Car Insurance For My Business

Thursday, December 5, 2024

Edit

How Car Insurance Can Protect Your Business

If you own a business, car insurance can be an important safety net to have in place. Not only is it essential for legal compliance, but it can also provide financial protection for your company in the event of an accident. In this article, we’ll discuss how car insurance can protect your business, the types of coverage available, and the different factors to consider when choosing the right policy for you.

The Benefits of Having Car Insurance for Your Business

Car insurance is an important form of protection for businesses, as it can help to cover the cost of damages, repairs, and medical bills if an accident should occur. This type of coverage is also essential for legal compliance, as most states require drivers to have a minimum amount of insurance coverage in order to drive legally. Furthermore, having car insurance can provide peace of mind, as you know that your business will be protected if something unexpected happens.

Types of Car Insurance Coverage

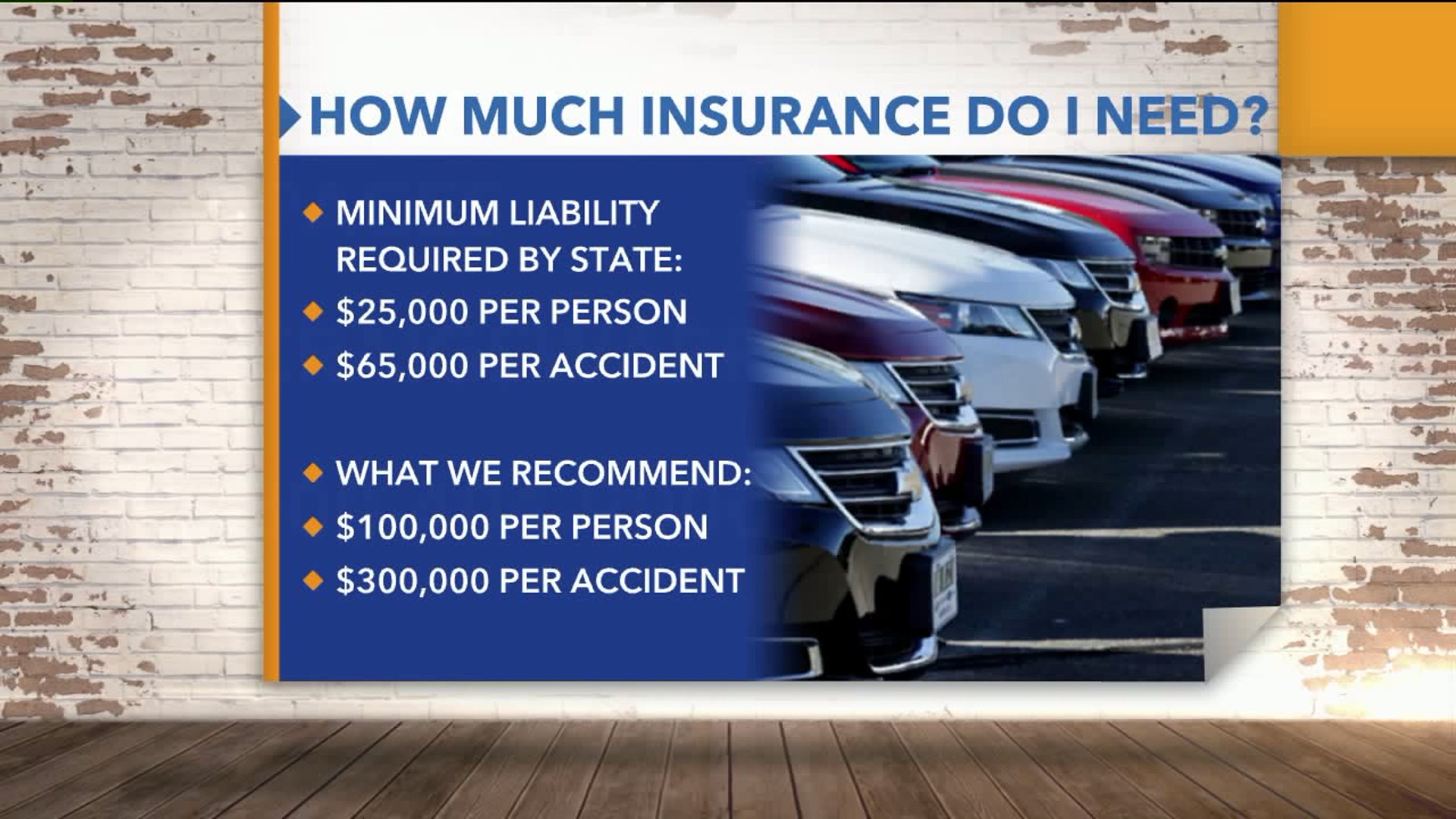

When it comes to car insurance, there are a variety of coverage options available. This includes liability coverage, which covers the cost of damages or injuries caused by the insured driver; collision coverage, which covers the cost of repairing or replacing the insured vehicle; comprehensive coverage, which covers damages caused by non-accident events such as theft, vandalism, or weather damage; and uninsured and underinsured motorist coverage, which can help to cover the cost of medical bills if the at-fault driver does not have any insurance.

