Minimum Amount Of Liability Insurance Coverage Required

Minimum Amount Of Liability Insurance Coverage Required

What Is Liability Insurance Coverage?

Liability insurance coverage is a type of insurance coverage that provides protection for an individual or a business against claims arising from damages caused to another party. It is an important form of insurance coverage that should be taken into consideration by individuals or businesses who may be held responsible for damages to another party. Liability insurance can include coverage for bodily injury, property damage, personal injury, advertising injuries, and medical payments.

What Is The Minimum Amount Of Liability Insurance Coverage Required?

The minimum amount of liability insurance coverage required will depend on the type of business that you are running, your state, and the type of activities that you will be performing. For example, if you are a small business that operates within a state, the minimum amount of liability insurance coverage that you will need will likely depend on the state’s regulations. Generally, the minimum amount of liability insurance coverage required for small businesses is $500,000 per occurrence for bodily injury and property damage and $1,000,000 for personal and advertising injuries.

What Are The Different Types Of Liability Insurance Coverage?

There are several different types of liability insurance coverage available, including general liability insurance, professional liability insurance, and product liability insurance. General liability insurance provides coverage for bodily injury and property damage caused by the insured’s negligence or carelessness. Professional liability insurance provides coverage for errors and omissions made by professionals in the course of their work. Product liability insurance provides coverage for damages caused by a product that was manufactured, sold, or distributed by the insured.

Why Is Liability Insurance Coverage Important?

Liability insurance coverage is important because it provides protection for an individual or a business from claims arising from damages caused to another party. Without the proper amount of liability insurance coverage, an individual or business could be held liable for damages caused to another party. This could lead to the individual or business having to pay expensive legal fees, medical bills, and other costs associated with the damages.

What Are The Benefits Of Having Liability Insurance Coverage?

The benefits of having liability insurance coverage include protection from expensive lawsuits, protection from costly medical bills, and protection from claims of negligence or carelessness. Additionally, liability insurance coverage can provide peace of mind knowing that you are protected should something unexpected happen. Furthermore, liability insurance coverage can help to keep your business running smoothly and provide financial security.

Conclusion

Liability insurance coverage is an important form of insurance coverage to consider for individuals and businesses who may be held responsible for damages caused to another party. The minimum amount of liability insurance coverage required will depend on the type of business that you are running, your state, and the type of activities that you will be performing. There are several different types of liability insurance coverage available, and the benefits of having liability insurance coverage include protection from expensive lawsuits, protection from costly medical bills, and protection from claims of negligence or carelessness.

All the Different Types of Car Insurance Coverage & Policies Explained

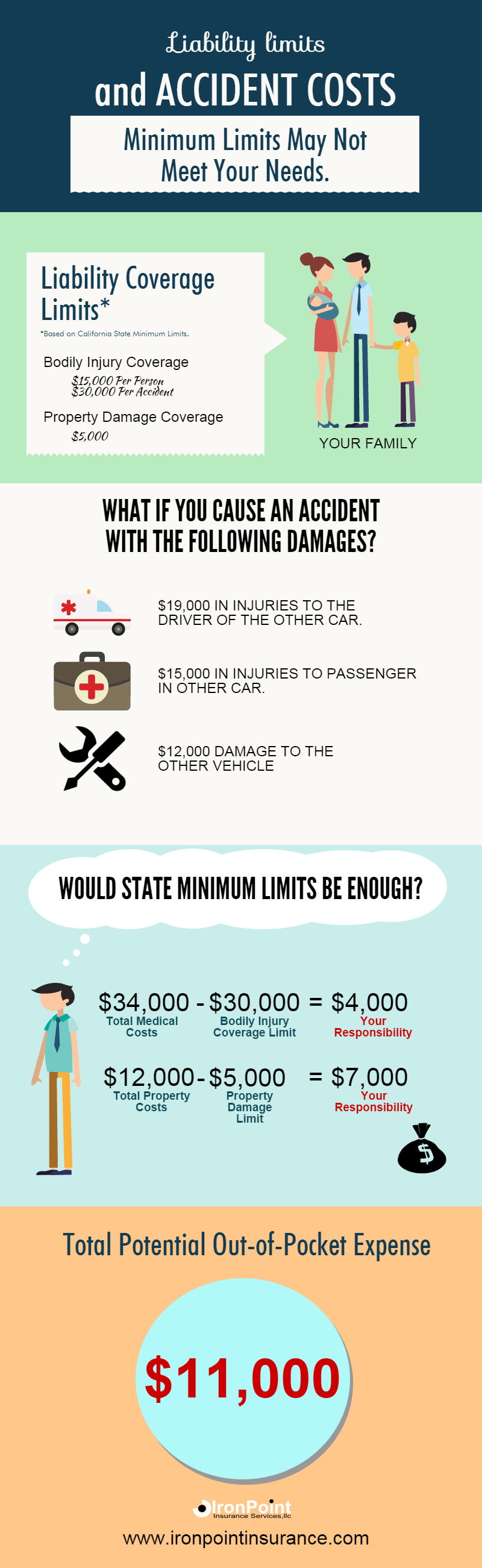

Should I buy minimum liability limits auto insurance?

What Is The Minimum Amount Of Liability Insurance Coverage Required In

Auto Insurance Liability Limits: What Do The Numbers Mean? | Visual.ly

What Is The Minimum Amount Of Liability Insurance Coverage Required In