Caa Auto Insurance Cancellation Fee

Everything You Need to Know About CAA Auto Insurance Cancellation Fees

CAA Auto Insurance is a Canadian-based auto insurance provider that provides a wide range of coverage options for vehicle owners. Insurance coverage is tailored to the needs of the customer and can include collision, liability, and uninsured motorist protection. CAA also offers a variety of other services, such as roadside assistance, towing, and rental car discounts.

When Are Cancellation Fees Charged?

CAA auto insurance cancellation fees are charged when a policy is cancelled before it expires. The amount of the fee will depend on the type of policy and the length of time that it was in effect. Generally, the longer the policy was in place, the higher the cancellation fee will be. For example, if a policy was in place for six months and then cancelled, the fee could be as high as 50% of the total premium.

What Do Cancellation Fees Cover?

CAA auto insurance cancellation fees are used to cover the costs associated with cancelling a policy. This includes administrative expenses, such as processing paperwork, as well as costs associated with providing the coverage, such as paying out claims. The fee is also used to cover lost profit that would have been earned had the policy been kept in place until its expiration date.

Are Cancellation Fees Refundable?

CAA auto insurance cancellation fees are typically non-refundable. However, in some cases, a portion of the fee may be refunded. For example, if a policy was cancelled due to an accident or other unexpected event, some of the fee may be refunded. Additionally, if the policy was cancelled within a certain time frame, such as within seven days of purchase, the entire fee may be refunded.

What Other Fees Are Associated with CAA Auto Insurance?

In addition to cancellation fees, CAA auto insurance policies may also include other fees and charges. These may include policy renewal fees, late payment fees, and administrative fees. It is important to read through the policy carefully to understand all of the fees and charges that may be associated with a CAA auto insurance policy.

How to Avoid CAA Auto Insurance Cancellation Fees

The best way to avoid CAA auto insurance cancellation fees is to keep your policy in effect until its expiration date. If you need to cancel your policy, make sure that you do so within the specified time frame in order to receive a full or partial refund of the cancellation fee. Additionally, make sure that you understand all of the fees and charges associated with the policy before you sign up.

Caa Logos

CAA Niagara

CAA Car Insurance Review June 2020 | Finder Canada

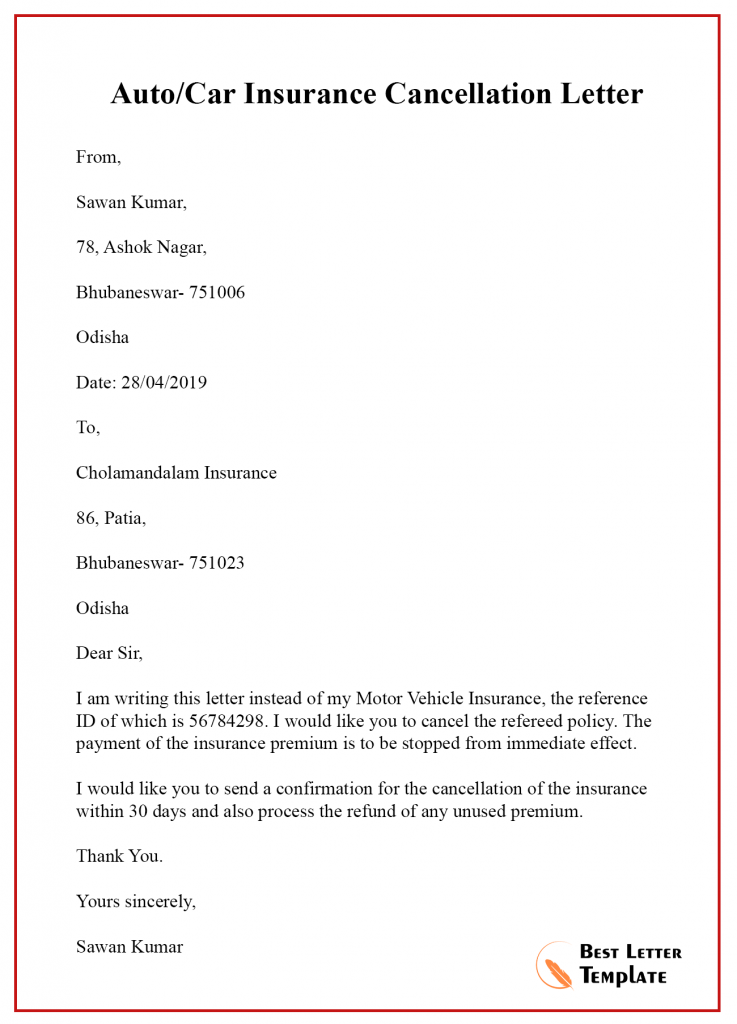

How To Fill Out An Insurance Cancellation Form

Notice Of Non Renewal Insurance Form Washington