Kotak Mahindra Car Insurance Policy

Kotak Mahindra Car Insurance Policy – What You Need To Know

Introduction

Kotak Mahindra is one of the leading financial institutions in India, providing a range of services and products to its customers. Among these is the Kotak Mahindra Car Insurance Policy, which is a comprehensive car insurance policy designed to provide financial protection for your car and its occupants. This policy covers all types of losses or damages to your car caused by accidents, natural disasters, theft, fire and other risks. It also provides cover for any legal liability arising out of the use of your car.

What Does The Policy Cover?

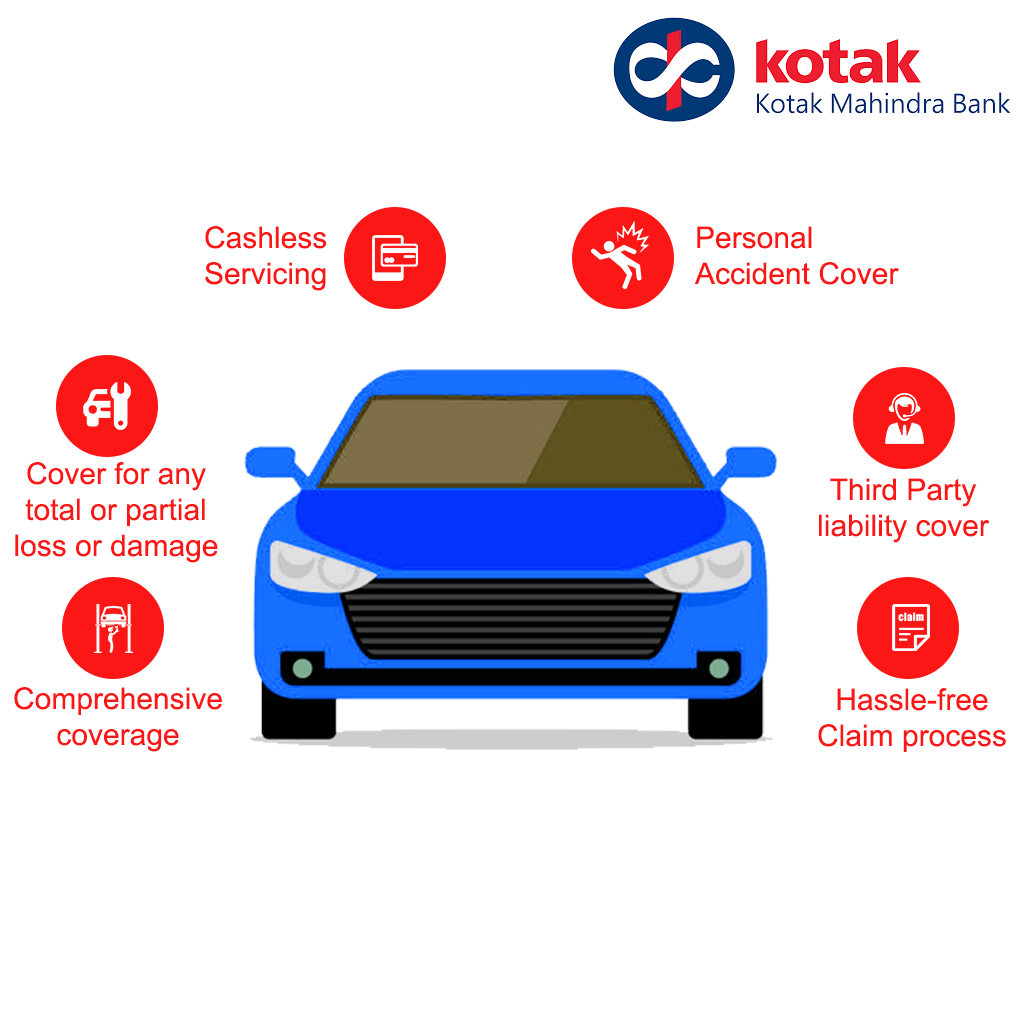

The Kotak Mahindra Car Insurance Policy covers a wide range of risks and losses. It provides cover for any damage or loss to your car caused by accidents, theft, fire, natural disasters and other risks. It also covers the costs of repairs or replacements of your car, as well as any legal liabilities arising out of the use of your car. The policy covers personal accident cover for the occupants of the car, as well as any third party liability arising out of the use of your car.

Benefits of the Kotak Mahindra Car Insurance Policy

The Kotak Mahindra Car Insurance Policy provides several benefits, such as:

1. Coverage for all types of losses or damages to your car caused by accidents, natural disasters, theft, fire and other risks.

2. Coverage for any legal liability arising out of the use of your car.

3. Personal accident cover for the occupants of the car.

4. No Claim Bonus (NCB) on renewal of the policy.

5. Discounts on premium for installation of safety devices in your car.

6. Cashless repair facilities at network garages.

7. 24x7 customer service.

What Are The Eligibility Criteria For The Policy?

The eligibility criteria for availing the Kotak Mahindra Car Insurance Policy are mentioned below:

1. The policyholder must be aged between 18 and 65 years.

2. The policyholder must be an Indian resident.

3. The policyholder must have a valid driving license.

4. The policyholder must have a valid registration certificate for the car.

How To Buy The Policy?

The process of buying the Kotak Mahindra Car Insurance Policy is quite simple. You can buy the policy online, by visiting the official website of Kotak Mahindra. All you need to do is fill in the required details, make the payment and the policy will be issued to you instantly. You can also buy the policy through an insurance agent or broker.

Conclusion

The Kotak Mahindra Car Insurance Policy is a comprehensive car insurance policy that provides coverage for all types of losses or damages to your car caused by accidents, natural disasters, theft, fire and other risks. It also provides cover for any legal liability arising out of the use of your car. The policy provides several benefits, such as no claim bonus, discounts on premium and cashless repair facilities at network garages. You can easily buy the policy online or through an insurance agent or broker.

Kotak Mahindra General Insurance Company Limited — Not giving my claim

Kotak Mahindra Car Insurance - Compare Plans, Renewal & Reviews

Compare Kotak Mahindra vs IFFCO TOKIO Car Insurance Quotes

Kotak Life Insurance Policy Status | Kotak Mahindra life login

Kotak Mahindra General Insurance Company Limited — Not giving my claim