Car Insurance Price For 18 Year Old

Friday, December 20, 2024

Edit

Car Insurance Prices for 18-Year-Olds

Understanding Car Insurance Costs for 18-Year-Olds

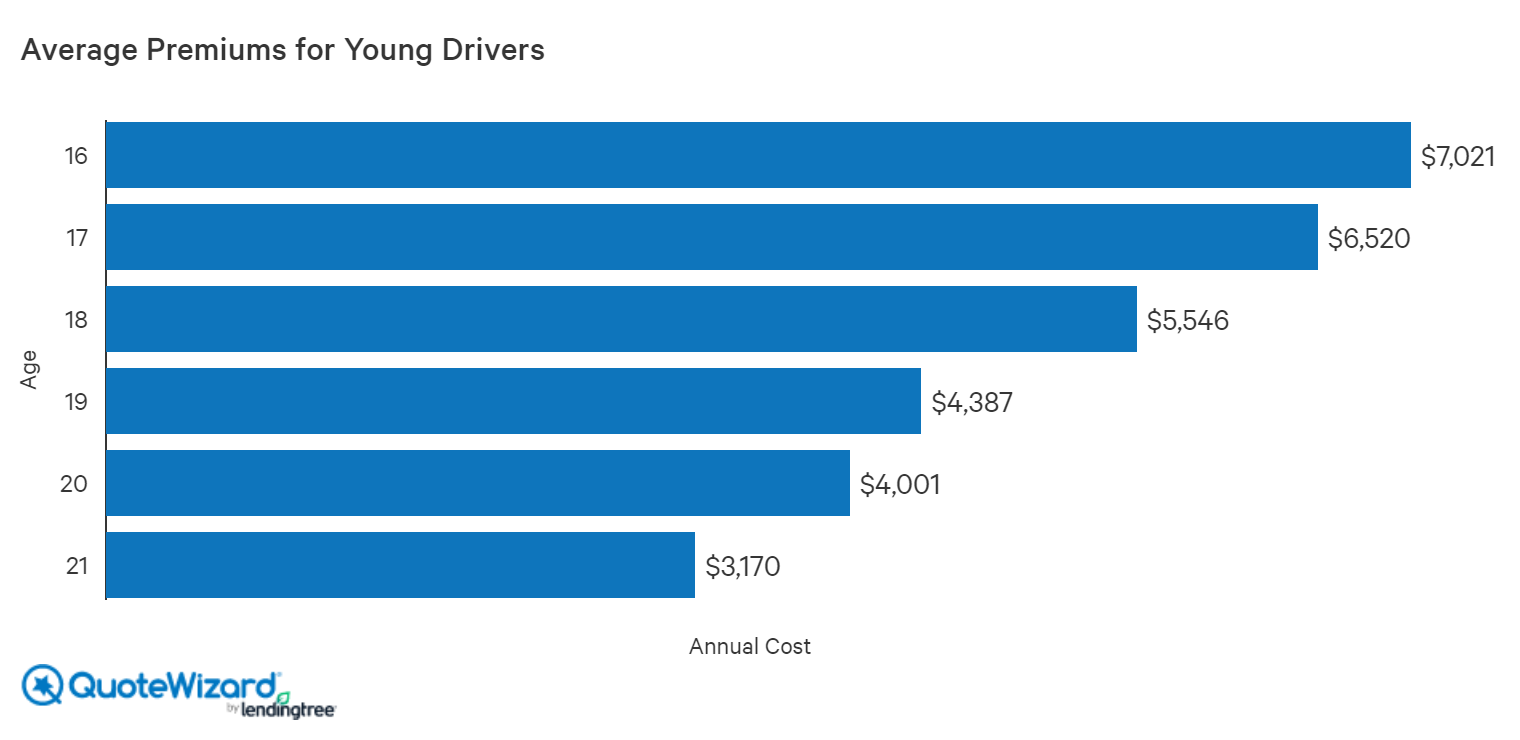

Car insurance can be expensive, especially for 18-year-olds. Statistics show that young drivers between the ages of 16 and 19 are more likely to be involved in car accidents than any other age group. As a result, insurance companies tend to charge higher premiums for young drivers. But there are still ways to save on car insurance for 18-year-olds.

The Average Cost of Car Insurance for 18-Year-Olds

According to the Insurance Information Institute, the average cost of car insurance for an 18-year-old is $5,836 per year. This is higher than the average cost for all drivers, which is $1,555 per year. The cost of car insurance for 18-year-olds can vary based on several factors, such as driving record, type of car, and location.

Factors That Affect Car Insurance Costs for 18-Year-Olds

The type of car you drive can have a major impact on car insurance costs for 18-year-olds. Generally, luxury cars and sports cars cost more to insure than sedans, minivans, and other less expensive cars. The age and condition of the car can also affect insurance costs. Some cars may be considered high-risk due to their age or condition, and this can lead to higher premiums.

Location is another factor that can affect car insurance costs for 18-year-olds. Insurance companies take into account the number of accidents and thefts in an area when calculating premiums. In general, living in a rural area can result in lower insurance costs, while living in an urban area can result in higher costs.

Tips for Finding Cheaper Car Insurance for 18-Year-Olds

One way to save on car insurance for 18-year-olds is to get a quote from several different insurance companies. Comparing quotes can help you find the best deal. It’s also a good idea to ask about discounts. Many insurance companies offer discounts for good grades, safe driving, and other factors.

Another way to save on car insurance for 18-year-olds is to increase the deductible. The deductible is the amount of money you pay out-of-pocket before the insurance company pays for a claim. Increasing the deductible can lower the monthly premium, but it also means you’ll be responsible for more of the costs if you get into an accident.

Conclusion

Car insurance for 18-year-olds can be expensive, but there are ways to save. Comparing quotes from multiple insurance companies, asking about discounts, and increasing the deductible are all ways to lower the cost of car insurance for 18-year-olds. By taking the time to shop around and compare rates, 18-year-olds can get the coverage they need at a price they can afford.

Cheap Insurance Cars For 18 Year Olds - BLOG OTOMOTIF KEREN

Average Car Insurance For 18 Year Old Per Month - New Cars Review

Average Car Insurance For 18 Year Old Female Per Month https://goo.gl

Car Insurance for a 20-year-old | QuoteWizard

How Much Is Car Insurance Per Month For A 18 Year Old ~ news word