What to Consider When Choosing a Car Insurance Policy

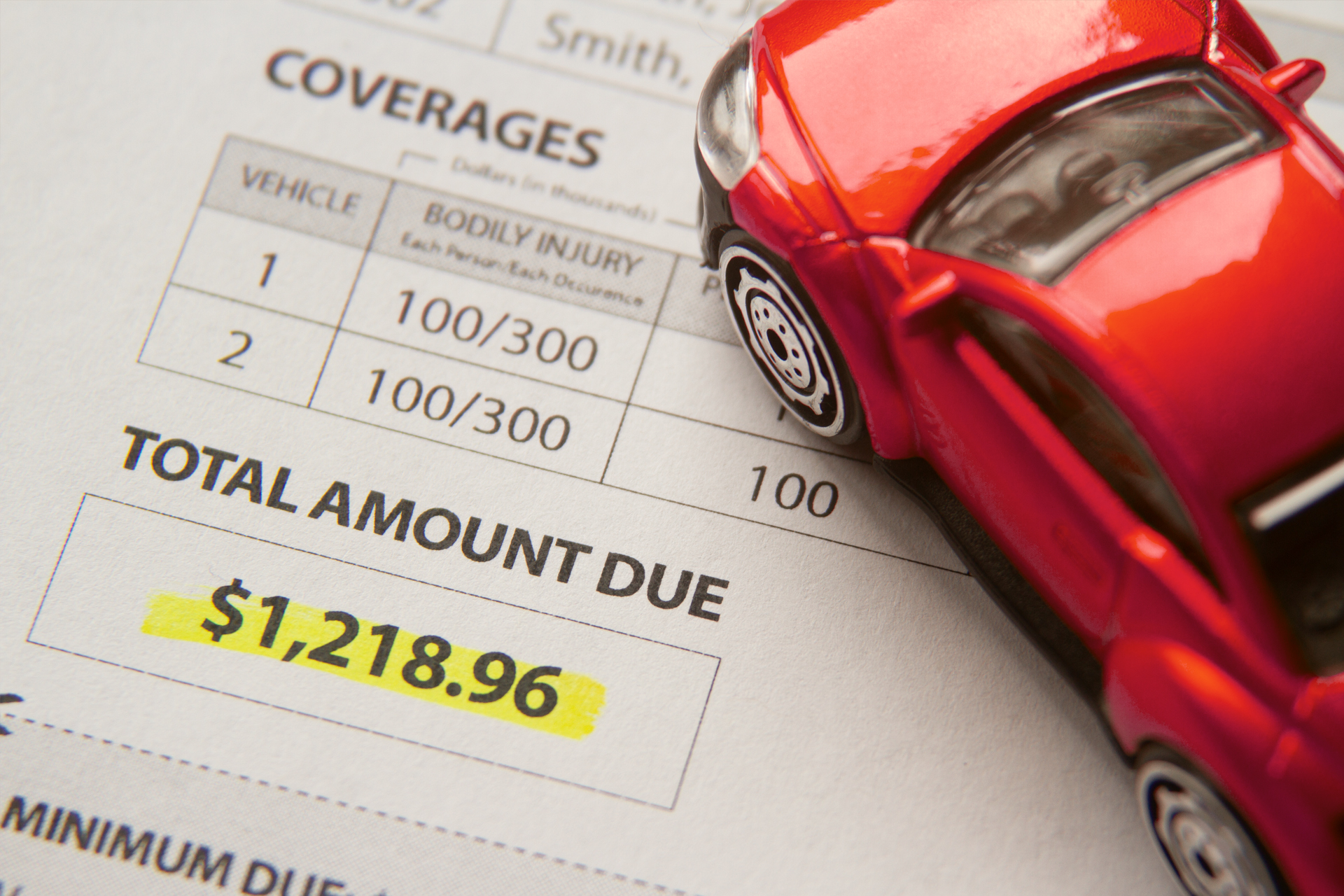

When selecting a car insurance policy for your business, there are a few things to keep in mind. First, consider the type of coverage you need and make sure the policy you choose provides adequate protection. Additionally, consider the cost of the policy and make sure you’re getting the best value for your money. Finally, be sure to read the policy carefully in order to understand the terms and conditions, and make sure you’re aware of any exclusions or limitations.

Getting the Right Car Insurance for Your Business

Car insurance is an essential form of protection for businesses, as it can help to cover the cost of repairs, medical bills, and other expenses in the event of an accident. There are a variety of coverage options available, so it’s important to consider the type of coverage you need and the cost of the policy before making a decision. By taking the time to do your research and shop around, you can ensure that you get the best car insurance policy for your business.

Conclusion

Car insurance is an important form of protection for businesses, as it can help to cover the cost of damages, repairs, and medical bills in the event of an accident. There are a variety of coverage options available, so it’s important to consider the type of coverage you need and the cost of the policy before making a decision. By doing your research and shopping around, you can ensure that you get the right car insurance policy for your business.

Car Insurance - Online Insurance Quote

Best Free Auto Insurance Images and Photos

Why You Should Get Business Car Insurance | ABS-CBN News

What Is The Cheapest Car Insurance / 5 Ways To Buy The Cheapest Car

Understanding auto insurance