Adding A New Vehicle To Insurance Policy

Friday, December 13, 2024

Edit

Adding A New Vehicle To Insurance Policy

Why Do You Need to Add a New Vehicle to Your Insurance Policy?

If you recently bought a new vehicle, you may need to update your insurance policy. Adding a new vehicle to an existing policy can be a bit confusing, but it doesn’t have to be. Insurance companies have rules and regulations that must be followed when adding a new vehicle to your policy. There are also certain factors that can affect your premiums.

Before you add a new vehicle to your policy, it’s important to understand why you need to do so. Insurance companies require that vehicles be added to a policy in order to provide coverage. Without the coverage, you could be held liable if you’re involved in an accident. Additionally, adding a new vehicle to your policy can help you save on your premiums.

How to Add a New Vehicle to Your Insurance Policy

There are several steps you need to take when adding a new vehicle to your insurance policy. The first step is to contact your insurance provider. Most companies have a customer service line that you can call in order to add the vehicle to your policy. You will need to provide the make, model, and year of the vehicle as well as the VIN.

The next step is to provide additional information about the vehicle. This could include the vehicle’s safety features, the type of vehicle, and other details about the vehicle. This information is necessary for the insurance company to determine the best coverage and premium for your policy.

Once you’ve provided all of the necessary information, the insurance company will be able to determine the best coverage and premium for your policy. The insurance company may also request additional information about the driver of the vehicle, such as their driving record and credit score.

Factors That Can Affect Your Premiums

Once the insurance company has all of the necessary information, they will be able to determine the best coverage and premium for your policy. However, there are several factors that can affect your premiums. These include the age of the driver, the type of vehicle, the amount of coverage, the area where you live, and the type of driving you do.

For example, if you live in an area with higher rates of theft and vandalism, your premiums may be higher. Similarly, if you’re a young driver, your premiums may also be higher. On the other hand, if you have a good driving record and a low credit score, your premiums may be lower.

What Happens After You Add a New Vehicle to Your Policy?

After you’ve added a new vehicle to your policy, you will need to make sure that the coverage is up to date. This means that you need to review your policy and make sure that you are adequately covered. You will also need to review any discounts or special offers that you may be eligible for.

Once you’ve reviewed your policy, you can make any necessary changes. This could include adding additional coverage or changing the deductible. You should also review your policy periodically to make sure that you are still getting the best coverage at the best rate.

Conclusion

Adding a new vehicle to your insurance policy can be a bit confusing, but it doesn’t have to be. By following these steps, you can make sure that you have the best coverage and the best premium for your policy. Additionally, by reviewing your policy periodically, you can make sure that you are still getting the best coverage at the best rate.

So if you’ve recently purchased a new vehicle, it’s important to add it to your insurance policy. By following these steps, you can make sure that you’re adequately covered and that you’re getting the best rate.

Duplicate Car Insurance Policy ~ ytdesignwork

State farm auto insurance policy pdf - insurance

Collector's Car Insurance Policy - Do's And Don'ts

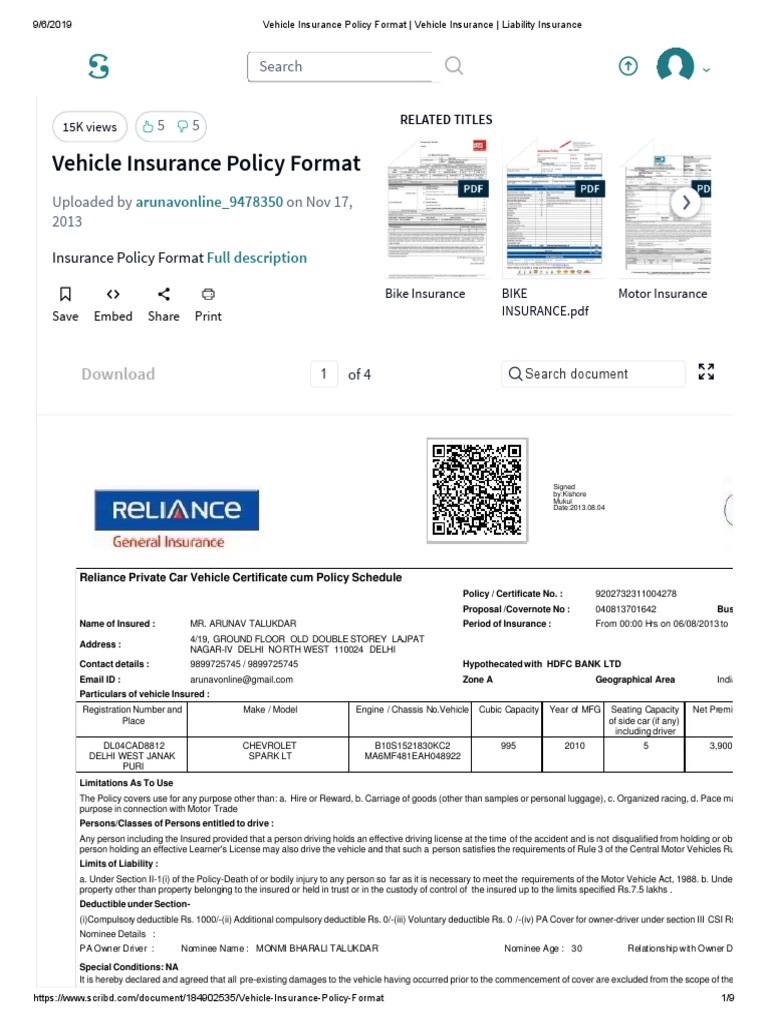

Vehicle Insurance Policy Format _ Vehicle Insurance _ Liability