Lower Car Insurance Low Mileage

How to Get Lower Car Insurance With Low Mileage

Driving less is not only beneficial for the environment, but also for your wallet. Low mileage car owners can get lower car insurance rates if they can prove that they drive their vehicles less than the average driver. However, there are several different factors that insurance companies take into consideration when determining your premium, so it's important to understand how the process works before you start shopping around for a better rate.

Determining Your Low Mileage Discount

Insurance companies typically consider the number of miles you drive in a year when calculating your car insurance rate. Generally, the lower your mileage, the lower your premium. Some companies offer discounts on premiums for drivers who drive fewer than 7,500 miles a year, while others offer discounts to drivers who drive fewer than 10,000 miles a year. It’s a good idea to call up your insurance provider to find out what their exact mileage requirements are for a low mileage discount.

What Else Do Insurance Companies Consider?

Insurance companies also take other factors into consideration when setting your car insurance rate. Your age, credit score, driving record, and the vehicle you drive all play a role in the rate you get. Insurance companies also look at the area you live in and how often you drive in high-traffic areas. All of these factors can affect the rate you get, so be sure to shop around for the best rate for your specific needs.

How to Prove Low Mileage

Most insurance companies require you to provide proof of your low mileage. This can include a copy of your car registration or an odometer reading from a certified mechanic. It’s important to keep records of your car’s mileage, as this can help you get the lowest rate possible. You should also keep a log of your daily trips and their mileage, as this can help you prove to the insurance company that you are driving fewer miles than the average driver.

When Is Low Mileage Not Enough?

Sometimes, even if you have a low mileage rating, you may still not be eligible for the lowest rate. Insurance companies may also consider other factors such as your age, credit score, and driving record. If your credit score is low or you have had multiple accidents, your rate may still be higher even if you are driving fewer miles than the average driver. It’s important to shop around and compare different insurance providers to find the best rate for your specific needs.

Final Thoughts

Low mileage car owners can save money on their car insurance by proving to their insurance provider that they are driving less than the average driver. However, it’s important to remember that insurance companies also take other factors into consideration when setting your rate. Shop around and compare different providers to get the best rate for your specific needs. Keep records of your car’s mileage and your daily trips to help prove your low mileage rating.

10 Best Ways To Lower Your Car Insurance Costs - Be The Budget

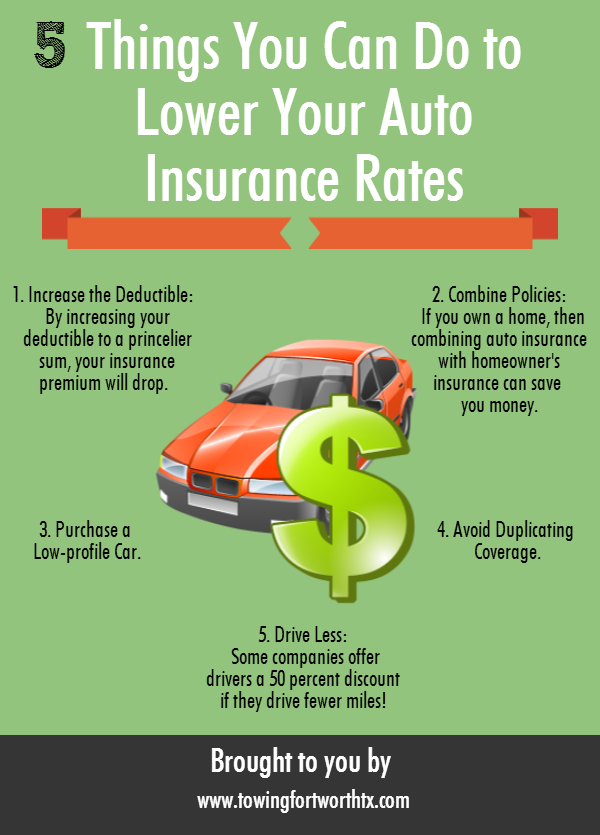

Lower Your Auto Insurance Rates with 5 steps

Top 4 Ways to Lower Your Car Insurance Premiums | Inexpensive car

How to Lower My Auto Insurance Premium Costs | Cheap car insurance, Car

How to lower car insurance: 7 tips to help you save now