Car Insurance For Drivers Under 25

Car Insurance For Drivers Under 25

Overview of Car Insurance for Drivers Under 25

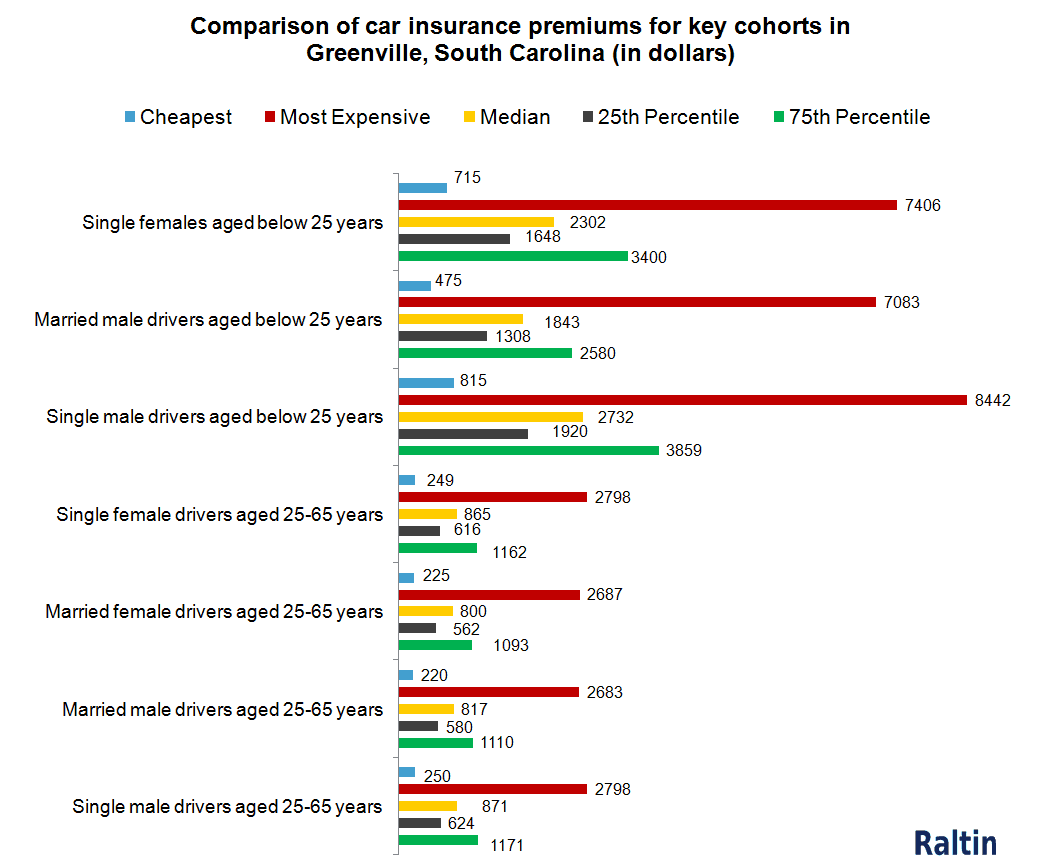

Getting a car insurance policy can be a daunting task, especially if you are a driver under the age of 25. Statistically, drivers under 25 are more likely to cause accidents, meaning that insurance companies may charge higher premiums for younger drivers. However, this doesn’t mean you have to break the bank to have adequate coverage. There are various ways to save money on your car insurance, and it’s important to research the different options available to you.

Tips for Finding Affordable Car Insurance for Drivers Under 25

One of the best ways to save money on car insurance for drivers under 25 is to take advantage of any discounts that may be available to you. Many insurance companies offer discounts for good grades, or for taking a driver safety course. You may also be able to get a discount if you are a member of a certain organization, or if you drive a certain type of car. It’s important to shop around and compare car insurance policies to make sure you are getting the best rate.

Additional Ways to Save Money on Car Insurance for Drivers Under 25

Another way to save money on car insurance for drivers under 25 is to increase your deductible. By raising your deductible, you will be responsible for paying a larger portion of any claims that you make. This can be a great way to save on your premiums, but it’s important to make sure that you have enough money saved to cover the cost of your deductible in case you need to make a claim. You should also consider raising your liability limits, as this can help you save money on your car insurance policy.

Choosing the Right Car Insurance for Drivers Under 25

When shopping for car insurance for drivers under 25, it’s important to find a policy that meets your needs. You should look for a policy that offers the coverage you need at a price you can afford. It’s also important to make sure that the policy you choose includes all the coverage you need, such as liability, collision, and comprehensive coverage.

Conclusion

Finding the right car insurance for drivers under 25 can be challenging, but it’s important to make sure that you have adequate coverage. Taking advantage of discounts, raising your deductible, and increasing your liability limits can all help you save money on your premiums. It’s also important to shop around and compare policies to make sure you are getting the best rate. By doing your research and finding the right policy, you can ensure that you and your car are adequately protected.

Best Car Insurance For New Drivers Under 25 (In 2020)

Best Car Insurance For New Drivers Under 25 (In 2020) | BLOGPAPI

Car Insurance Under 25: Can I Get Cheap Car Insurance? - Cover

Best Car Insurance for Drivers under 25 with Lowest Monthly Rates | Car

Under 25 Car Insurance – The Housing Forum