Ala Gap Insurance Policy Wording

What is Ala Gap Insurance Policy Wording?

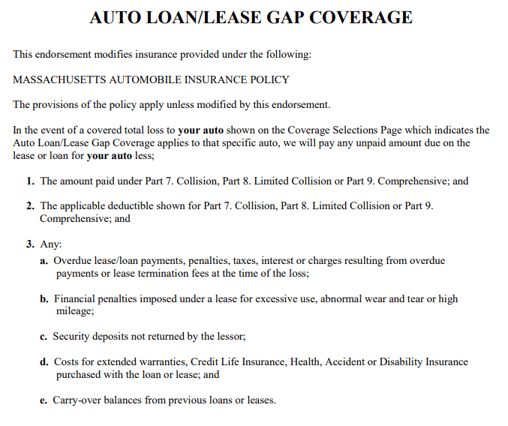

Gap insurance policy wording is insurance that covers the gap, or difference, between the market value of a vehicle and the amount the owner still owes on the loan or lease. Gap insurance, also known as loan/lease payoff insurance, is typically offered by car dealers as an optional service. It’s important to understand exactly what your gap insurance policy covers, what type of policy you’re buying, and what the cost is before you decide to purchase it.

Who Should Buy Gap Insurance?

If you’re financing or leasing a vehicle and have a high loan amount relative to the car’s value, then you should consider gap insurance. This is usually the case when you’re buying a new car, as the depreciation in value is greater in the first few years. Gap insurance can also protect you if you make a large down payment or if you’re making a balloon payment. If the car is stolen or totaled in an accident, gap insurance ensures that you won’t be left owing money on a vehicle you can no longer drive.

What Does a Gap Insurance Policy Cover?

A gap insurance policy covers the difference between the market value of the vehicle and the amount the owner owes on the loan or lease. It’s important to note that gap insurance does not cover any additional costs, such as taxes, insurance, or other fees.

What Types of Gap Insurance Policies Are Available?

There are two main types of gap insurance policies available: those provided by the car dealership, and those provided by the lender. The type of policy you choose will depend on the specific terms of your loan or lease agreement. The car dealership policies typically provide the most coverage, but may also be the most expensive option. The lender policies may provide less coverage, but are usually cheaper.

What Is the Cost of Gap Insurance?

The cost of gap insurance depends on the type of policy you choose, the amount of coverage, and the length of the policy. Generally, the cost of gap insurance can range from a few hundred dollars to several thousand dollars. It’s important to shop around and compare prices before deciding on a policy.

Conclusion

Gap insurance policy wording is an important type of insurance that can protect you from financial hardship if your car is stolen or totaled in an accident. It’s important to understand what type of policy you’re buying, what it covers, and the cost before making a decision. Gap insurance can be a great way to protect yourself from financial hardship, but it’s important to do your research before making a purchase.

ALA Gap insurance | Audi-Sport.net

ALA Gap insurance | Audi-Sport.net

ALA Gap insurance | Audi-Sport.net

When To File Gap Insurance Claim - kunleydesign

What is Gap Insurance and Why Do I Need it? | Berry Insurance