Average Cost Of Long term Care Insurance At Age 65

<h1>Average Cost Of Long Term Care Insurance At Age 65</h1>

<h2>What is Long Term Care Insurance?</h2>

<p>Long Term Care Insurance is a type of health insurance designed to cover the cost of long-term care services, such as nursing home care, home health care, or other medical and non-medical services. It can help you pay for your care if you become unable to perform activities of daily living, such as bathing, dressing, eating, or getting in and out of bed.</p>

<p>Long Term Care Insurance helps you pay for the care you need and helps protect you from spending your savings and investments on long-term care costs. It also helps to protect your family from having to pay for your care. It can help you maintain your independence and control over your life and future.</p>

<h2>What Does Long Term Care Insurance Cost?</h2>

<p>The cost of long term care insurance depends on your age and health, the type of policy you choose, and the benefits you select. For most people, long term care insurance premiums will range from a few hundred dollars to several thousand dollars per year.</p>

<p>The cost of long term care insurance for people age 65 and over is typically higher than for younger people. This is because people aged 65 and over are more likely to need care in the future and the cost of care is much higher for seniors than for younger people.</p>

<h2>How Much Does Long Term Care Insurance Cost At Age 65?</h2>

<p>The cost of long term care insurance for people age 65 and over is typically higher than for younger people. The average cost of long term care insurance for people age 65 and over can range from a few hundred dollars to several thousand dollars per year.</p>

<p>The cost of long term care insurance will vary depending on the type of policy you choose, your age, and the benefits you select. For example, some policies may have lower premiums but require a larger deductible or co-insurance payment. Other policies may have higher premiums, but offer more comprehensive coverage.</p>

<h2>Is Long Term Care Insurance Worth It At Age 65?</h2>

<p>Long term care insurance can be a good option for people who are at risk of needing long term care in the future, such as people age 65 and over. It can help you pay for the care you need, protect your savings and investments, and help you maintain your independence and control over your life and future.</p>

<p>Before you purchase long term care insurance, it is important to understand the costs and benefits associated with the policy. You should also compare different policies and make sure the policy you choose meets your needs and budget.</p>

Cost of Care in Arizona – INtouch Senior Services

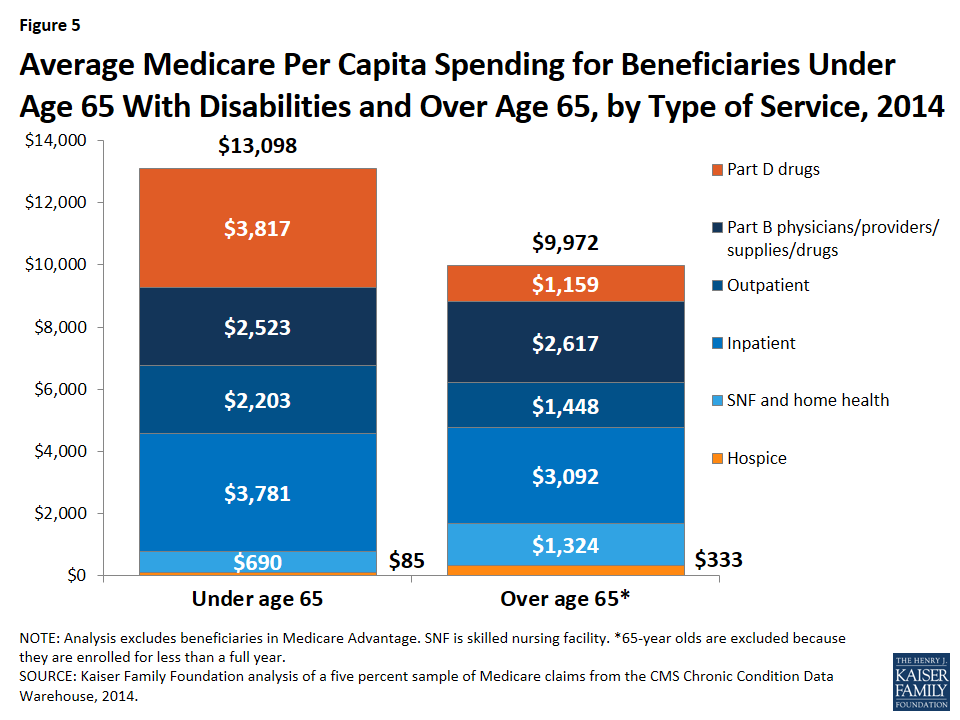

Medicare’s Role for People Under Age 65 with Disabilities | KFF

Long-Term Care Insurance Information: Policy Features & Benefits

2016 Montana Long Term Care Insurance Rate Comparison Guide by Montana

Long Term Care Insurance | Infographics About Seniors | Pinterest