the best deal. Additionally, make sure to read the fine print and understand the terms and conditions of each policy before signing up.

What Are the Benefits of Full Coverage Car Insurance?

Full coverage car insurance offers a number of benefits, including protection against damage to your vehicle, liability coverage for any accidents you may be involved in, and comprehensive coverage in case of theft or vandalism. Additionally, it can provide peace of mind, knowing that your car is fully protected in the event of an accident. Full coverage car insurance also helps to keep your monthly costs down, as it can provide additional discounts and incentives.

Tips for Keeping High Risk Car Insurance Costs Low

There are a few things you can do to help keep your car insurance costs low, even if you are a high risk driver. First, make sure to maintain a good driving record by following the rules of the road and avoiding any traffic violations. Additionally, try to avoid filing claims on your car insurance, as this can increase your premiums. Finally, consider raising your deductibles or switching to a higher deductible policy, as this can help to reduce your monthly car insurance costs.

Where Can I Find More Information About High Risk Car Insurance?

If you need more information about high risk car insurance, there are a number of resources available. You can speak to your car insurance provider to find out more about their policies and coverage options. Additionally, there are a number of websites and blogs dedicated to providing information about high risk car insurance, including tips and advice on finding the best deals. Finally, you can always speak to an insurance agent to get personalized advice and information about your particular situation.

Cheap Auto Insurance for High Risk Drivers

PPT - Cheap Full Coverage Car Insurance For All People PowerPoint

How to get cheapest car insurance for high risk drivers | Car insurance

High Risk Driver Car Insurance, Auto Insurance Quotes For High Risk

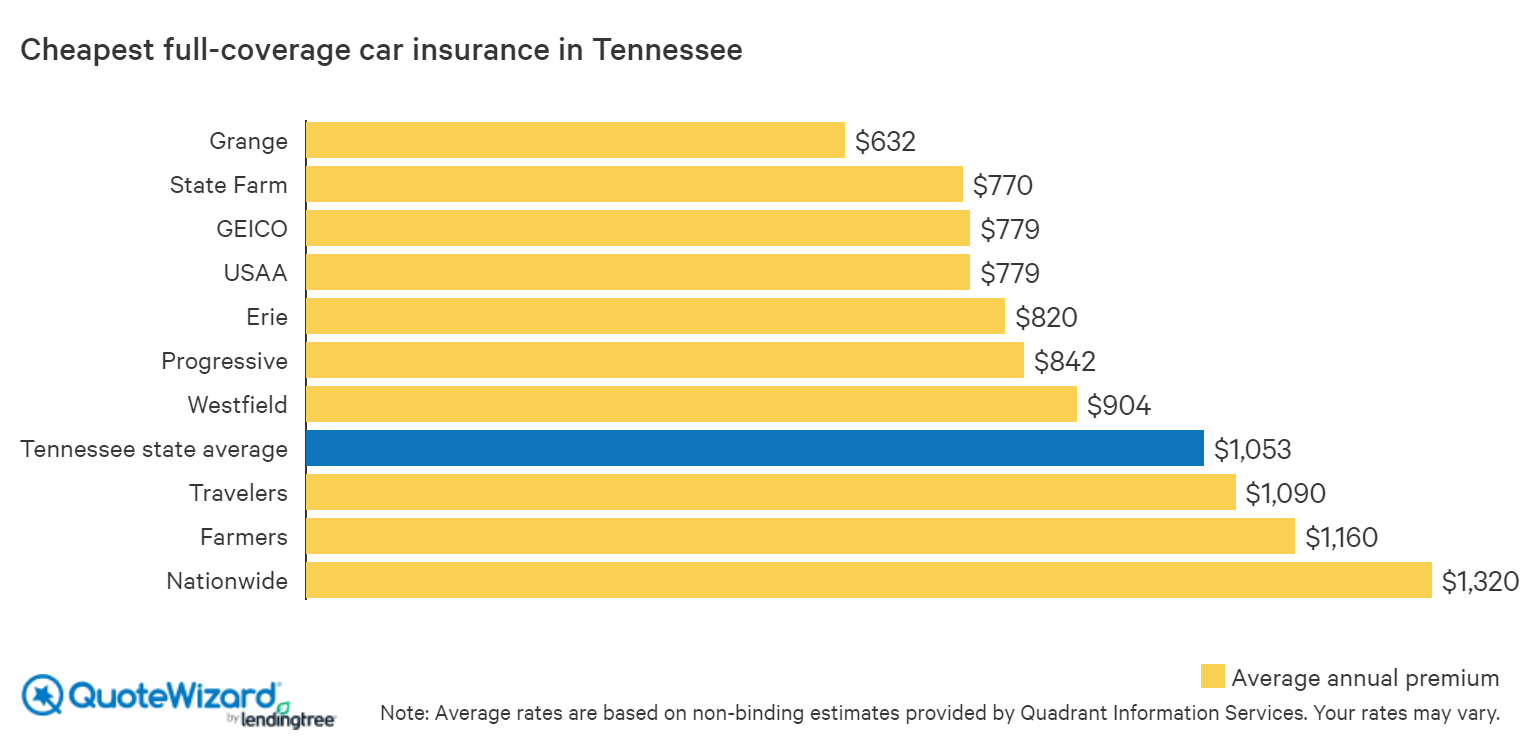

Find Cheap Car Insurance in Tennessee | QuoteWizard